3 Interesting Takeout’s from the US Fed’s Rate Hike

The ASX200 enjoyed a fairly sanguine trading session yesterday ahead of the US Fed’s interest rate decision plus more importantly, its outlook moving forward. Understandably volumes were low with the banks a standout for the bulls, while the healthcare and “yield play” stocks were the noticeable drags on the index. As we look at the moves in US markets following their widely anticipated US +0.25% interest rate hike, overall it looks like Australian stocks called it pretty well.

US stock market sectors continued with their underlying trends while the broad S&P closed marginally lower:

- Utilities fell -0.34% along with Real Estate -0.91%, adding to the last 3-month losses and making it -6.2% and -4.3% respectively – not the areas to be invested in when interest rates are increasing.

The ASX200 remains locked in a tight and decreasing trading range, a break out from the 5886 – 6026 band which has held us for over 20-days feels likely to lead to some reasonable follow through, in whichever direction it may unfold. Hopefully from our perspective at MM, it’s to the upside as we are looking to increase our cash levels over the short-term.

This morning the futures are pointing to a weaker open by the local market, down around 15-points. However we feel this is a touch pessimistic considering that banks have held nicely over recent days and resources were very strong overnight e.g. BHP closed up 56c / almost 2% in the US and gold soared over $US20/oz.

ASX200 Chart

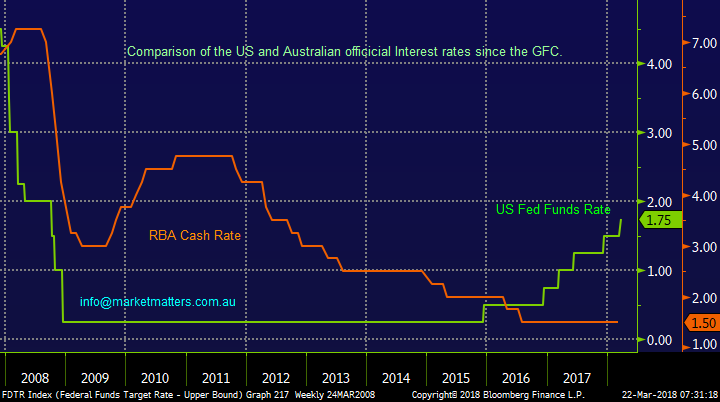

1 Interest rates and respective differentials

As we said, the Fed stuck to its forecasted interest rate hiking path, raising rates to 1.75% and maintaining a goal of 2 more hikes to 2.25% in 2018. Looking further ahead the forecasts are now for 3 hikes in 2019 and an additional 2 hikes in 2020, although there is clearly an enormous number of factors that can derail this thinking over the coming years. When we stand back and look at the interest rate differential between the US and Australia a couple of points jump out at us:

1 Australia must not get complacent with the current low domestic interest rates, they will eventually rise and more than likely aggressively as we play catch-up.

2 With US interest rates already increasing from 0.25% to 1.75%, plus another 7 forecast into 2020, while ours remain rooted to 1.5% its hard not to see a significantly lower $A medium-term.

3. With higher interest rates looming on the horizon portfolios should be structured accordingly e.g. avoid the “yield play” while we believe $US earners should outperform.

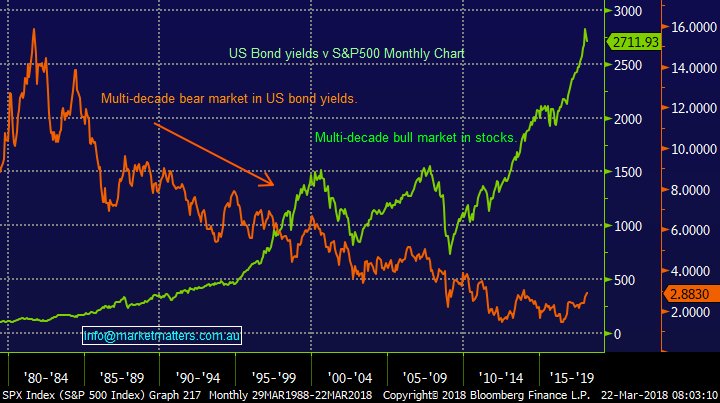

4. Eventually as interest rates rise asset prices, including equities, should suffer after enjoying a bear market by interest rates for the past few decades, the question is where will the “uncle point” be? See second chart below.

Australian v US Official interest rates Chart

US Bond Yields v S&P500 Chart

2 The $US and implications

Overnight the lack of surprises by the Fed, especially a potential 3rd rate hike in 2018, led to a 0.8% drop in the $US index which subsequently reignited commodity prices denominated in $US e.g. Gold up $US20/oz, crude oil +3% and copper up +1.43%. The $US has been in a bear market since early 2017 and our ideal scenario remains for one final low, probably under the 88 level.

- While our picture remains on track the likelihood is Australian resource stocks should have an excellent few weeks e.g. BHP is set to open up almost 2% today.

- Also, the Emerging Markets which are highly correlated to our resources sector are nicely on track to make fresh highs for 2018.

Even following our recent 2 successful forays into the lithium space MM remains extremely overweight the resources space compared to our historical portfolio mix i.e. we are positioned for a final pop higher in the sector.

- We plan to sell our resources exposure into strength from portfolio’s i.e. AWC, BHP, FMG, OZL, RIO and WPL.

$US Index Chart

Emerging Markets ETF Chart

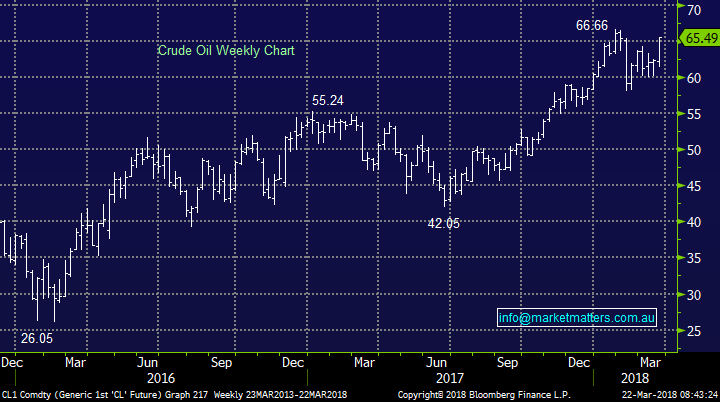

Pleasingly, overnight we saw heavyweight commodity crude oil hit a 6-week high, this bullish acceleration very similar to what we are hoping will follow for stocks. We maintain our bullish target towards the $US70/barrel area i.e. ~7% higher.

- This should help our positions in both BHP and Woodside (WPL) which intend to sell into strength.

Crude Oil Chart

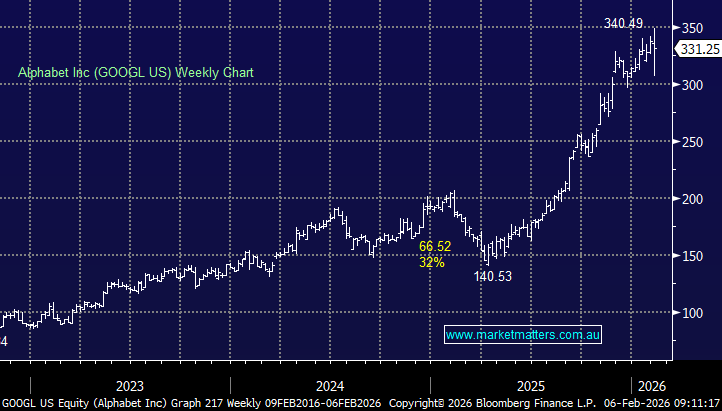

3 US & Global equities

Overnight, US stocks had a very choppy reaction to the Fed’s decision with only the tech NASDAQ stocks coming under any noticeable pressure e.g. APPLE -2.3%. This fits our profile of a US market looking for a major top i.e. the NASDAQ which outperformed on the way up is likely to underperform on the way down.

At this point in tie it feels like concerns around Donald Trumps tariffs, especially towards China, is weighing on the market.

The broad based S&P500 is still sticking to our targeted path back in early January:

- A sharp warning correction should be close at hand – we had that in February although the -11.8% drop was greater than the ~8% we expected.

- Following the drop we expected, a number of choppy weeks around the 2700 area – currently unfolding.

- Next we expect failed breakout attempt targeting 2900-3000 area, before a correction of +20%.

So far we have 2 out of 3 but if our 3rd string to the bow starts to unfold expect MM to take a more of defensive / negative bias.

US S&P500 Chart

Conclusion

- We overall very cautious stocks at present due to our medium-term bearish view, but things look on track for a rally over coming weeks led by the resources sector.

- Importantly we maintain our stance of being sellers into strength.

Watch for alerts.

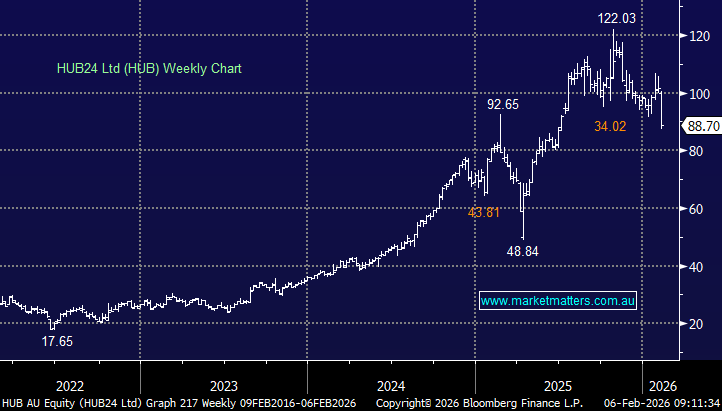

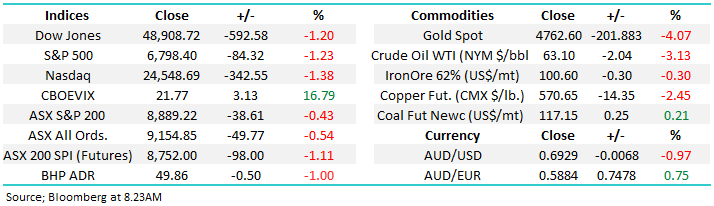

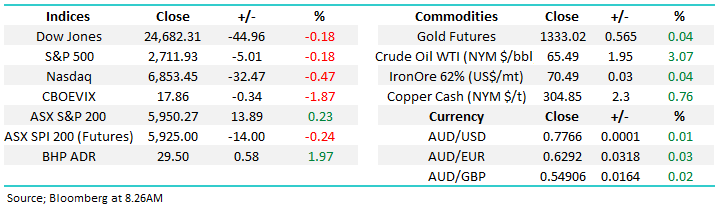

Overnight Market Matters Wrap

· A volatile session was experienced in the US, rallying earlier in the session, only to sell off post interest rate rise of 0.25% as investors digested less hawkish than anticipated comments from US Fed Chair, Jerome Powell. An extra interest rate rise for 2019 however, has been added to the Fed’s forecast.

· Locally, unemployment is out later today with Capital Economics forecast no real change to the rate at 5.5%, with employment rising around 20,000.

· The energy sector is expected to outperform the broader market, following crude oil’s rally overnight, with BHP in the US ending its session up an equivalent of 1.97% from Australia’s previous close towards $29.50.

· The June SPI Futures is indicating the ASX 200 to open 11 points lower towards the 5938 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/03/2018. 8.26AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here