Leading mining and infrastructure solutions provider ORI has been on the MM Hitlist since early June. However, the stock has trod water for the last six months, leaving us wondering if there’s still good reason to consider the chemical and explosive business – i.e., is there a catalyst that can wake the stock from its recent slumber? Tuesday saw the stock fall -2.9%, the most in eight weeks after being downgraded to neutral by Jarden, although it remains a popular stock with most analysts with 3 Holds, 8 Buys and 2 Strong Buys.

Its latest trading update in September was solid and contained no nasty surprises, but it failed to send the stock higher ahead of its FY numbers in November:

- Firstly, its Blasting Solutions enjoyed a good half, driven by continued demand for products and services across the mining and civil infrastructure value chain.

- Secondly, its Digital Solutions Business performed solidly, with demand remaining strong for its digital offerings and value-added services despite continued softness in mining exploration activity.

- Conversely, its Speciality Mining Chemicals business is currently the weakest link, reporting lower-than-anticipated production.

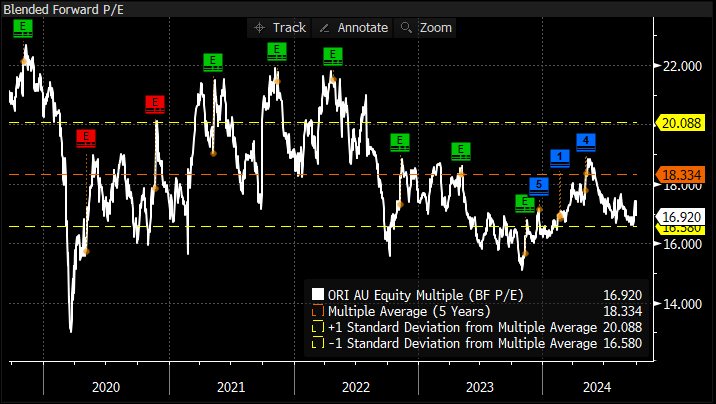

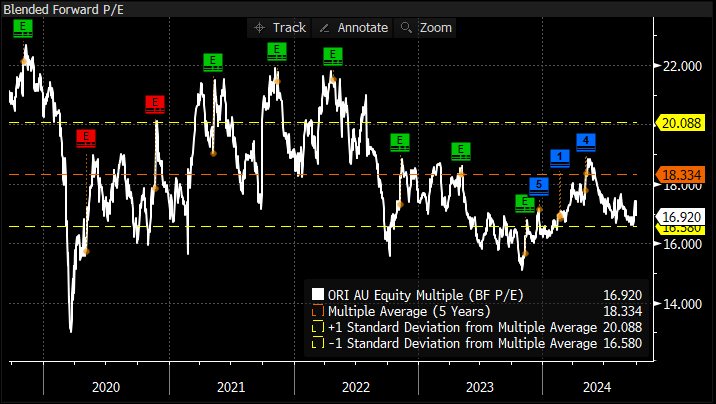

The stock has performed well in 2024, advancing over 15% year-to-date, up about the broad market. However, interestingly, it is still trading on the cheap side, and a dip down towards 16x should offer solid support.

There are a couple of reasons to like ORI as a business, including their very strong market position in the areas they operate, global diversification, they’re at the forefront of technological innovation, plus, their earnings have some defensive qualities while still being exposed to some cyclicality in mining.

Earlier this year, it was encouraging to see solid demand for a $400mn cap raise ~$16 to partially fund the acquisition of Cyanco, a US-based leader in the manufacture and distribution of sodium cyanide primarily serving the global gold mining industry, i.e. the $8.8bn business is still in expansion mode. ORI looks solid, but it’s hard to identify a catalyst to drive the stock back up to and through $20 unless China’s “Whatever it takes Moment” proves successful. At this stage, we see better ways of gaining exposure to Beijings stimulus bazooka.

- We like ORI, but because we run real-money portfolios, we have removed it from our Hitlist, unlikely to buy it in the new term