As we touched on earlier, IAG is rich for a stock whose sector appears to be in “peak cycle.” The reaction to yesterday’s illustrates the risks: the numbers were good. Cash earnings surged 54.2% in the December half to $640 million, about 6%t above market expectations, thanks to good weather and cost-cutting during the period. However, chief executive Nick Hawkins provided a more conservative outlook than expected and softer than rival Suncorp delivered on Wednesday, sending the stock plunging – the reaction wasn’t helped by the likelihood it’s a crowded holding for the momentum traders.

Two factors caught our attention and raised questions about IAG’s elevated valuation:

- The good news for consumers is that premium growth for motor and home insurance is finally slowing, with the increases of around 6% IAG put through in the December half well down on the increases of more than 15% six months ago. Consumers may have hit their limit.

- The global reinsurance market has now reset (albeit at a higher level for Australian insurers), and inflation in the home and more insurance supply chains is cooling.

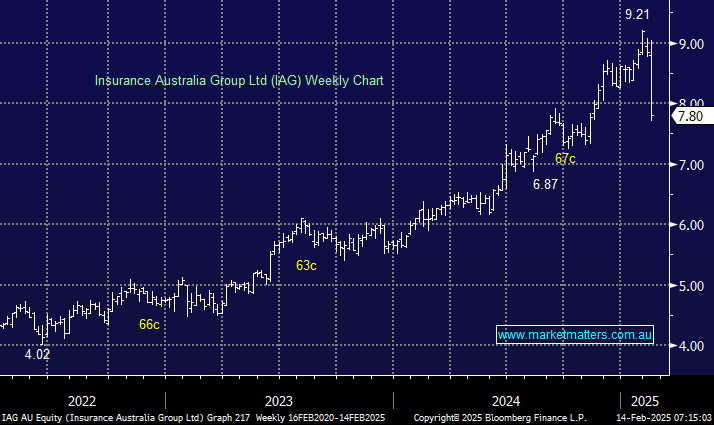

With an unexciting yield below 4%, entry levels into IAG are pivotal to MM, and even after yesterday’s steep decline and solid result, this insurer is too expensive for us.

- We like IAG around $7, or over 10% lower.