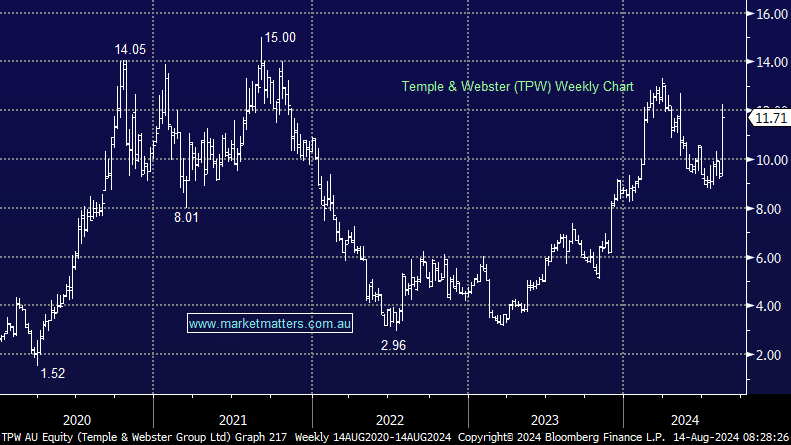

A big reaction (+23%) to a reasonable beat at their FY24 results from the online furniture retailer on Tuesday, with great performance to start FY25 underpinning the market’s positive view. TPW has had a storied history, with COVID driving a phenomenal uplift in sales and pushing the shares to a high above $14 in 2021, before crashing to below $3 in 2022. We have owned TPW in the past, selling it back in 2021 above $12, however, we’ve not been back in since. Does yesterday’s update change our view?

TPW reported record sales of $498m for FY24 in a period where interest rates went up, and disposable income went down, representing an impressive increase of 26% on FY23. While profit is low given they’re building out the platform, they are profitable and the sales numbers are impressive against a backdrop of a market that actually declined by 4%.

- A higher proportion of repeat customers (57% of all orders) is a worthy aspect to highlight; it’s a lot more efficient to sell to existing customers than find new ones.

In the first 5 weeks of FY25, sales were up another 26% y/y, and when we consider the size of the local furniture and homewares market ($19bn), TPW is only scratching the surface. Their target of $1bn in sales in the next 3-5 years seems very achievable.

As they continue to scale this year, margins will remain low, however, they will improve over time. They also have over $100m cash on the balance sheet and no debt. Like JBH this week, it’s not all doom and gloom in retail, and those companies executing well, are stealing market share.

- At nearly $12, the risk/reward is not appealing, however, we have greater confidence their model is working. Into any market related sell-off, TPW will likely find its way back onto the Hitlist for our Emerging Companies Portfolio.