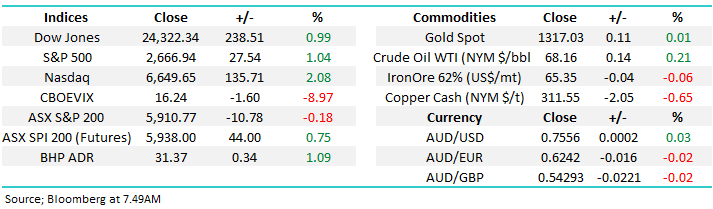

Global stocks remain bullish short-term, but do we? (HSO, WBC, BHP, USD)

The ASX200 slipped -0.18% yesterday but it certainly felt far worse if you hold any Australian banks! The Influential Swiss investment bank UBS tossed Westpac (WBC) into the sin bin, dramatically dropping its valuation of Australia’s second largest company -14.5% from $31 to $26.50.

This time the concerns emanating from the royal commission are around the banks lending standards in the mortgage area i.e. a $400bn mortgage book for WBC. A few quick thoughts:

· Unfortunately, we have no doubt WBC lending standards have been slack but the horse may have bolted and looking forward the banks should emerge stronger after the current pain.

· Australia needs a significant property downturn to have an immediate negative impact on the banks profitability, not our preferred scenario at MM.

· However, credit growth is very slow and the banks themselves are only growing at 2-3% pa hence they clearly have little “wriggle room” before a deterioration to current valuations.

· The banks already have a high payout ratio hence any meaningful downturn in its profitability could lead to cuts in their sacred dividends.

Perhaps we will see a “sell on rumour buy on fact” for Westpac who report on 7th of May.

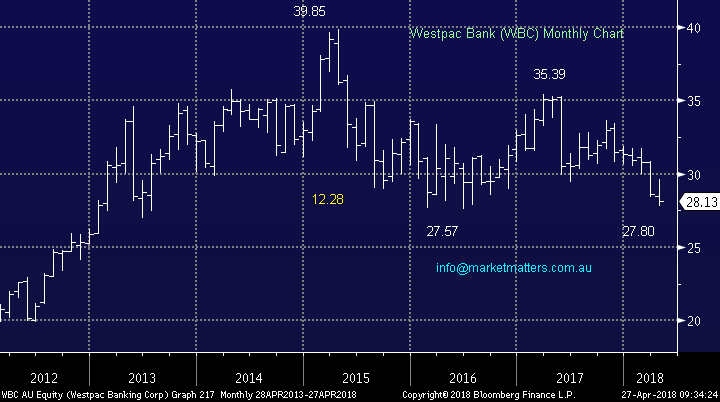

Westpac Bank (WBC) Chart

Westpac has now corrected over 30% since its high in 2015 illustrating why investors must remain open-minded and look ahead. Nobody wanted to sell banks 3-years ago yet today they feel almost as bad as say Telstra!

· Australian banks have performed awfully compared to their global counterparts with a huge disconnect in performance starting in mid-2017 but is the underperformance mature?

· Local banks have tumbled up to 30% since mid-2015 but is this move mature?

· Westpac has fallen ~30% but UBS’s new pessimistic target for Westpac is currently less than 6% away, not exciting for the sellers.

The royal commission in the short-term has helped hedge fund managers who have doubled their “short positions” in our banks while devaluing almost every Australians super but as we said earlier we believe they will emerge stronger albeit in a low growth position.

At MM we believe Australian banks are now very cheap, and have already priced in the bulk of this current negativity e.g. CBA 5.95% and Westpac 6.68% both fully franked.

Following our 2% allocation into NAB our MM Growth Portfolio is now holding 27% exposure to the “big 4” banks, about 4% overweight but it certainly felt more yesterday.

However, we are still considering increasing our banking exposure slightly into current weakness, probably via another 2% into CBA.

*Watch for alerts.

A quick thought moving forward, when we believe its time to sell / short equities a reasonable position in our banks offset by a short ETF may prove ideal, we will be evaluating this idea over coming weeks.

Phew, now to move on from the banks which feel like they’ve dominated the press and our reports over recent times.

Australian Banking Index v Global Banking Index Chart

This morning the ASX200 is set to open strongly around the 5950 area, its highest level in over a month – not a bad effort with the huge banking sector down -2% over the same period.

The close back above 5900 has switched us to a short-term bullish stance although how far we can rally is likely to be determined by the banks – here we go again, the banks! Ideally, we will see fresh highs in 2018 before MM will switch to a bearish position, in-line with our 2018 outlook piece – less than 4% away.

ASX200 Chart

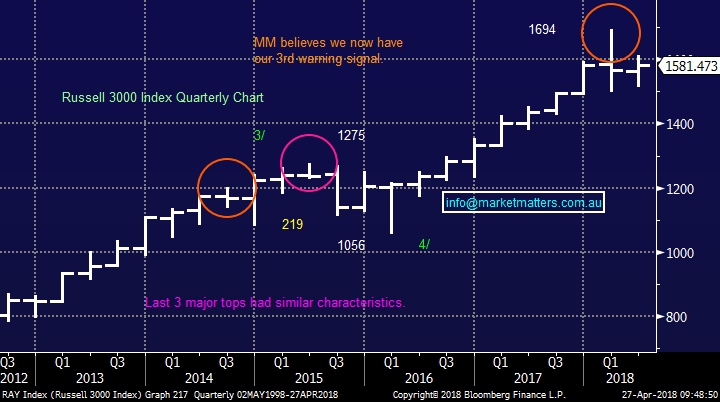

US stocks continue to rotate between the extremes set in the recent panic fortnight back in January / February with the 12% range finding it easy to contain the market over the last 11-weeks.

Our preference is still that US stocks make fresh all-time highs in 2018 before the post GFC bull market is complete i.e. around 7% away. Fundamentally the news remains ok and as the nerves calm and hopefully Trump takes another holiday so markets can regain their bullish undertone.

· So far this reporting season 80% of S&P500 companies have beat on earnings with over 70% beating on revenue.

· Leading economic indicators remain positive and supportive for stocks, assuming bond yields do not surge higher.

· The markets P/E has come back to around 16.5x from 18.5x reducing the valuation risks for the bulls.

US Russell 3000

Two other quick subjects that have been getting press recently, one being our biggest call for 2018.

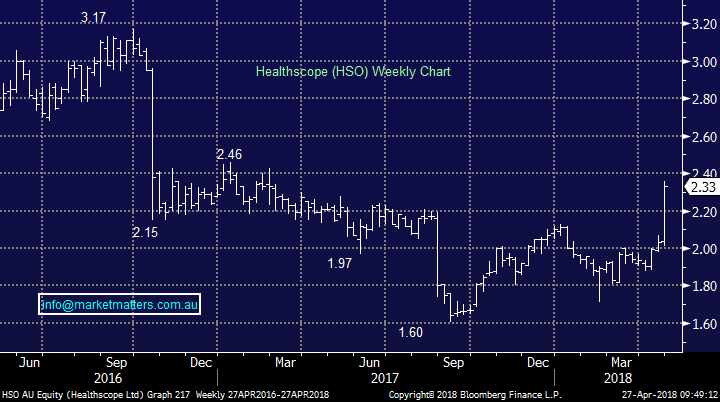

Healthscope bid

Yesterday the BGH Capital Fund bid for Healthscope interestingly with Australian Super being part of the bid. Our initial thoughts are the bid sitting at a 16% premium to the previous closing price of $2.03 is too low, although the stock closed at $2.33 yesterday, a few cents below the bid.

While we obviously do not know if a higher offer will eventuate there were rival offers last time Healthscope was the subject of a takeover offer in 2010. Our “Gut Feel” is for the takeover of HSO to be successful a price over $2.50 is likely to be required.

Healthscope (HSO) Chart

The $US Index

The $US again closed this morning at its highest level since early January and we believe its headed towards at least the 95 area / 4% higher – perfect for our ETF position.

So far this advance in the $US has not particularly led to the weakness we believed was likely to unfold in resources although the market may not yet believe the $US is going up.

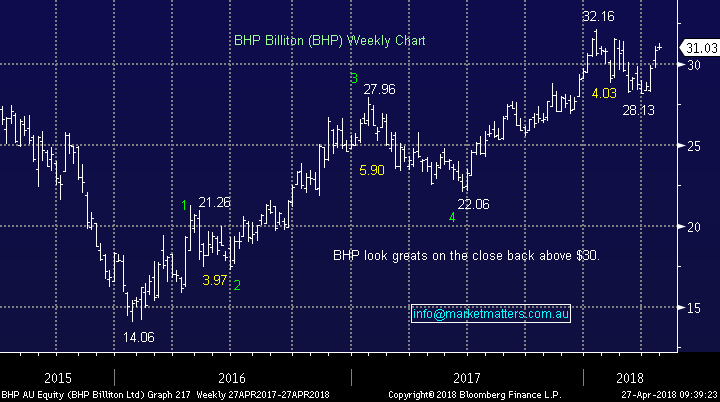

Also, when we look at our position in BHP our target of ~$32.50 still feels attainable, around 4.5% higher.

We like our combined position of long BHP and long $US ETF.

$US Index Chart

BHP Billiton (BHP) Chart

Conclusion (s)

1. We remain bullish equities short-term.

2. Australian banks feel good value and we like the accumulation into weakness approach until a recovery catalyst eventually emerges.

3. We remain bullish the $US which benefits Australian $US earners.

Overnight Market Matters Wrap

· The US major indices gained overnight, led by the tech heavy Nasdaq 100, rallying 2.08% as earnings continue to surprise analysts to the upside. Last night, it was Facebook (FB.US) up 9.06% and Amazon (AMZN.US) up over 6% in after-hours trade following its 3.96% increase in normal trade.

· The US$ Index continues to rise, and we remain confident that this has found a major bottom.

· Bonds rallied a little, with the benchmark US 10 year back below 3%, a level it hit yesterday for the first time in over 4 years. Commodities were mixed, with Brent recovering 1%, easing back towards US$75/bbl, while aluminum also rallied but copper, iron ore and gold were slightly weaker.

· BHP is expected to outperform the broader market, after ending its US session up an equivalent of 1.09% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 48 points higher, testing the 5960 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/04/2018. 8.26AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here