3 very different tales of “insider” buying & selling (RHC, ILU, GEM, BPT, HVN)

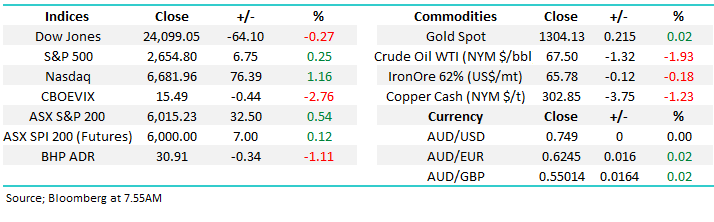

The ASX200 again rallied strongly yesterday to close well above the psychological 6000 level, making fresh 7-week highs in the process. The embattled banks were again the main drivers rallying over 1%, twice the performance of the broad market with ANZ leading the charge gaining +2.35%. Basically, the market had become too negative our banking sector and when we get news that is “not too bad”, like ANZ’s report yesterday we see a scramble to cover the “shorts” – we envisage more of this over the forthcoming weeks.

- Market Matters remains bullish the ASX200 targeting the 6250 area, or ~4% higher.

Today’s report is going to look at the fascinating / often frustrating subject of “insider dealing” within the Australian market, while focusing on 3 topical examples.

ASX200 Chart

Yesterday, the resources sector remains mixed with RIO, S32 and Iluka all closing in the red as the $US continued its rally, making fresh 4-month highs overnight. This morning BHP is set to open down just over 1%, around $30.90

The $US strength has led to our anticipated decline in commodity prices with gold falling ~$US15/0z overnight, its lowest level since December 2017 – again excellent correlation with the $US.

Yesterday we did not press the “buy button” on Independence Group (IGO) which was discussed in the morning report for 2 reasons:

- IGO’s report was pretty poor and further downgrades are anticipated this week.

- The strengthening $US is likely to put ongoing downward pressure on the important underlying nickel price.

MM is now looking to buy IGO under $4.70 / over 4% lower.

$US Index Chart

Independence Group (IGO) Chart

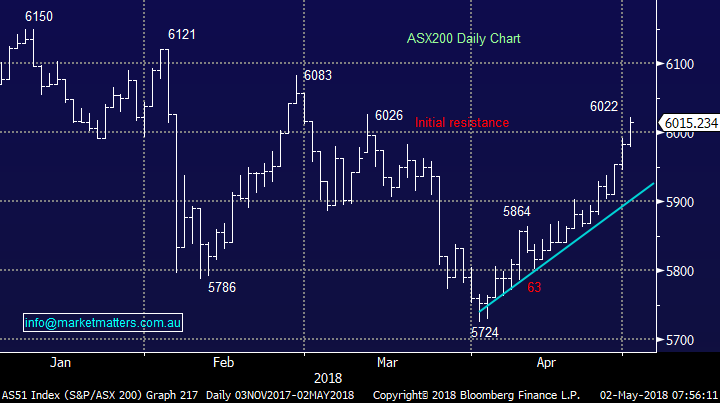

Overseas indices behaved themselves last night leading to a 3% drop in the VIX (Fear Index) as it challenges the post panic February lows. The main standout was APPLE which rallied +2.3% but is now up an additional ~5% following its after-market report.

MM remains bullish the often leading US NASDAQ index targeting fresh all-time highs in the coming months.

US NASDAQ Chart

Insider activity - 'An under-appreciated source of intelligence'

There is nobody who should know a business better than its directors, both now and in the future – not always acknowledged in the royal commissions! Historically insider buying / selling can be a very important “valuation” indication to the market and unfortunately often for very questionable reasons. There have been some classic examples recently that belied any statistical arguments against this view.

- Insider buying / selling refers to transactions performed by company directors and / or people within the company.

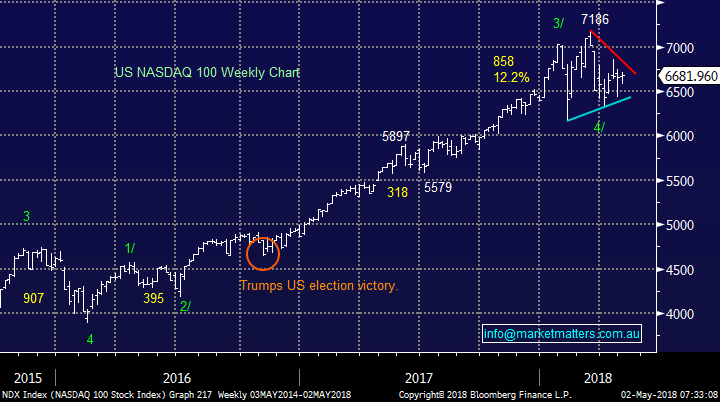

In 2016 /7 there were six much publicised examples of insider selling – the companies at the time were Australia's worst-performing listed companies which lost $11 billion in value in just six months after well-timed sales by "insiders". The selling helped the insiders avoid the sharp falls that followed profit warnings, downgrades and other corporate disasters.

In total nine executives and directors sold shares in Aconex, Sirtex Medical, Bellamy's Australia, Vocus Group, Healthscope and Brambles worth about $60 million, those shares were subsequently worth just $32 million ~6-months later – amazing timing and easy to warm the interest of any cynic.

- Hence at MM we believe it’s very important to be abreast of any significant insider activity.

Importantly not all stories are bad, a great example was with BHP in 1999 when the incumbent CEO Paul Anderson told his executive to team to get on board in a very strong manner. An interesting lesson in executive/director alignment with shareholders, colloquially known as “skin in the game” -

- “If you believe the story that we as a team have planned and can deliver on, then go out and BUY one times your salary in BHP shares (not company options, stock or money lent by BHP) but with your own money. If not you probably shouldn’t be here …” – Paul Anderson.

We simply love this attitude!

NB BHP shares rallied from ~$4 in 1999 to $46 in 2008.

Today we have looked at three examples that have caught our attention over recent times.

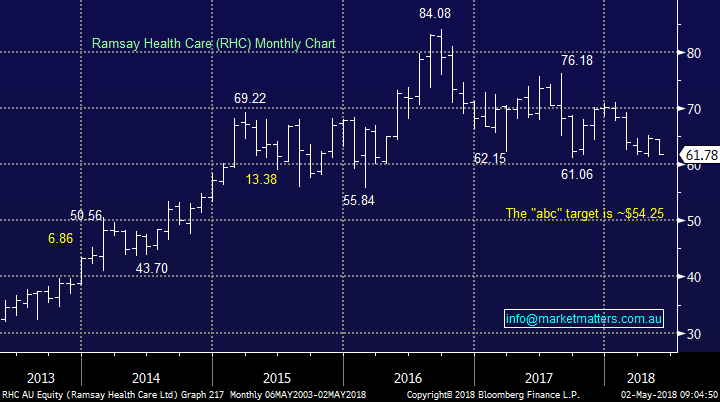

1 Ramsay Healthcare (RHC) $61.78

Yesterday RHC shares dropped -4.5% falling to close within a whisker of its 2-year lows. This previously much loved healthcare stock is now sitting -26% below its 2016 high but a valuation of 21.7x is still not compelling – comparatively Healthscope is sitting on 24.8x earnings as it trades above its takeover bid.

We’ve witnessed high powered executives selling RHC in current times:

- In the months before he left the company / board long-standing CEO Chris Rex sold $27.2m worth of shares - however he still does have ~800, 000 shares.

- CFO Bruce Soden sold alongside Rex in March plus again by himself in November, earning him $12.5 million over the year.

- Now Rex's replacement Craig McNally, who revealed the company “faced tough European conditions” in the February results, has also sold down. The company told the market on Monday afternoon at 4:09:45 (15sec before the mkt closed – cheeky buggers) that McNally had sold 75,000 shares in three instalments last week to net $4.8 million – the sale represents 18 per cent of his total stake.

It feels like there are further sell-downs to come and overall this smells to us that more bad news is on the horizon for RHC. Importantly, the value of sells has far outweighed the value of any buys – an important element.

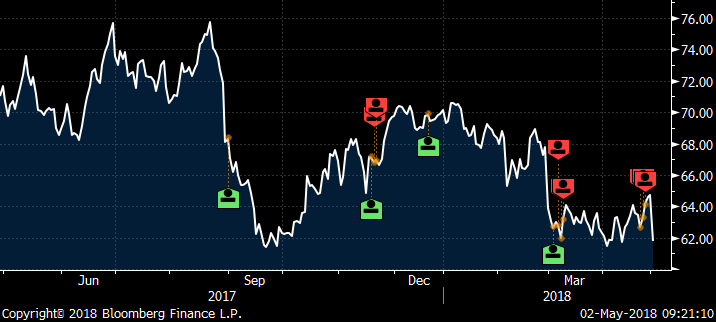

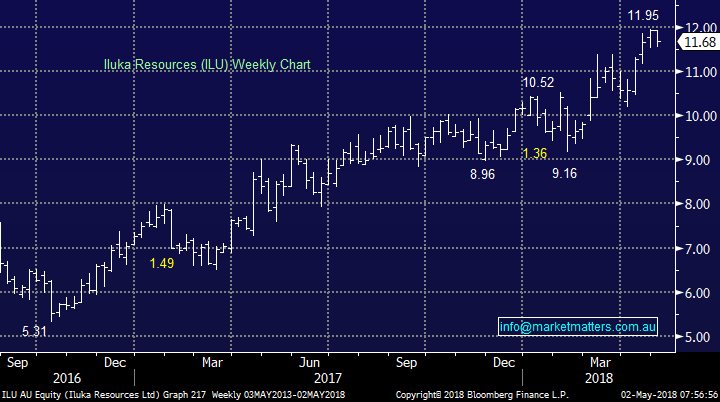

RHC Insider Buying marked in Green – Insider Selling in Red

- MM remains bearish RHC maintaining our initial target of ~$55, another 10% lower.

Ramsay Healthcare (RHC) Chart

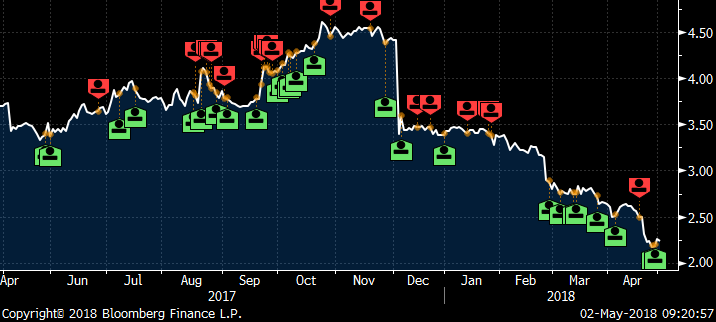

2 Iluka (ILU) $11.68

Recently we’ve seen Iluka directors / insiders “top up” their holdings – certainly not in a significant way but it’s a lot better than selling!

- Following a 5-year down cycle it’s nice to see 4 directors top up their holdings, albeit in a very small way. I ponder the boardroom discussion to arrive at this collective decision.

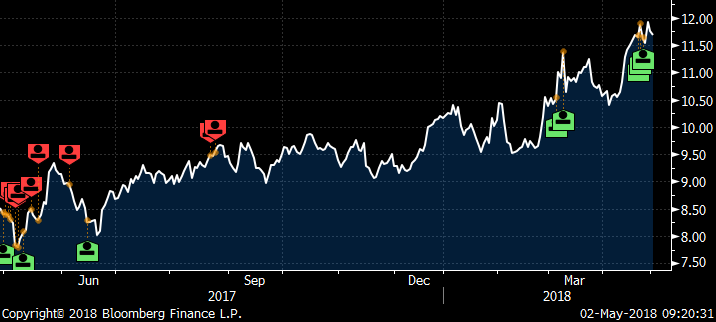

ILU Insider Buying marked in Green – Insider Selling in Red

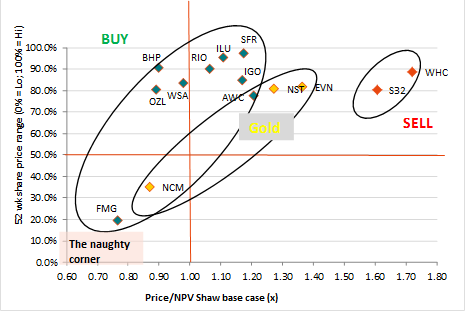

We have ILU in the “buy into weakness” bucket with the below valuation comparisons looking ok, we would get excited below $10 which is not out of the question given we’ve seen 2 such corrections in the last 2-years.

Source; Shaw and Partners

Iluka (ILU) Chart

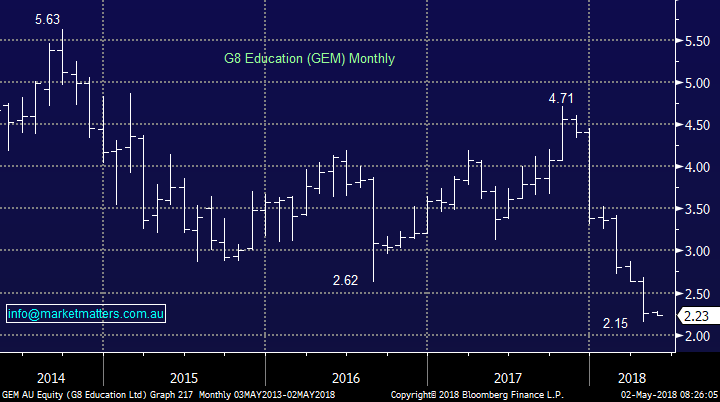

3 G8 Education (GEM) $2.23

Talk about catching a falling knife, a GEM has fallen well over 50% since October 2017 but in the last week we’ve seen 3 insiders buy stock, a combined value of under $100k but still a step in the right direction. The little group of non-executive directors / directors must be vaguely optimistic moving forward unless they are trying to buy investor confidence which feels off the mark to us.

GEM Insider Buying marked in Green – Insider Selling in Red

Child care operations feels like it should be a healthy space but alas this has not been the case with GEM over the last 12-months as supply continues to outpace demand in the childcare industry putting pressure on occupancy & margins.

Management has been optimistic that conditions will improve in the second-half of FY 2018 thanks to the new Child Care Funding package but the company intends to provide a new three-year earnings per share target when it releases its half-year results in August – investors nerves are likely to be tested until then.

The insider buying is definitely not enough to trigger us into buying GEM but we would consider the stock as an aggressive play around / below $2.

G8 Education (GEM) Chart

Also, the following 2 stocks caught our eye in the last few months following some meaningful insider buying:

Beach Energy Ltd (BPT) - Non-executive director Jocelyn Morton has bought 50,000 Beach shares at an average price of $1.245 each. Ms Morton joined the board last month and was also appointed chair of the audit committee. Clearly Ms Morton has been impressed with what she has seen, the shares closed at $1.61 yesterday!

Harvey Norman Holdings Limited (HVN) - Figurehead Gerry Harvey recently picked up 1 million shares for almost $3.8 million through on-market trades. It looks as though Mr Harvey has seen the retailer’s post-earnings share price weakness as a buying opportunity to top up his massive holding. With the shares trading at 10x earnings he might be a winner on this one – at MM we like HVN around $3.50.

Conclusion

We like ILU but ideally 10% lower, have no interest in RHC and GEM until further notice.

MM believes it’s very important to keep abreast of any insider activity. Overall it’s the selling that we believe gives investors more clues apart from in the small-cap end of town.

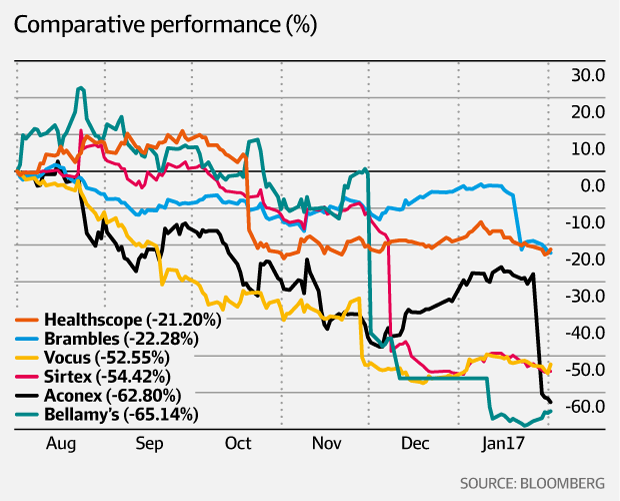

Overnight Market Matters Wrap

· A mixed session was seen overnight in the US, with the Dow and Broader S&P 500 ending the day with marginal change, while the tech heavy Nasdaq rallied 1.16%.

· Apple reported strongly after the market closed and announced a $100B buy back. NASDAQ futures surged as a result.

· Pundits are sceptical that a major trade deal between the US and China will eventuate, despite a US delegation travelling to Beijing on Thursday. The US extended steel and aluminium tariff exemptions for Australia and a handful of other countries.

· The June SPI Futures is indicating the ASX 200 to open marginally higher, towards the 6022 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 02/05/2018. 8.26AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here