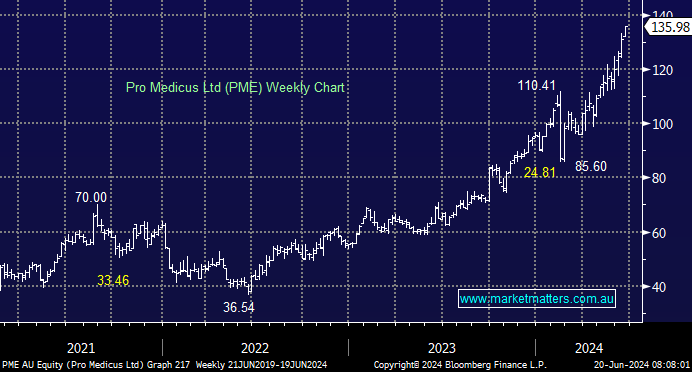

When we wrote about the Medical software business PME in March, we said, “We like PME over the coming weeks/months, initially targeting fresh highs or 8-10% higher.” This call was too conservative as this standout business has soared over 30% in just a few months. PME provides advanced medical imaging software and services globally, and it is enjoying solid success in the US. The company receives revenue from subscription fees and a small fee charged per each medical imaging done on its platform. In 1H FY24, its revenue grew 30% to $74.1 million, with an operating margin of 66%. The company is debt-free due to its strong operating cash flows, which require little capital investment to operate.

While the stock is expensive on today’s numbers, its valuation will fall over the coming years as earnings growth continues.

- We can see PME trading higher over the coming months/years, but volatility will likely increase in line with its valuation.