WHC transitioned its business after buying Daunia and Blackwater last year for $3.2bn, transforming it from a NSW thermal coal producer into a company that will generate most of its revenue by selling Queensland coking/met coal to steel makers. However, the purchase ended WHC’s tremendous “cash cow” or dividend stream of recent years, at least for now i.e. WHC will pay a total 20c fully franked final dividend in 2024, compared to 74c in 2023.

- We are very bullish on WHC over the years ahead, but it will take time and a higher coal price before the dividends flow again.

- Markets are looking for WHC to yield around 3% over the next few years, but the coal price is the huge variable here, with WHC ready to benefit from any improvement in demand.

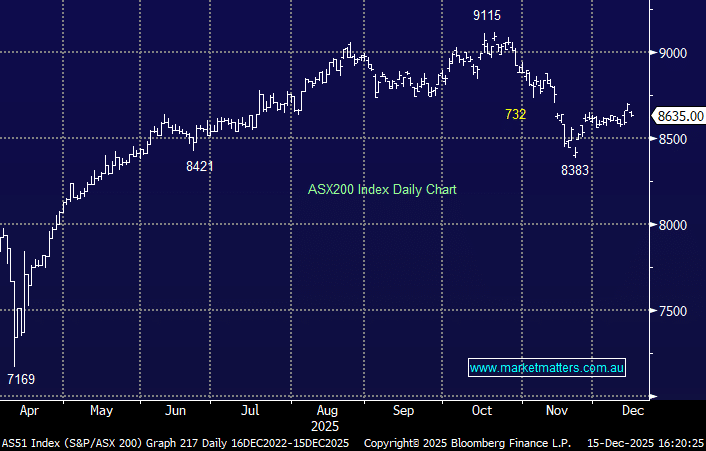

We are initially targeting a test of $8.50-9 by WHC, a very bullish call—MM is long WHC in our Active Growth Portfolio.