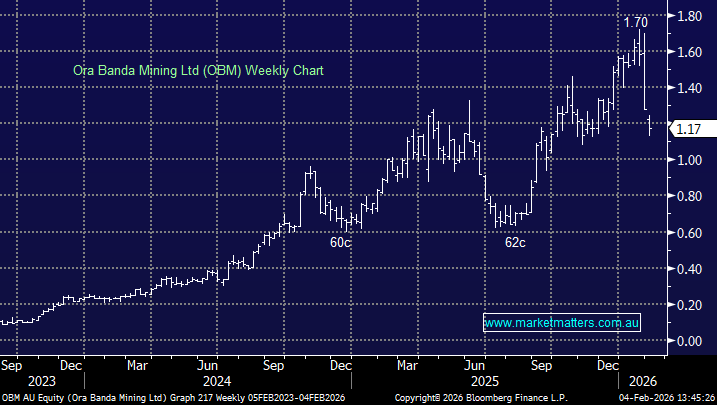

Any value in yesterday’s 3 worst ASX200 stocks? (PDL, ORI, SYR)

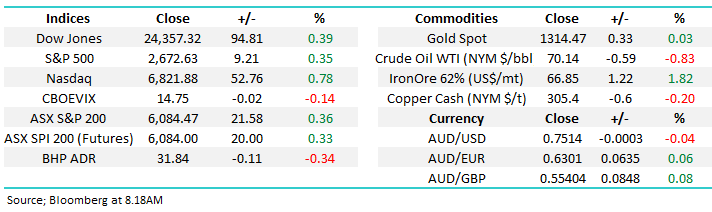

Yesterday the ASX200 had an ok day closing up 21-points, as local stocks take an understandable rest following their impressive 5-week rally. The market feels a touch “tired” around the 6100 area and a few more day’s consolidation &/or a pullback towards 6040 would not surprise. Yesterday, Westpac’s (WBC) report was the main news and it came in solid resulting with the bank closing up +0.8%, unfortunately still ~14% lower on the year before dividends. The futures market is suggesting another attack on 6100 early today, but it feels a touch optimistic to us given the move in resource stocks overnight and some weakness amongst the bank ADRs overseas.

- Market Matters remains bullish the ASX200, initially targeting the 6250 area, or ~2.7% higher.

Today’s Federal Budget could easily be a catalyst for a reasonable market move in either direction, who knows with politicians. We have a struggling Liberal Party desperately needing a leg up in popularity with a Federal Election looming – however 10-years of excessive spending by respective incumbent governments has led to Australia evolving from no debt to carrying a deficit of $370bn, which unfortunately comes with an obvious interest bill. This budget will look better than it might have thanks to higher commodity prices however a downturn there and things could deteriorate rapidly – these risks support our negative call on the $A, technically targeting the 65c area, or 13% lower.

Today’s report is going to focus on 3 stocks which came under selling pressure yesterday falling between 4.9% and 6.5% to explore whether any value has emerged?

ASX200 Chart

Australian Dollar ($A) Chart

Overseas Indices

As we roll into the seasonally dangerous May period, global stocks remain firm and in our opinion short-term bullish. The recent panic of February feels way behind us and is hardly getting any mention in the press.

The US tech NASDAQ index is close to breaking above its 2018 overhead resistance and currently now sits only 5.4% below its all-time high – see graph below.

The broader based S&P500 / Russell 3000 indices need to rally a few more percent to look as positive, conversely the Russell 2000 smaller cap index which benefits the most from Trump’s recent tax cuts is now only 2.3% below its all-time high.

- We remain short-term bullish US stocks targeting fresh 2018 / all-time highs.

US NASDAQ Chart

European Indices remain both clearer and more bullish than the US. The German DAX for example looks excellent while it can hold above the 12,600 area.

- We remain bullish European markets, targeting fresh all-time highs in 2018 – now only 5% higher for the German DAX.

German DAX Chart

Now moving onto yesterday’s 3 “wooden spooners” in the ASX200 as we look for potential short-term opportunities.

1 Pendal Group (PDL) $9.05

PDL was smacked -6.5% yesterday as it tried to enjoy its new name after evolving from BT Investment Company. To be fair it was the whole investment manager’s group who came under pressure, with Platinum Asset Management (PTM) falling -4.1% even after reporting increased funds under management (FUM) for April. However, downgrades within the sector by UBS were enough to send the Diversified Financials down -1.5% on a positive day for the overall market.

- PDL feels pretty average presently with sub-$8 our target i.e. ~11% lower.

Our medium-term negative outlook for stocks also adds weight to our bearish feelings and general concern for our positions in Janus Henderson (HGG) and IOOF Holdings (IFL) both of which are now sitting in the damage control corner while we also have exposure to Perpetual (PPT) in the Income Portfolio.

Pendal Group (PDL) Chart

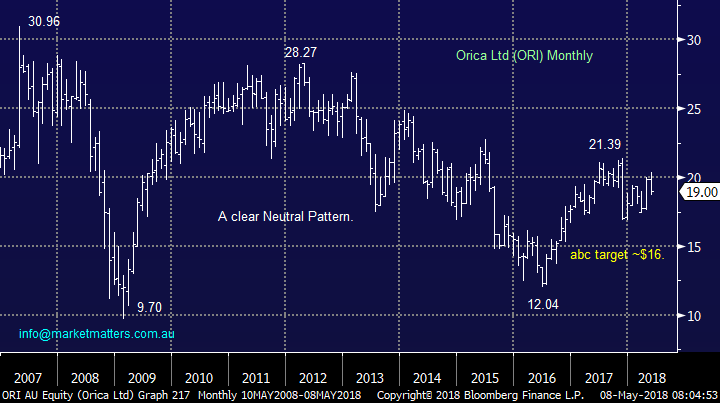

2 Orica (ORI) $19

Orica (ORI) is the largest provider of commercial explosives in the world, but it was sold off -6.4% yesterday following a poor result with its businesses outside of Australia missing expectations. While the company has maintained full year guidance, technically the picture is looking pretty average.

- MM is neutral / negative ORI with a potential target ~$16, another 15% lower.

ORI is highly dependent on the mining sector and we reflect on Rocky’s comments in the recent MM resources video – he remains bullish the resources stocks, but believes the 2 ½ year rally in the sector is definitely late cycle i.e. “he’s on alert but not yet alarmed”. Hence if we want to maintain, or gain exposure to the last piece of the “resources pie”, MM would rather hold resource companies who are approaching large capital management tailwinds, yielding solidly plus have the potential to be taken over.

- We believe ORI is actually a sell relative to BHP, FMG, OZL, AWC or IGO.

Orica Ltd (ORI) Chart

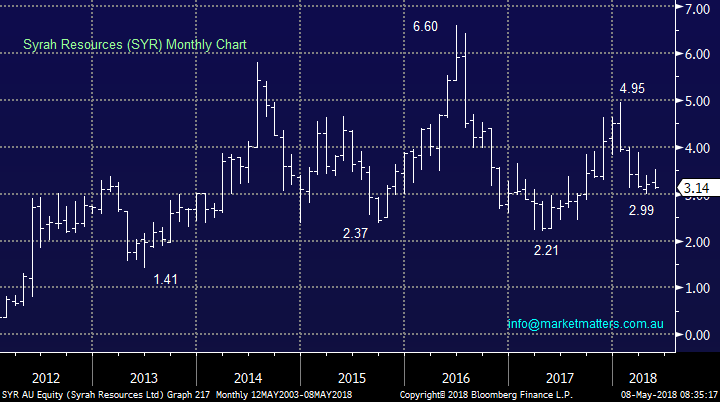

3 Syrah Resources (SYR) $3.14

Graphite producer SYR was sold off almost 5% yesterday and it maintains the disturbing honour of being the “most shorted stock in Australia” – over 20% of the stock is short sold!

Hedge funds clearly do not believe SYR can ever make enough money from graphite to warrant a company valuation of $933m. There have also been a number of setbacks for SYR over the last 6-months helping shorts look good on paper.

On further review, we have tweaked our view on SYR and would rather play the “battery space” via lithium producers Orocobre (ORE) / Kidman Resources (KDR).

- Although short squeezes do often occur I would steer away from betting against professional investors / traders on this one.

Syrah Resources (SYR) Chart

Conclusion

We have no interest in PDL, ORI and SYR.

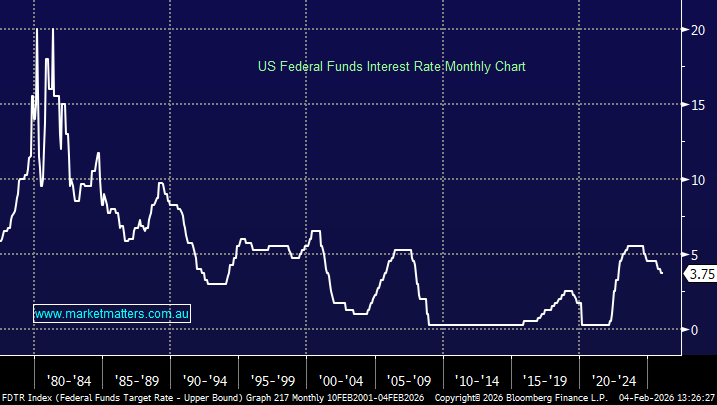

Overnight Market Matters Wrap

· The US equities markets followed Asia-Pacific’s lead overnight and started the week in positive territory.

· The IT sector outperform the broader US market following Buffet’s increased stake of Apple (AAPL.US), while the defensives – utilities, telcos and consumer staples lagged.

· Locally, investors will be looking towards the Australian budget tonight, with Federal Treasurer, Scott Morrison, handing down his third budget, with expectations he will handout tax cuts and boost infrastructure spending on the back of a stronger than expected economy, which has been boosted in particular by stronger commodity markets.

· The June SPI Futures is indicating the ASX 200 to open 23 points higher this morning, testing the 6110 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/05/2018. 8.26AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here