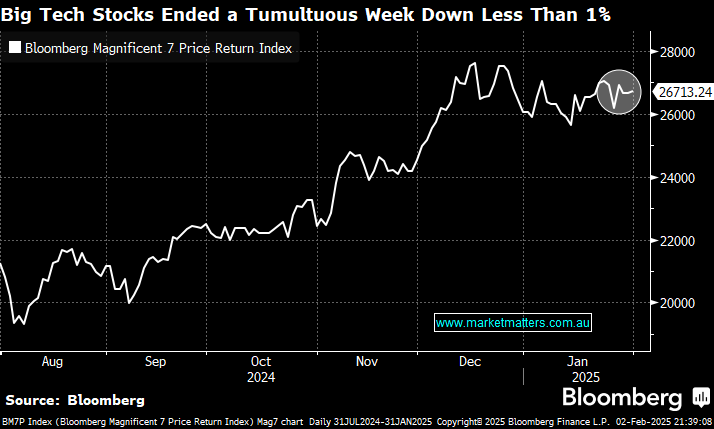

After a volatile week for the biggest US technology companies that began with a shock from a Chinese AI upstart and included a batch of pivotal earnings, the biggest surprise may be how well they ultimately fared. Four of the biggest tech firms managed to mostly deliver on the promises implied by their gigantic market values, while at the same time assuaging anxieties brought by DeepSeek. Shares of Apple Inc. and Meta Platforms Inc. ended the week higher, helping to push the S&P 500 Index to the cusp of another record despite a walloping for Nvidia Corp. and other AI infrastructure stocks. As a group, the Magnificent Seven companies, ended the week largely unscathed helped by good old-fashioned earnings.

However, it wasn’t all good news. Microsoft slipped 6.5% last week after growth in its cloud-computing division fell short of expectations as the company struggles to build out enough computing capacity to meet demand for its AI products. And while executives at Meta and Microsoft both said they remain committed to massive outlays in the year ahead for their artificial intelligence plans, many AI infrastructure stocks ended the week in the red. Nvidia fell 16%, wiping out more than half a trillion dollars in market value. Other chipmakers including Broadcom Inc. and Micron Technology Inc. also fell.

With Alphabet and Amazon on tap next week, profit growth for the Big Tech cohort in the fourth quarter is now expected to come in at 26%, up from 22% at the start of the week, according to data compiled by Bloomberg Intelligence. A Bloomberg index tracking the Magnificent Seven stocks is priced at 31x times earnings projected over the next 12 months, which is up from about 20x at the end of 2022 and well above the S&P 500 at 22x.