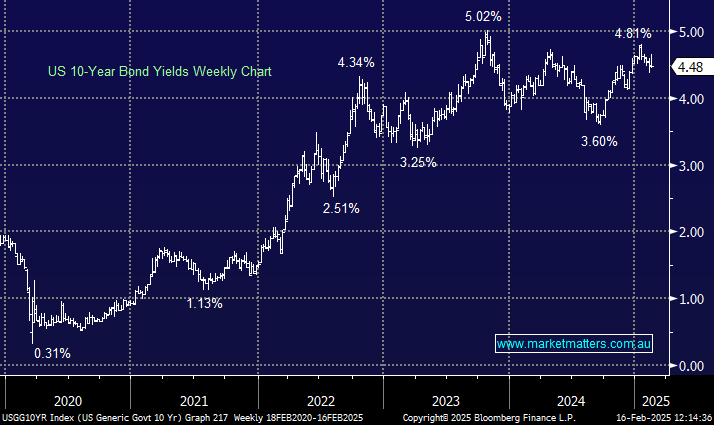

US retail sales data tumbled by the most in nearly two years in January, reflecting harsher winter weather and the impact of the ferocious wildfires in Los Angeles. The data overshadowed an earlier hotter-than-expected CPI inflation print, sending the yield on the US 10-year note down 6 basis points to 4.48%, narrowing the gap to its Australian counterpart trading at 4.41%. Until we hear a change in tune from Jerome Powell and the Fed we believe US bonds are likely to go into a holding pattern, although you never know with Trump at the helm!

- We expect the US 10 years to test the 4% area in 2025/6, but the less dovish Fed will likely limit any downside move in the short term.