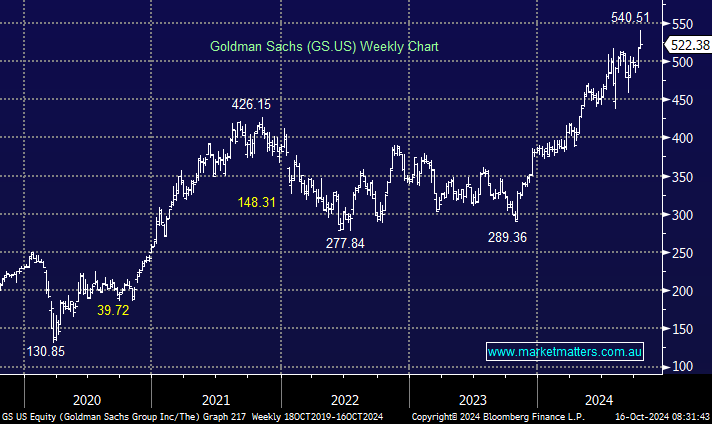

Goldman Sachs (GS US) reported third-quarter results overnight that showed investment markets are alive and well, sending stock to new all-time highs, building on its near 40% rally over the past year. The result was very strong, with profit up 45%, and was a beat across all major metrics, particularly in equity-trading revenue and the investment-banking business. Fixed income and the retail-facing business were on the softer side, with the latter being impacted by falling interest rates. However, that same theme is helping with the deal flow as investment-banking fees continued to roll in, and they highlighted a strong backlog of deals in the pipeline.

- These trends are indicative of a strong market, not one about to enter a protracted slowdown, and with rates set to come down further and the capital markets backdrop looking good, we think GS and others are very well positioned to take further advantage of what comes next.

Divisionally, the $3.5bn of revenue chalked up in the stock-trading unit was its best quarterly result since 1Q21. Fixed-income trading was down 12% to $2.96bn, but in line with expectations, while investment-banking revenue of $1.87bn was a big beat. Their asset- and wealth-management business were a highlight, posting revenue of $3.75bn, up an impressive 16% from a year earlier. The one area that dragged was their consumer-platforms business, which saw a 32% drop in revenue to $391mn, however this is an area they are scaling back.

- All in all, this was a great result from GS US, providing a positive read-through for the market more broadly.