US bond yields have more than doubled in under 2-years!

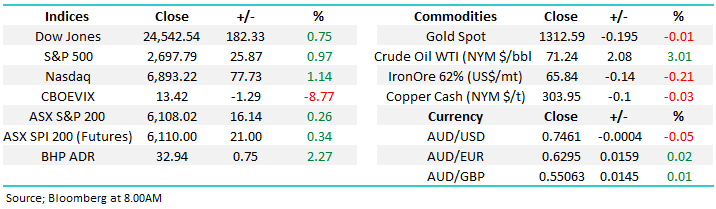

The budget is now behind us and will become tomorrow’s fish and chip paper. Overall, it’s added a slightly positive tailwind to an already very bullish local stock market. Yesterday’s 16-point / 0.26% rally by the ASX200 was extremely impressive considering that our markets largest company Commonwealth Bank (CBA) fell almost 3% following a disappointing 3rd quarter update. For the last 5-days the markets felt like a champagne cork trying to pop higher but in this case it’s been capped by the 6100-6110 region, as opposed to a Portuguese made cork.

- A market that does not fall on bad news is a bullish market.

Overnight global stocks rallied strongly with the US finally joining in the party – after advancing strongly for the last 7-weeks the UK FTSE is now only 1.7% below its all-time high. As readers know the ASX200 has a high correlation to the FTSE and we continue to believe it’s just a matter of time before both indices make fresh 2018 highs. The futures market is pointing to a strong open this morning, around 6125, even with BHP down 25c in the US.

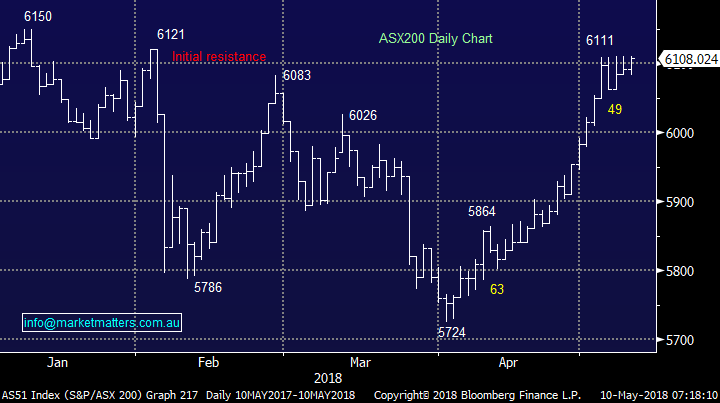

The ASX200 Accumulation Index (includes dividends) again closed at fresh all-time highs yesterday and now sits only 5-6% below our target for an important top. We believe it’s not the time to be chasing the last piece of the pie which the market has to offer, however it is the stage of the cycle to be planning selling strategies – most retail investors weakest process. Hence we are in sell mode at MM.

- Market Matters remains short-term bullish the ASX200, initially targeting the 6250 area, or ~2.7% higher.

Today’s report is going to focus bond yields both in the US and at home.

ASX200 Chart

ASX200 Accumulation Index Chart

Overseas Indices

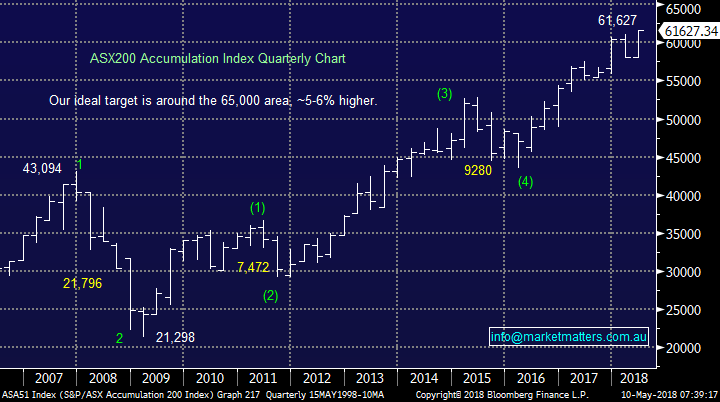

One of our favourite beliefs / sayings at MM is the “US NASDAQ tech Index usually leads” and in this case its clearly breaking out to the upside.

- We remain short-term bullish the NASDAQ with a target ~6-8% higher.

US NASDAQ Chart

European equities were again firm overnight and remain on track to make fresh 2018 / all-time highs in the coming weeks – our target for the German DAX is at least 5% higher.

German DAX Chart

The US & Australian bond markets

American 10-year bond yields have more than doubled in under 2-years, closing above the psychological 3% area last night. Over the same period shorter dated 2-year bond yields have increased fivefold as the Fed continues to raise interest rates – its already hiked rates six times since December 2015 with more forecast ahead as they attempt to normalise interest rates into a strengthening economy.

- Rising interest rates in the US has seen their utility stocks fall almost 8% over the last 6-months compared to the consumer discretionary sector which has boomed +13.7%.

The strong US economy has led to the average American having more $$ in their pockets subsequently increasing discretionary spending – things feel very different in Australia as burgeoning debt levels has kept our hands firmly in both pockets.

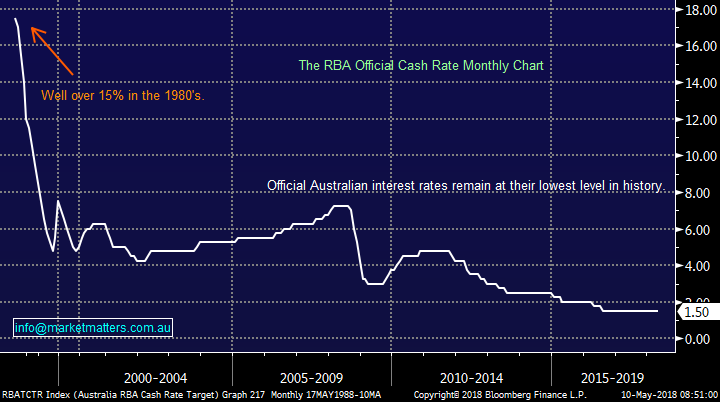

The rapid acceleration in US rates cannot be ignored and local investors should not underestimate how fast interest rates are likely to rally in Australia when our economy shows further strength – at MM we believe the RBA cash rate of 1.5% is ridiculously low when unemployment is not an issue, a few strong inflation prints and rates could double in a flash.

US 2-year bond yields Chart

Australia’s 10-year bond yields have dropped to their lowest when compared against U.S. counterparts since the 1980s and the gap looks set to keep widening, at least for now.

- The American economy is clearly much further down the post GFC recovery path than our own.

As we said above people are focusing on the “yield gap” widening moving forward – complacency in a market view by the majority always pricks our ears up!

US v Australian 10-year bond yields Chart

Investors believe that Australian rates “will remain lower for longer” because our housing market is brittle at best. While we agree with this point of reason for now when we see stability return to Australian housing prices beware complacency on interest rates – the RBA has a huge amount of catching up to do.

The RBA Cash Rate Chart

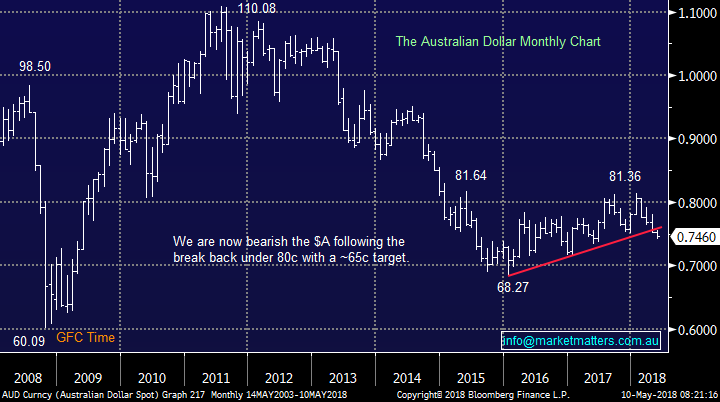

The Australian dollar is an excellent barometer to the strength of our economy and unfortunately it currently looks awful, even with ongoing support from a strong China through commodity prices.

- We remain bearish the $A looking for another ~15% downside.

The weak Australian implies to us that the RBA are not likely to press the hike button in the short-term but when they do local portfolio’s sector mix will certainly need scrutiny.

The Australian Dollar Chart

The local market, along with Europe, has outperformed the US quite noticeably over the last 6-weeks.

- The US has seen safe bond yields exceed the after dividend yield on offer by the S&P500.

It appears that rising interest rates is slowly starting to bite into US stocks, at least on a relative basis. We believe the ASX200 will outperform the US until the RBA becomes active.

The US Dow Jones v ASX200 Chart

Conclusion (s)

1 Like the overall market we believe that US bond yields will continue to increase faster than our own but we are “stalking” the turn of this crowded opinion as we believe the RBA is falling behind the curve – housing prices are a large part of this puzzle.

2 When the RBA start hiking rates we are likely to see the “yield play” stocks get sold off and with some discretionary companies move back into favour.

3 We remain bearish the $A looking for ~15% further weakness – good news for companies with offshore earnings.

4 We believe that European and Australian markets will outperform the US over the rest of 2018.

Watch for alerts.

Overnight Market Matters Wrap

· Energy and technology stocks led the US markets higher overnight, with the Dow up 0.75%, while broader S&P 500 ended its session up 0.97%.

· On the commodities front, the oil price rallied over 3% to 3 ½ year highs after an unexpected fall in US oil stockpiles and in the wake of yesterday’s decision by President Trump to walk away from the Iran nuclear agreement.

· BHP is expected to outperform the broader market today, after ending its US session up an equivalent of 2.27% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 26 points higher, towards the 6135 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/05/2018. 8.26AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here