Brace for a Trump Dump! (CBA, ORE, COH)

Yesterday’s small drift lower by the local stocks at the time surprised us, especially considering the strength from our resources sector, but it has turned out to be another case of an excellent call of overseas markets by the ASX200 with the Dow plunging 724-points overnight.

Donald Trump has announced tariffs on ~$50bn worth of Chinese goods, siting intellectual-property violations, which caused already frail equity markets to plunge on renewed concerns of a full-blown trade war. In his speech he quoted US cars exported into China receive a 25% tax but Chinese cars into the US only receive a 2% tax - he forgets how lucky everyday Americans are because of the low import taxes, cars are approximately half the price in the US compared to Australia!

Moving back to the issue at hand we see a couple of important points:

- There is nothing new / unexpected here and the move seemed to be well and truly leaked when our market was open yesterday, probably explaining the average performance.

- China is already addressing the large issue and we feel this is just another Trump muscle flex before the negotiations commence, however given the two countries account for 39% of global trade, this is a negotiation that will impact the global economy

- What this does show us very clearly is US stocks are far more vulnerable to bad news around their all-time highs with Februarys memory clearly not forgotten.

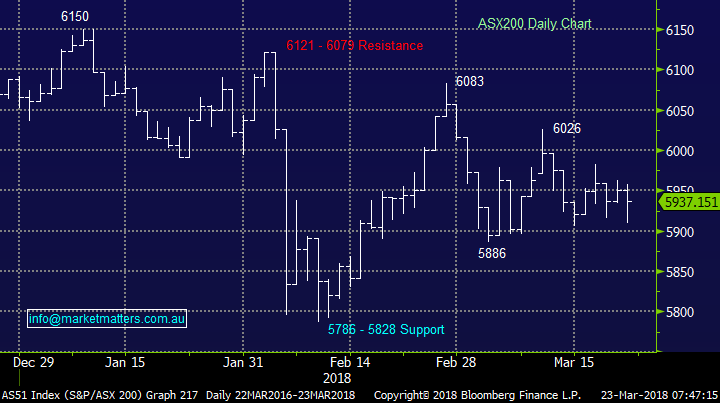

Following the failure of the ASX200 to hold above 5950 we had moved short-term neutral stocks requiring a close back above 6030 to become bullish – no change with this view from recent notes.

- MM remains currently a net seller of strength not a buyer of weakness in aggregate.

However, we will still consider good risk / reward opportunities if / when they present themselves (with our overall desire being to increase cash in the portfolio’s (into strength – not weakness).

This morning the ASX200 looks set to open down ~100-points / 1.7%, testing the panic lows of February.

Today’s report will look at 3 potential buying opportunities into expected morning weakness.

ASX200 Chart

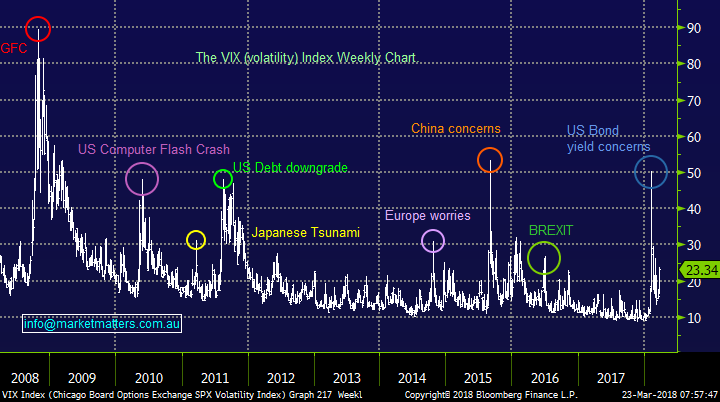

At this junction it’s important that investors do not get too rattled by the day to day swings which stock markets are experiencing, they mainly feel huge because of the unheard-of absence of volatility in 2017 – we felt this was unhealthy and Februarys volatility fuelled panic sell-off showed how all good things come to an end.

Interestingly overnight following the Dows over 700-point dive the VIX only rallied to 23, albeit a 30% advance, it remains under half of the level touched in February, this may be dangerous complacency but at this stage we think it’s because traders / fund managers expected this recent sell-off before markets can regain their “mojo”.

- Historically when we see stocks plunge as they did in February, with an accompanied spike in volatility, the lows of the initial sell-off can often be tested.

Volatility (Fear Index) VIX Chart

Overnight the US market sold-off aggressively with 500-points / 70% of the drop unfolding in the last 3-hours. Overall the broad-based S&P500 remains range bound between 2600 and 2800.

- The S&P500 remains in a neutral Pattern between 2532 and 2872.

US S&P500 Chart

Our medium/long-term outlook for stocks remains fairly bearish targeting a -20% correction hence the current weakness / volatility is certainly testing our resolve with regards to our short-term view for a final spike up in stocks to position ourselves defensively / negatively equities.

US S&P500 Chart

1 Commonwealth Bank (CBA) $74.87

We’ve had our eyes closely on CBA around $73 and this morning, courtesy of Mr Trump, it feels a strong possibility.

- Short-term we remain bullish CBA around the $73 area targeting a bounce to at least $77.50.

Due to our current holding in CBA and medium outlook for stocks we are unlikely to take this opportunity at MM but it adds weight to our view not to panic about stocks – just yet!

- We like CBA as a trade / aggressive play ~$73.

Commonwealth Bank Chart

2 Orocobre (ORE) $6.02

We’ve enjoyed the lithium sector in 2018 courtesy of successful forays into Orocobre (ORE) and Kidman Resources (KDR) while playing the relative value spread between the two.

We remain buyers of ORE into weakness which I touched on in yesterdays “Direct from the Desk” – (click here), this is a position I am relatively comfortable with as the stock has a fairly low correlation to the underlying ASX200.

- We like ORE from a risk / reward basis ~$5.80.

Orocobre (ORE) Chart

3 Cochlear Ltd (COH) $185.41

In the last few weeks we received a Monday question “debating” our negative view on COH around $190. At the time we pointed out it was a technical angle supported by the concerns of a stock trading on a huge valuation i.e. P/E well over 43x.

Today without a crystal ball we do not know who is correct with COH yesterday closing just -2.4% below our sell level. However, the important part of the equation is where we would like to buy this quality company, especially as we like its solid $US earnings profile moving forward.

- We are buyers of COH in the low $160 region.

This may feel miles away at present but COH can be a volatile stock regularly providing buying opportunities courtesy of decent corrections.

Cochlear (COH) Chart

Conclusion (s)

- We believe the ASX200 will hold the 5800 level but remain very aware of our medium term bearish outlook for stocks.

- We like CBA ~$73, ORE ~$5.80 and COH below $165.

- ORE is the most likely short-term play that MM will consider, probably today or never.

*Watch for alerts.

Overnight Market Matters Wrap

· US Stocks fell sharply overnight as worries of a potential trade war and the continued decline tech shares. The broader market received added pressure by the decline in bank stocks.

· Earlier in the session overnight the Trump administration unveiled a new round of tariffs targeted at China imposing close to $60bn in charges. These charges were seen as in retaliation for intellectual property theft.

· Expect the diversified financials to underperform the broader market, particularly Macquarie Group (MQG).

· The June SPI Futures is indicating the ASX 200 to open 95 points lower towards the 5840 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/03/2018. 8.01AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here