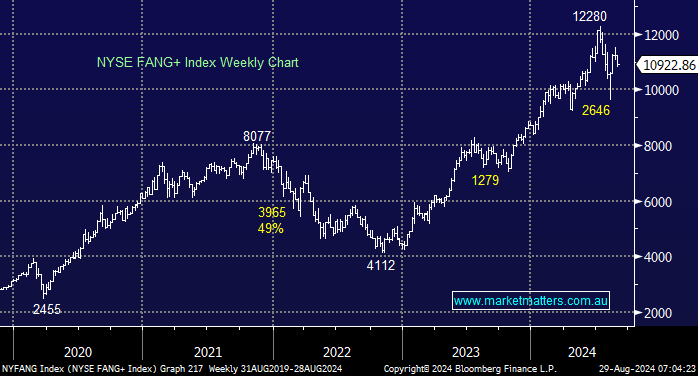

The FANG+ Index is a good gauge of the health of the aptly named “Magnificent Seven” stocks, which have lifted US indices higher over the last twenty months. The recent ~21% sharp pullback illustrates that even the most robust pockets of the market retrace when they get ahead of themselves, i.e. positions become “crowded” leaving fresh buying scarce at best. We don’t believe the advance is over, but it’s maturing, which is likely to see the weaker members start/continue to struggle.

- We are bullish towards the large-cap US tech stocks over the coming years but are more cautious in the short term.