JD.com is one of China’s largest e-commerce platforms and generates most of its revenue from its core retail business, which sells goods across various categories, including electronics, home appliances, clothing, and lots more. Like Amazon, this is split between direct sales (where JD.com buys goods and sells them directly to consumers) and marketplace sales (where third-party sellers use JD.com’s platform to reach consumers).

This is a Chinese-facing consumer stock, and while it has global operations and is listed on the Nasdaq (IPO’d in 2014), it is highly reliant on Chinese consumption, which, as we know by now, has been in a funk. We continue to believe that China must support consumption to reinvigorate growth, and policy announcements in 2024 will be expanded upon this year, benefiting JD’s business.

- JD is not just a website; it operates one of the most advanced and extensive logistics networks in China, generating revenue through logistics services provided to both its own e-commerce business and external companies. Its supply chain infrastructure is phenomenal driving fast deliveries and last-mile services, which is a major contributor to its income.

- It is also a major player in China’s online healthcare market, offering online pharmacy services, telemedicine, and health management – this has become an increasingly important revenue stream for JD.

- And finally, JD Finance provides consumer finance, wealth management, insurance, and other financial products and has grown significantly in recent years.

In 2024, buying undervalued stocks over and above momentum style plays detracted from returns. The S&P 500 appreciated 25%, including dividend reinvestment in 2024, a great result; however, the 10 largest companies in the S&P 500 accounted for nearly 60% of total index returns – the average stock in the index was up just 13%. That has created a huge spread in valuations, with the largest 10 companies trading on 27x earnings, pushing the overall S&P up to a multiple of 22x. The other 490 companies in the index, trade on an average PE of 20x, not expensive when anchored to expected growth.

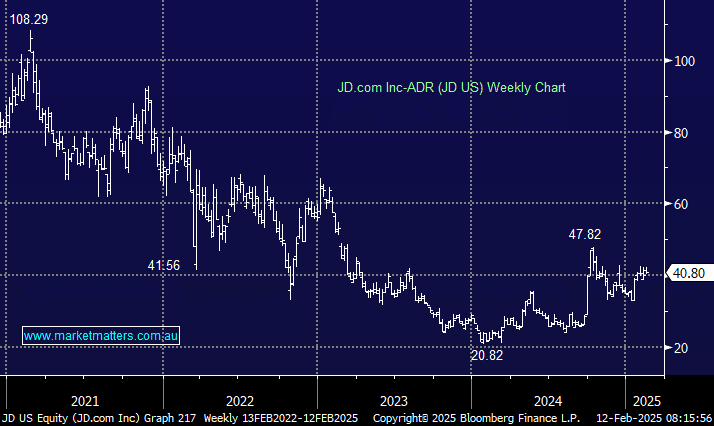

JD is at the extreme, with the ‘China discount’ pushing it to its lowest valuation in history, trading on a PE of 9.4x (and an EV/EBITDA multiple of 7x). There is clearly not a lot of upside factored into this earnings multiple, which is why 44 of the 47 analysts that cover the stock are buy rated. This is not a new phenomenon though, with most being ‘long and wrong’ JD over recent years, however, if Chinese consumption improves, which is a theme we are backing, JD will experience better growth in earnings than currently tipped, which would be amplified by a re-rate higher in the earnings multiple, potentially driving significant upside. But perhaps more importantly, the downside feels limited, creating very solid risk/reward.