Has the ‘Oil Trade’ become a crowded one? (WPL, NFLX)

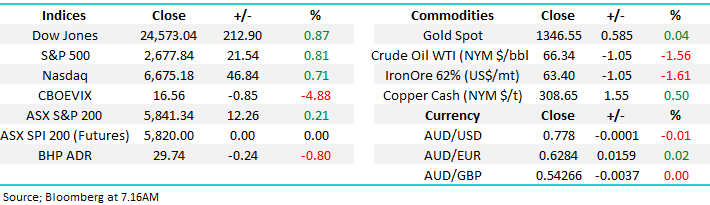

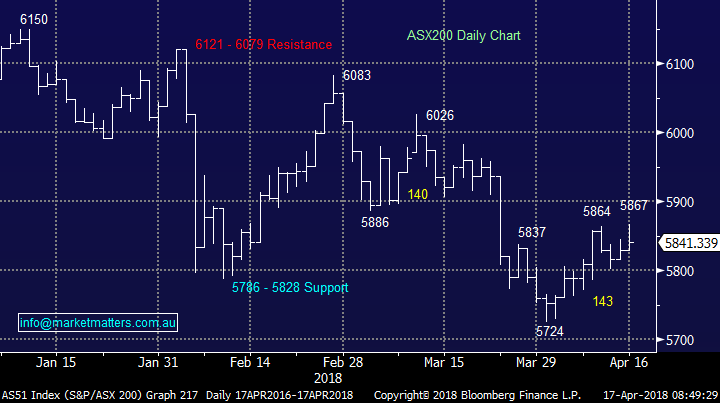

The ASX200 closed up yesterday however it slipped away from early highs and closed back under the 5850 level at 5841. The banks have continued to provide a drag on the local market and yesterday was no exception with CBA for example closing at $72.62 and is now up just 0.43% for April after declining by -5.34% in March – usually the two strongest months of the year for the most dominant sector on the ASX.

Amongst the resources we saw BHP have a tilt at the $30 region yesterday closing just 2c below while Rio and Fortescue also suffered from a selloff in the Iron Ore market during Asian trade. BHP set to open down around $29.74 this morning. Some clear divergence in the commodity markets between the ‘haves’ and the ‘have nots’. Iron Ore has been under significant pressure and the consensus call is now for lower prices while Crude Oil has been strong with the consensus now targeting ongoing strength.

Yesterday’s price action on the ASX 200 was choppy and neutral at best - while we retain a slight positive bias at the moment, we need to see a break above 5900 on a close basis to confirm that stance.

S&P/ASX 200 Chart

Overnight the US market traded in a reasonably tight range finishing higher overall. 1st quarter reporting season is now well underway with Bank of America and Netflix headlining overnight. Bank of America delivered a strong overall result with trading revenues the clear standout – seems recent volatility has improved trading activity significantly, while recent corporate tax cuts have helped the four banks that have reported to date (JP Morgan, Citi, Wells Fargo & Bank of America) report the highest first quarter combined profits since before the GFC.

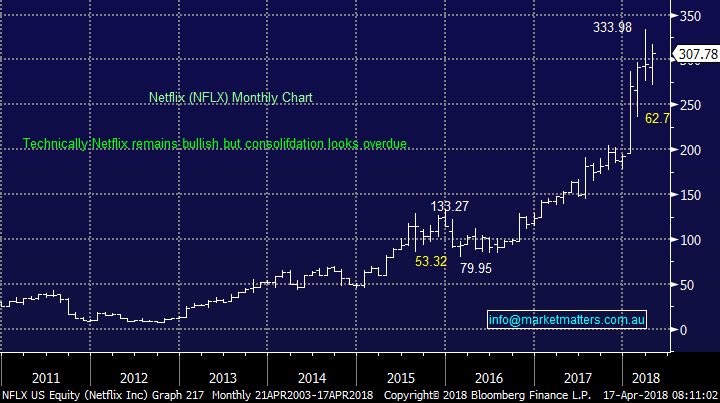

Netflix was also out last night and this is an interesting story with 7m new subscribers coming on board in the 1st quarter while the company is guiding for another 6.2m in Q2 – it would be nice if Market Matters was on that run rate! For the 1st quarter Netflix generated revenue of $3.7b - not bad for a company that offered itself up for sale to Blockbuster for $50m in 2000 before becoming a streaming service in January 2007. Now it’s a $133b dollar company – basically in 10 years!!

Netflix remains bullish however a period of consolidation would not surprise

Netflix Chart

Has the ‘Oil Trade’ become a crowded one?

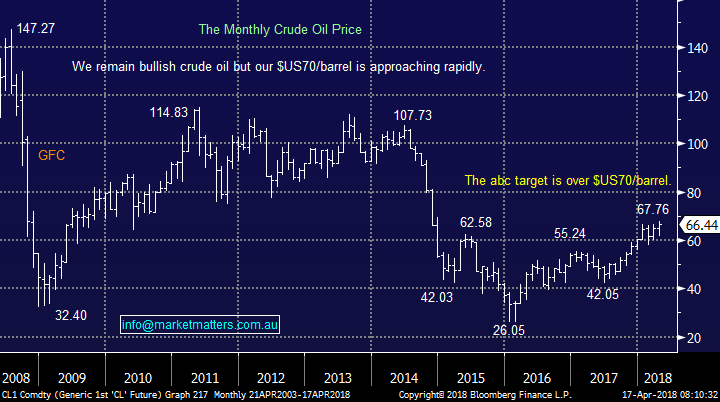

In our 2018 Outlook Report, our third prediction was that Crude Oil looks destined for $US70/barrel when it was trading at $US60. There’s no doubt that crude oil has been on a wild ride since the GFC but volatility has diminished since 2016. In 2017 we expected Crude to range trade between $US40/60bbl which played out nicely. We are bullish the energy sector into 2017 targeting a 15% advance for crude oil.

We now see Crude’s recent high at $US67.76/bbl and the market has turned decidedly bullish on Oil. The overwhelming production glut from US shale has been forgotten, global growth is accelerating, we’re not hearing talk of the risk posed by alternatives (electric cars and the like) and Saudi Arabia have started banging the drum for $80 per barrel Oil, however as we suggested recently this comes as the Arab state tries to get the most favourable valuation for the proposed IPO of state owned energy behemoth Aramco.

We now also have rumblings that OPEC and others will look to extend an agreement to cut Oil output into 2019 at their next meeting in June. The initial production cuts took effect in late 2016 and were to stay in play until late this year as the world worked through a massive glut in inventories. The deal made sense at the time with Crude Oil languishing around $US45/bbl after OPEC successfully rendered much of the US Shale production uneconomical.

Since those cuts Oil has put on ~50% bringing US Shale back into the fold. We’re also seeing an uptick in ‘rig count’ in the US for the second straight week as new rigs come online to take advantage of the higher prices while the Syrian attacks on the weekend were a short term positive for the Oil price.

It’s easy to comprehend that OPEC may continue to curb production to support prices and the listing of Aramco in the second half of 2018 and the Oil price may remain supported as a result, however the easy gains have been gotten. We had two energy exposures across the Market Matters Portfolios – Woodside which was exited yesterday around $30.60 while we have retained our holding in BHP (for now) – targeting as exit around $32 assuming it can hold the $30 region.

At this stage, MM will continue to sell holdings into strength with Woodside being a clear example yesterday.

Crude Oil Chart

Woodside Petroleum (WPL) Chart

Conclusion (s)

- Oil has traded close to our long held $US70/bbl target and we used strength to reduce our exposure

- We still hold BHP targeting a move to $32 assuming it can hold the $30 region

Global Indices

US Stocks

Overall we must remain neutral just here, but our preferred scenario moving forward still remains a doomed attempt to break upwards towards the psychological 2900-3000 area.

US S&P500 Chart

European Stocks

No major change with our call for the German DAX – the correction back to the 12,000 level played out and the index is now mildly bullish.

German DAX Chart

Asian Stocks

Similarly, to western global indices the Hang Seng has corrected over 10% and is looking good from a risk / reward perspective.

Hang Seng Chart

Overnight Market Matters Wrap

· The US equities markets bounced back, as geopolitical tensions dissipate and investors’ focus back on its quarterly earnings.

· On the commodities front, Crude Oil slid 1.56%, while Dr. Copper gained 0.5%, a widely received indicator on the health of global economy.

· Iron Ore however lost ground, with BHP expected to underperform the broader market, down in the US an equivalent of -0.8% to $29.74 from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open marginally lower, hovering near the 5840 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/04/2018. 8.26AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here