IAG pushed up another +3.5% on Thursday, posting fresh highs following the news it will acquire the insurance business of the Royal Automobile Club of Queensland for $855 million, giving the company a 25-year exclusive distribution agreement to sell home and car insurance policies in what it claims is a sound bet on the state’s future growth. Australia’s largest general insurer already owns the NRMA insurance brand, which is strong in NSW, and has a joint venture with RACV, which grew out of Victoria. To put this deal into perspective, it’s expected to add $1.3 billion to gross written premiums while also addressing its relatively small footprint in QLD.

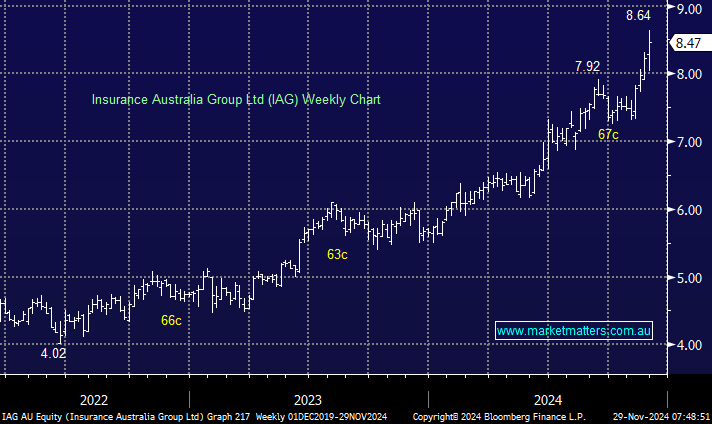

The insurer is funding from surplus capital, and the tie-up is expected to be earnings-per-share accretive in the first full year of ownership, assuming it gets approval from the ACCC in 2025. We like IAG’s move but are reticent to chase the insurer above $8.50.

- We haven’t called IAG particularly well through 2024 but it does look ok versus WBC, though both look rich.