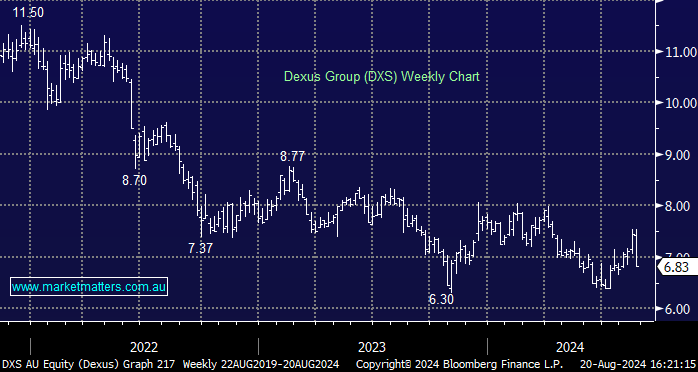

DXS -8.93%: An inline result for FY24 from Australia’s largest office landlord despite an eye watering headline loss of $1.58bn due to property revaluations, with lowered guidance for FY25 the catalyst for today’s slide;

- Revenue of $902.2 million was up +6.3% yoy

- Adjusted Funds From Operations (AFFO) per security of $0.480 vs. $0.516 yoy, was inline with guidance and consensus

- Final distribution per security $0.213 vs. $0.236 yoy was also inline.

- A big headline net loss of $1.58 billion built on last year’s loss of $752.7 million, all down to revaluations of their properties.

- Portfolio revaluations resulted in a circa 12.9% decrease on prior book values for the 12 months to 30 June 2024. These revaluation losses primarily drove the $1.91 or 17.6% decrease in net tangible asset (NTA) backing per security during the year to $8.97 at 30 June 2024.

For FY25 they have now guided for AFFO per security $0.445 to A$0.455, which was 6% below consensus and that translates into a lower expected distribution, guiding to $0.37 for the year, underpinned by a tweaked dividend policy, paying out 80%-100% of AFFO for FY25. DXS closed yesterday (before todays update) at $7.44 and had built in a recovery, which is now not expected in FY25 given today’s guidance.