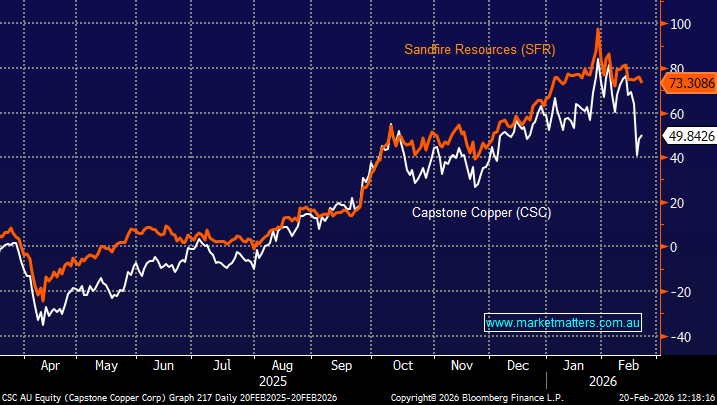

US oil stocks have significantly outperformed their ASX peers, rallying over recent years while domestic names have struggled. Earlier this month, Chevron CEO Mike Wirth made it clear that he would not miss the Biden administration, slamming his ban on new oil and gas drilling in 625 million acres of waters along the U.S. coasts while indicating that he looks forward to working with the incoming Trump administration. US oil stocks are well positioned under Trump and look more appealing than ASX names; even if oil prices slip, they can benefit if their output increases significantly. Like MM, the CEO sees a significant opportunity for natural gas on the horizon as AI data centres consume a growing amount of electricity.

In November, Chevron beat third-quarter earnings and revenue expectations, returning a record $7.7 billion to shareholders. The company is delivering operationally, with revenue of $50.67 billion, vs. $48.99 billion consensus, and underlying earnings per share (EPS) coming in at $2.51, vs. $2.43 expected. The current consolidation by the stock is likely to be a good buying opportunity, assuming the oil price doesn’t plunge below $US70.

- The risk/reward towards CVX looks interesting if a dip in oil prices takes the stock back toward $US140.