In the energy sector, uranium companies soared on Thursday after Amazon became the latest tech giant to embrace nuclear energy to power its data centres; it was always a matter of time for MM, and the following recent announcements have confirmed our expectations:

- Last month, Microsoft signed a deal with U.S. energy firm Constellation to resurrect a defunct reactor at Pennsylvania’s notorious Three Mile Island nuclear power plant, signing a 20 year deal to buy 100% of the power.

- On Tuesday, Google said it would buy power from the nuclear energy company Kairos Power, as tech companies increasingly turn to nuclear energy to meet data centres’ growing power demands.

- On Wednesday, Amazon subsidiary AWS said it had signed an agreement with a Virginia utility company to explore the development of small nuclear reactors, following similar announcements from Google earlier in the week.

Following the news on the ASX, Paladin Energy (PDN) rose 11%, Deep Yellow (DYL) advanced by 7.3%, and Boss Energy (BOE) by 6.7%, and although it’s a long game with Google’s first small modular reactor not coming online until 2030, we believe the cards are being played, and the world will be short of uranium in the coming years. However, like all investment themes, there are risks, and in the short term, we see it as Putin and Donald Trump. If Trump does indeed win next month as the bookmakers believe, he may again get “cosy” with Putin. Kazakhstan is the largest uranium producer in the world, with ~45% of the market, a country where Putin’s influence is growing. This could be interpreted both ways for the U price, but with enriched uranium from Russia currently banned by the US, a rekindled friendship could increase supply.

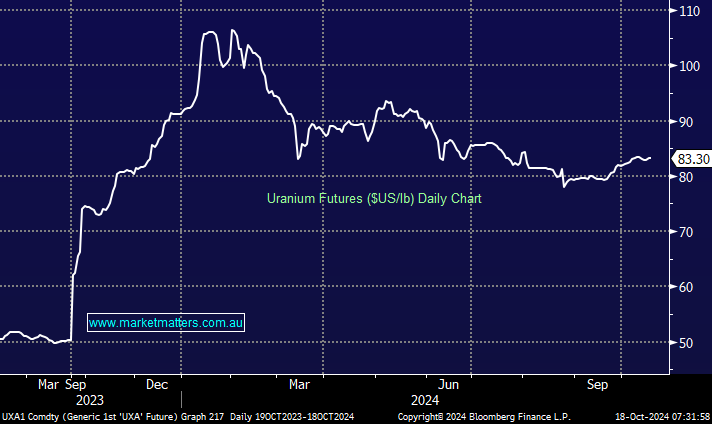

- We believe the U price has found a floor around $US80, and a rally back towards $US100 is likely into 2025.

We remain bullish on the outlook for uranium prices and 2024 could mirror 2023 when uranium prices surged higher in the 4th quarter.

The move by big tech has been significant in the U sector, with the uranium industry facing URA ETF testing its decade highs this week. As the fundamental stars align on the demand side of the curve, we believe it is time to ride the trend similar to the very real evolution of AI – arguably, exposure to the energy demands of AI is a “safer bet” than backing specific AI companies, at this stage we are still at the very early “picks and shovels” stage with stocks like chip providers NVBDA leading the gains.

- We see no reason to fight the bullish advance by the URA ETF, with further gains likely.