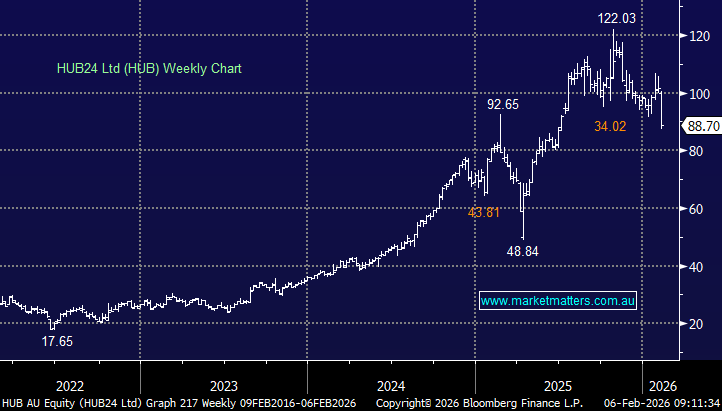

Evaluating the 4 additions to the ASX200 (ALS, BAL, SIQ, XRO)

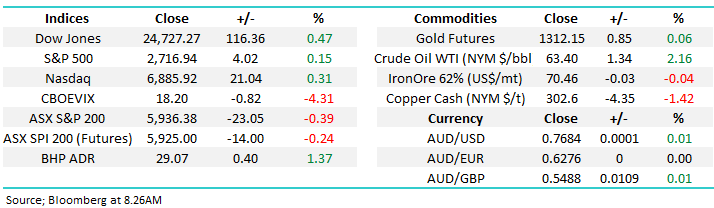

The ASX200 is set to open marginally higher this morning helped by a stronger open for the currently pretty volatile BHP – the “big Australian” closed up 41 c / +1.4% in the US aided by crude oil closing at multi-week highs. Generally markets were quiet overnight as investors await the flagged 0.25% interest rate hike by the US Fed plus more importantly they brace themselves for any surprises in the rhetoric following the decision.

Our market remains locked in a tight and decreasing trading range, a break out from the 5886 – 6026 that’s held us since the start of the month feels likely to lead to some reasonable follow through in whichever direction it may unfold. Hopefully from our perspective it’s to the upside as we are looking to increase our cash levels over the short-term into strength.

Yesterday’s strength in the local banking sector even in a weak market and in the face of ongoing negative news flow from the Royal Banking Commission was certainly encouraging short-term e.g. The Dow fell 335-points, the ASX200 closed 23-points in the red but CBA closed up +0.3%.

MM remains mildly bullish the ASX200 short-term targeting the 6250 area BUT we need a close above 6030 to reaffirm this view.

Today’s report is going to look at the 4 fresh additions to the ASX200.The ASX indices “rebalanced” on Monday morning, a rude awakening for the market “dogs” and a pat on the back for the recent success stories.

Some of the notable names we saw fall from grace were:

• ASX20 Index - out went QBE Insurance (QBE).

• ASX50 Index – out went both Fairfax (FXJ) and Vocus (VOC).

• ASX200 Index – out went Myer (MYR).

• ASX300 Index – out went both Cabcharge (CAB) and Vita Group (VTG).

ASX200 Chart

Overnight US stocks closed marginally higher even though Facebook fell another -2.6% but it was down well over -6% early in the session.

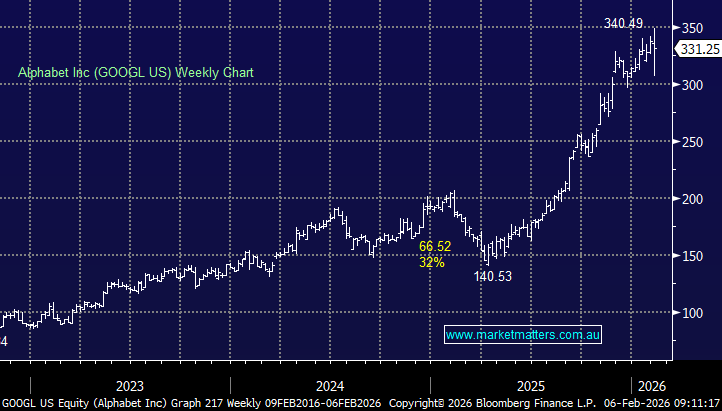

We currently must remain neutral here but our preferred scenario moving forward is still a doomed attempt to break upwards towards the psychological 3000 area.

US S&P500 Chart

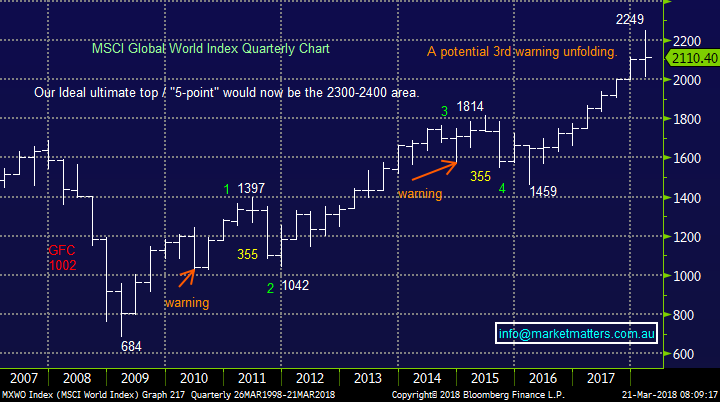

As most of you know we are looking for a significant pullback by global stocks over the coming years back towards the lows of early 2016.

Our intention at MM when / if this correction unfolds is hold some cash, have ‘short exposure’ through ETFs while looking to quality stocks at attractive levels – it does happen fairly regularly i.e. twice in the last 7-years. When markets have deep pullbacks generally the whole index falls enabling some amazing opportunities for the prepared - in all likelihood the actual mechanics of many of the stocks / companies remain unchanged yet the share price pulls back.

Today we are looking at 4 companies who have shown their quality over recent years to enter the ASX200, a great place to search for stocks which we may consider buying into market weakness.

MSCI Global World Equity Index Chart

1 Ausdrill Ltd (ASL) $2.73

ASL is a Western Australian based company which as the name implies provides specialist drilling services. The stock is currently trading on a forward P/E of 18.2x while paying a 2% fully franked yield.

This mining and energy services companies performance has tracked fairly closely to the overall resources sector which makes sense. The company has undoubtedly performed well over the last few years with Moody’s improving its credit rating on the back of a good volume of new project wins and contract renewals. At this juncture, we think Ausdrill has a lot of good news baked into its share price and any downturn in commodities would flow on to the ASL share price, but probably not to the same degree as the miners themselves.

We are neutral ASL at current levels.

Technically we could be buyers around $2.30 but would be sellers back over $3.

Ausdrill Ltd (ASL) Chart

2 Bellamys Australia Ltd (BAL) $21.88

BAL has been on a rollercoaster ride over the last 3-years but the last 6-months have produced some stunning returns. It seems the share price has benefitted from its addition to the ASX200 plus enjoying a ride on the coattails of a surging A2 Milk (A2M).

Importantly we would pick A2M ahead of BAL because it already has Chinese accreditation and is winning market share at a rapid rate of knots, however we think the BAL uptrend is strong and the company happily runs its own race as opposed to tracking the ASX200 closely.

We believe BAL is an aggressive technical buy ~$20 looking for 15-20% upside.

Bellamys Australia Ltd (BAL) Chart

3 SmartGroup Corporation Ltd (SIQ) $11.10

SIQ is an Australian outsourced salary packaging company – a sector we like especially in the current low wage growth environment. This quiet achiever is now trading on a forward P/E of 17.8x and pays a 3.15% fully franked dividend.

SIQ grew revenue an impressive 57% in the first half of 2017 leading to an exciting 68% increase in the dividend, the only obvious caveat being that salary packaging holds some regulatory risk from Governments looking for $$.

Technically SIQ looks to be “topping out” in a very similar manner to global equities and we cannot see much upside above $12-12.50 in 2018.

MM will consider buying between $9 and $9.50 into a market correction.

SmartGroup Corporation Ltd (SIQ) Chart

4 Xero Ltd (XRO) $35.25

XRO is an online accounting system based out of NZ – a product I use for various businesses. The share price has performed well of late, especially considering that their CEO quit at the start of this month.

XRO currently pays no dividend but the business is all about growth.

Technically we could be buyers with stops under $31.50 but the risk / reward is not exciting.

We are currently neutral XRO.

Xero Ltd (XRO) Chart

Conclusion

• We remain overall very cautious stocks at present due to our medium-term bearish view but are always looking for quality companies at the correct price when the opportunity presents itself.

• Being prepared will remain crucial, as opportunities present themselves this year – some great ones I would think

• We like ASL around $2.30, BAL beneath $20, SIQ under $9.50 while we are currently neutral XRO from a risk / reward perspective.

Global markets

US Indices

No major change, overall we believe US stocks have formed a low and they will be higher in 1-2 months’ time.

• While we expect US stocks to rally to fresh highs the likely manner of the advance is far more choppy / indecisive than the almost exponential gains we have witnessed from late 2016 – feels accurate at the moment.

US Dow Jones Chart

European Stocks

European indices have been lagging since late January but picked up over the last 48-hours, potentially we’ve seen their low for a few months.

German DAX Chart

Asian Stocks / Emerging Markets

We remain bullish Asia at current levels ideally targeting fresh 2018 highs in the next ~4-6 weeks – ideally the highly correlated Emerging markets Indices will trade in a similar manner, we are targeting ~10% gains which should theoretically be good news for our resources sector.

Emerging Markets Chart

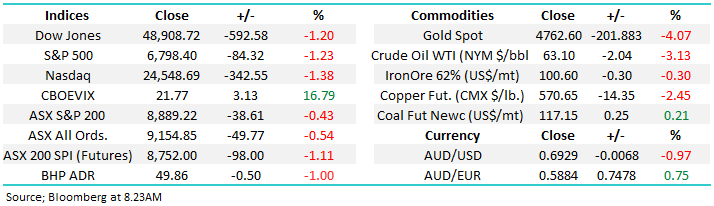

Overnight Market Matters Wrap

• US Stocks finished the session mostly higher overnight with lower than the 20-day average turnover ahead of the FOMC meet tomorrow.

• Energy shares were the largest contributor to market movements up 0.9% with some increased tensions in the Middle East re-emerging and falling output from Venezuela.

• European Shares were also stronger overnight, led by banking stocks whilst tech stocks remained under pressure after concerns were raised over increased regulation and taxation of large companies.

• Locally, Rio Tinto has confirmed the sale of Hail Creek and Valerie coal assets in Qld to Glencore for $2.2bn with both RIO and BHP expected to outperform the broader market today.

• The June SPI Futures is indicating the ASX 200 to open marginally higher, testing the 5945 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/03/2018. 8.26AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here