Subscribers’ questions (BHP, FMG, TLS, MQG)

The ASX200 looks set to retest the psychological 6100 area this morning, assisted by strong gains on Wall Street and speculation that Australia may be about to receive a classic “friendly” pre-election budget – perhaps Donald Trump does have one adhering quality as he appears to be a rare politician who certainly cannot be accused of focusing on being re-elected above all else, he appears not to care what people think!

After the recent strong market gains we can easily envisage a fairly quiet week of trading between 6050 and 6150, but we are mindful that statistical ranges point to higher prices in May i.e. around the 6170 in the next few weeks.

We remain short-term bullish at MM with an initial target in the 6250 area, but if the friendless banking sector could find a modicum of love we could potentially go significantly higher.

- Following the ASX200’s explosive 6.7% rally, we still believe any market surprises are likely to be on the upside over the coming weeks – bears beware.

We have again received an excellent group of questions this week, including some much appreciated positive feedback - thanks! We are committed at MM to continually improve our service so any constructive feedback, both positive and negative, helps us enormously.

ASX200 Chart

Question 1

“Just outstanding & interesting video, thank you!” – Kym E.

“Hi James Just a quick note to say "Thank you" for getting Peter O'Connor back to discuss opportunities in the resource space. Excellent insights. Thanks for following up on my earlier request.” - Regards, Jan

Hi Kym / Jan, thanks Rocky’s an excellent analyst (rated number 1 for BHP) whose more than comfortable to go out on a limb with his opinions and importantly I’ve witnessed him being right far more often than wrong!

A quick summary of the 4 points that caught our attention:

- He remains bullish the resources stocks but believes the 2 ½ year rally in the sector is definitely late cycle i.e. “he’s alert but not yet alarmed”.

- He is extremely bullish BHP especially with their huge capital management looming in the next 12-months – expect a special dividend and / or buybacks.

- He’s extremely positive Fortescue (FMG) as a speculative position believing the markets become too bearish FMG’s iron ore discount issues.

- He’s still bullish Alumina (AWC), Independence Group (IGO) and Oz Minerals (OZL) believing they also have the potential to be M&A targets.

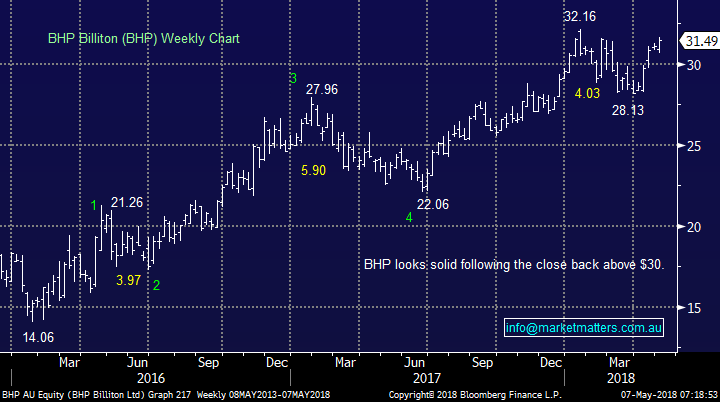

BHP is set to open around $32 today - we are long with our ideal target now ~$34, but are mindful that crude oil has basically hit or $US70/barrel target hence we may potentially take profits at lower levels.

BHP Billiton (BHP) Chart

We like FMG as a great risk / reward aggressive play i.e. Buy FMG ~$4.80 with stops below $4.55 targeting ~$5.40 i.e. excellent risk / reward. However we are currently long FMG in our Income Portfolio which may be enough exposure for now.

Fortescue Metals (FMG) Chart

Question 2

“I receive a number of investment newsletters, which I consider when making investments in my SMSF. Your newsletter is by far the best I have come across. Thank you & keep up the good work.” - Regards Michael

Hi Michael, we appreciate the positive comments and can assure you MM will be working harder to continually improve our offering. As you know we are short-term bullish looking for one of the most exciting market corrections in decades.

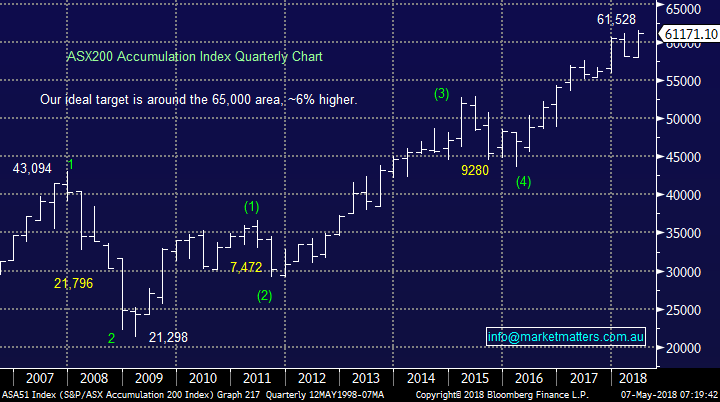

We’ve written a length that MM believes a ~20% correction is looming for global stocks which can be excellently illustrated by the ASX200 Accumulation Index.

- The ASX200 Accumulation Index made fresh all-time highs last week, we can see another ~6% upside short-term.

- However, we believe the next move of 10%, or more will be down and probably over 20%.

Hence if we can help you navigate this potential scenario I and the MM team will feel like we’ve nailed our job.

ASX200 Accumulation Index Chart

Question 3

“Hi, I have a question. Do you have an opinion on the soon to be released IPO WGB WAM Global? I am an active trader and am hoping buying pressure will reverse Friday’s drop” – Regards Richard S.

Hi Richard, thanks for the question (s) which I have covered in 2 halves:

WAM Global will list in June 2018 and become the newest listed investment vehicle (LIC) by Wilson Asset Mgt. They are looking to raise between $330m and $550m with shares at $2.20 each. As an investor they will sit on cash unless they perceive market value plus no position will be above 5% of the portfolio. Overall we like their market philosophies and WAM have a strong track record, but at the end of the day with today’s exciting market we would rather invest ourselves. That said, we will put a more comprehensive note out today on the intricacies of the offer + we’ll also cover the recently announced Macquarie Hybrid.

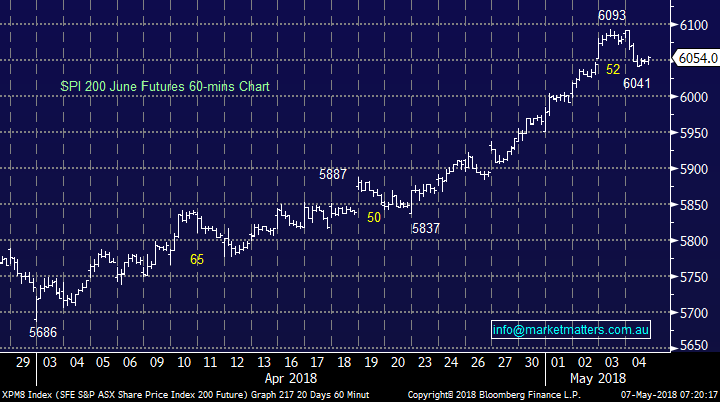

Friday’s drop felt almost inevitable after the recent market surge, the market appeared tired as opposed to receiving a tsunami of selling to match the buying earlier in the week. Technically we watch a markets pullbacks (Symmetry Waves) pretty closely and as you can see this was the second pullback of ~50-points since we took off 5-weeks ago. Our best guess from here is a test of 6100 in the futures market illustrated by the chart below before we experience a larger 65-70 pullback similar to that in mid-April but we remain mindful that short-term market movements are generally random noise and far harder to predict than longer term trends.

ASX200 June SPI futures Chart

Question 4

“Hi, We’re recent members of your service. We very much enjoy reading MM. Would you please give us your current thoughts and comment buying Telstra (TLS).” - Yours Sincerely, Rex & Miriam P.

Hi Guys, welcome aboard for what feels like an extremely exciting few years ahead.

TLS is clearly an unloved beast at present having fallen 55% from its 2015 high, before taking into account dividends. We like TLS at current levels and can easily see a decent rally towards $3.75-$4, when too many investors become bearish, opportunities regularly present themselves. TLS does not report until August, but following last year’s dividend cut an attractive yield of 6.8% fully franked is still expected.

- Our ideal buy are for TLS is below $3.20 and we would need a fall below $3.09 to feel wrong i.e. risk of 3-4%.

Telstra (TLS) Chart

Question 5

“HI MM, do you have a strong opinion on what may cause your expected large correction for stocks?” - Thanks John S.

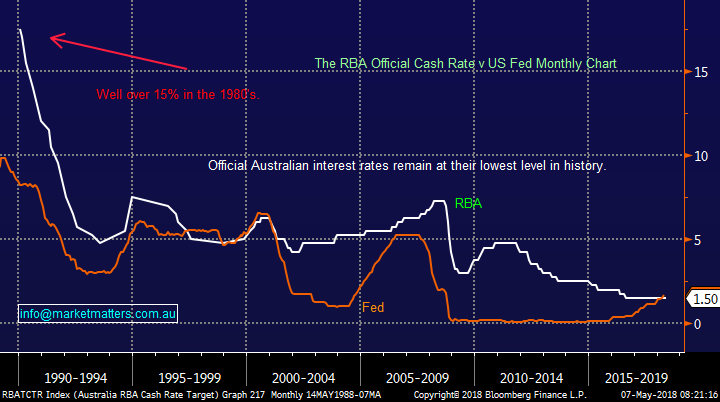

Morning John, this is a tough one but it certainly does not feel like Trump or North Korea, the market wobbles following these 2 characters feels to be behind us. Our best guess would be a combination of good old fashioned economics / valuations:

- Warren Buffett, the oracle of Omaha, has said previously it’s time to sell stocks when market cap of stocks trades above 130% of GDP, as it did just before the GFC – we are now way above that level.

- The risk free yields on US bonds has recently traded above that on offer by the S&P500.

- Global central banks are trying to stop / unwind their “financial engineering” which was undertaken to avoid a worldwide depression after the GFC – not an easy task with very little precedent.

- The multi-decade bear market for interest rates (bond yields) appears to be over reducing the relative attractiveness of assets including equities.

At the end of the day John, picking tops is extremely tricky, harder than market lows, but this is why we have a plan which includes our view on where individual stocks / the market no longer offers good risk / reward to the buyer.

US and Australian official interest rates Chart

Question 6

“HI MM, do you have an opinion on the new Macquarie Group (MQG) hybrid” - Thanks Steve E.

Morning Steve, you’re quick onto this. Macquarie are about to walk into the office to run through the details and we’ll put a note out later today on this, however it’s a ‘small’ $600m offer which includes a reinvestment offer for existing holders of MQGPA. The margin will be set at 4.00% - 4.20% above the bank bill rate which currently sits at 2.02% - so assuming lower end of the band, the rate will be 6.02% grossed for franking.

The new note replaces the existing MQGPA which has traded between $107 & $96 since listing in 2013. Interestingly, it was also issued at a margin of 4%, 5 years ago.

Macquarie Group Hybrid (MQGPA) Chart

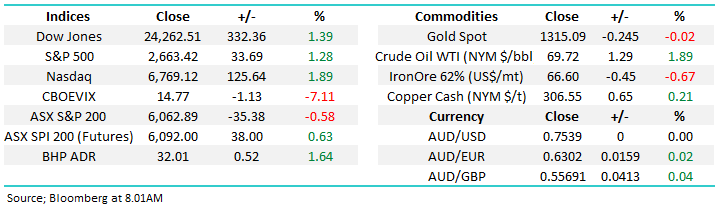

Overnight Market Matters Wrap

· The US equity markets ended last week with a strong session last Friday, with technology and financial stocks in particular leading the way following a solid job data reporting unemployment below 4% for the first time since 2000.

· The US economy added 164,000 jobs, which was slightly below consensus expectations of 193,000 as was wage inflation of 0.1% for the month (2.6%pa). Bond yields edged lower to 2.94% and the US$ eased a little as the Federal Reserve kept rates steady. Expectations remain for a June rate hike, and a further 1-2 more hikes in the second half of this year. Oil and aluminium remained strong, with WTI up 1.97% to just under US$ 70/bbl.

· BHP is expected to outperform the broader market, after ending its US session up an equivalent of 1.64% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 52 points higher towards the 6115 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/05/2018. 8.26AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here