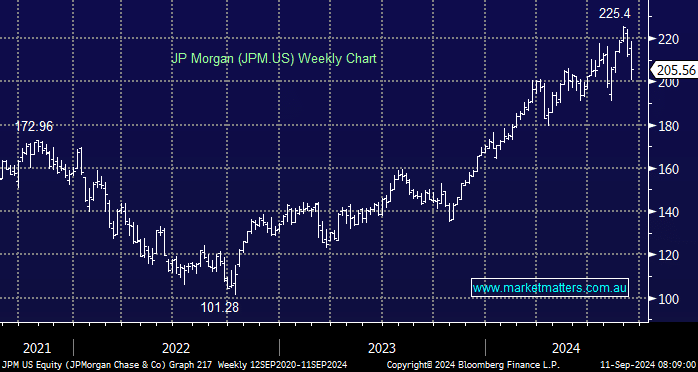

An interesting update from JP Morgan overnight, with their President Daniel Pinto, a potential successor to CEO Jamie Dimon who has run the bank for an impressive 18 years, highlighting that analysts’ expectations on their earnings are too high largely because the tailwind they’ve experienced in recent quarters, with rising interest rates underpinning an expansion in margins is turning, with the US Federal Reserve about to cut rates. The stock fell over 5% on the comments, its weakest session since 2020, prompting the obvious question of whether or not this is a warning sign for Australian banks that have enjoyed a phenomenal run.

- Net interest income, which is the difference between what banks earn on their assets and what they pay on debts, hit a record high for Wall Street’s four major banks. However, JPM is signalling that this is as good as it gets, which also mirrors similar comments made recently by Goldman Sachs.

Higher interest rates are a natural support to bank margins at a time when banks have been pulling costs out where they can. With rates about to turn and the low-hanging fruit from a cost perspective already harvested, the warnings from US banks should heed by local investors.

Banks are expensive, which is not a reason to sell in isolation, and they can stay that way if their operating metrics are improving (i.e. margins are expanding); however, when trends change, valuations can quickly revert. To put some simple numbers around this, JPM usually trades on a PE of 10.6x and a price to book, which measures its market capitalisation relative to the carrying value of its assets, of 1.6x. Right now, it’s on 11.9x and 1.8x, respectively. CBA generally trades on a PE of 18.2x and a price-to-book of 2.2x, and right now, it trades on 24.4x and 3.3x, respectively – its highest valuation ever!

- The US is ahead of Australia in the cycle, probably by around 6 months. However, the dynamics impacting US financials will certainly impact our own in time. We think US banks will provide an early signal, and this week, we’ve heard both Goldman Sachs and JP Morgan temper some of the high expectations in the market—certainly a warning for us as investors in the local banks.

What’s also a concern is the level of forced buying we’ve seen come into the banks, a result of their index weights being high and the value of passive money increasing, while we’re also seeing active managers becoming forced buyers to address underperformance, plus we’re getting more bullish notes across our desk on the sector from places that had been very bearish ~20% ago. We fear this has pushed banks to an extreme level ‘if’ the cycle is turning, i.e. margins move from expansion to contraction again.