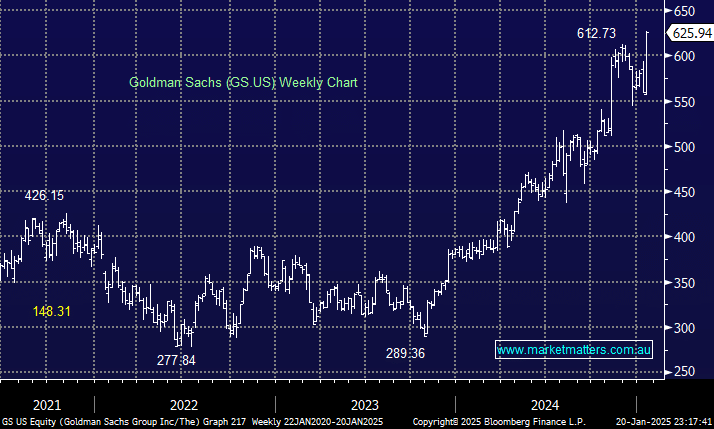

Goldman has more than doubled from its 2023 low, with the “Trump Bump” arguably just the icing on the cake. Earlier this month, GS reported fourth-quarter results that topped estimates on stronger-than-expected trading revenue, sending the stock up ~5% after the release. Profits roughly doubled from a year earlier to $US4.11 billion as revenue grew while expenses shrank – a healthy combination known as positive jaws. Revenue jumped 23% to $13.87 billion, helped by higher equities, fixed-income trading revenue, and rising investment banking results. Not surprisingly, the result was heralded by the company and market alike, with the stock pushing to new all-time highs last week.

We expect Goldman Sachs to be among the biggest beneficiaries of a more balanced regulatory environment, especially a likely change in regulatory attitudes toward the capital markets business. While shares have clearly been strong, Goldman’s still only trades 13.6x consensus FY25 earnings while producing forecasted earnings growth of 15%.

US banks do trade on a lower multiple to our given the more competitive environment, and GS is trading around ~20% expensive relative to its own history, however, if earnings growth surprises on the upside which is a fair chance in MM’s view, valuations can quickly revert back to normality while the stock remains supported.

- We like GS, though we currently own UBS and have a preference for Citi Group (C US) as they have more room for operational improvement.