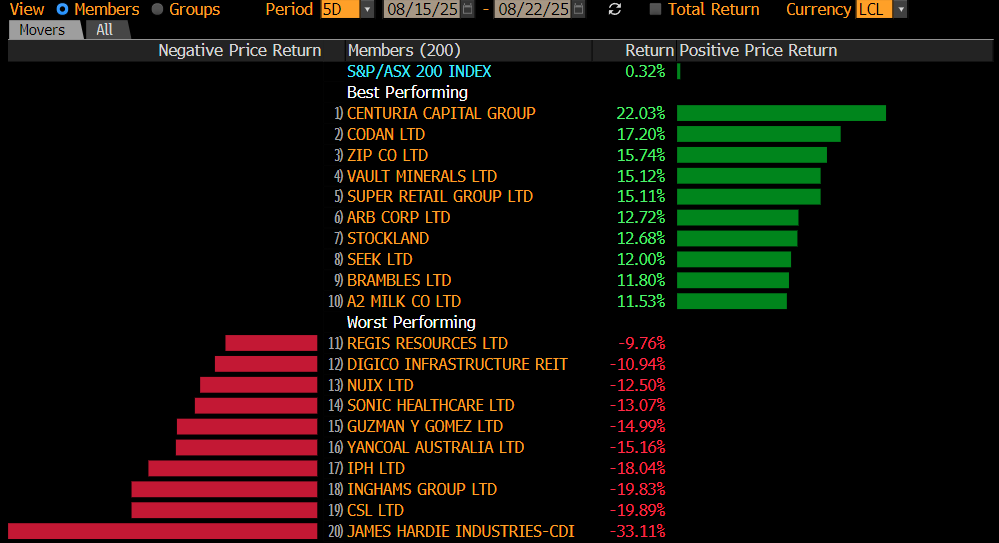

A whopping 9% of the ASX200 is up over 30% so far in 2024, although a lot of better-known “high flyers” didn’t make the cut with such a high bar. Surprisingly, after moves on the sector level, there were still plenty of miners in the winner’s enclosure driven by stock specific influences – which is true across the list below. While the Macro is important, and we place a lot of emphasis on it, stock picking is where the rubber hits the road.

Below is a snapshot of the eclectic bunch of winners since January under some simple categories; a couple could have been in more than one bucket and we doubt many would have figured in many investors’ Top 3 picks for 2024;

- Takeovers: Corporate activity has been rife in particular areas of the market in recent times, with the building sector the most obvious pocket, headlined with a bid for CSR Ltd (CSR), while Altium (ALU) and Alumina (AWC) also enjoyed bids that should complete.

- Recovery: Some of the ‘dogs’ of recent years have got back on track, enjoying incredible re-rates in share prices. A2 Milk (A2M) has been stellar, while Megaport (MP1) is finally delivering on a long list of prior promises. Virgin UK (VUK) is a recovery play that was also bid for.

- Innovative Healthcare: Polynovo (PNV), Pro Medicus (PME) and Telix (TLX) have enjoyed a phenomenal period.

- AI: The depth & breadth of AI is in its infancy, and Data Centres have been a buzzword recently, driving the stocks that facilitate them, namely Goodman Group (GMG) and NextDC (NXT).

- Gold: The precious metal has broken to new all-time highs before pulling back more recently, the smaller, more leveraged gold stocks that have got involved in M&A have done best, namely RED 5 (RED) and West African Resources (WAF).

- Uranium: One of our favoured sectors has done well, with Paladin (PDN) and Deep Yellow (DYL) the stars.

- Financials: Platforms & investment-related companies have outperformed the bigger financials, with Pinnacle (PNI) and Netwealth (NWL) making the list.

- Tech: Tracking movements and collecting data has driven the now dual-listed Life360 (360) shares up more 100% since January.

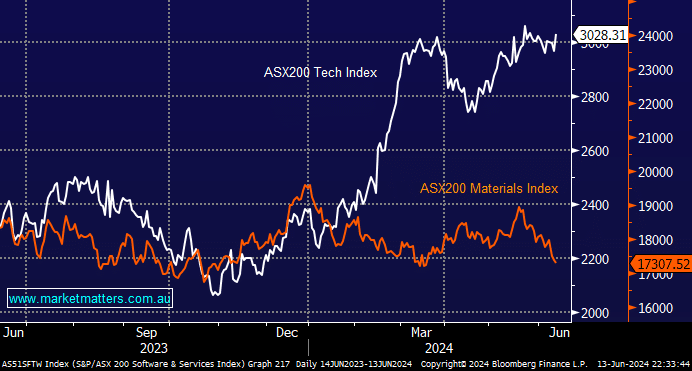

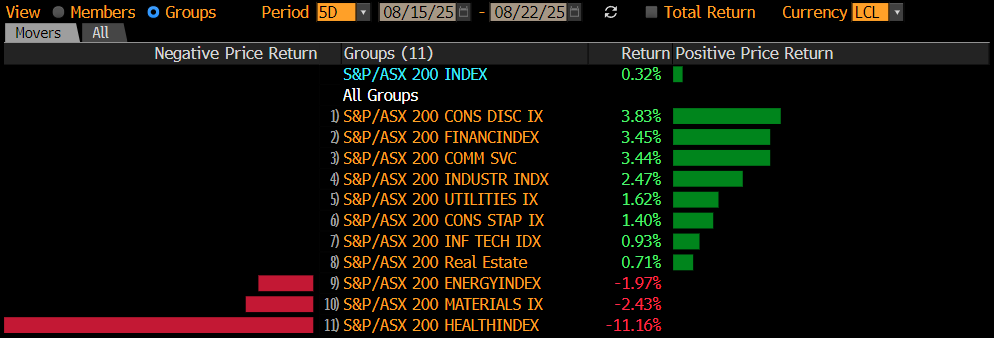

The performance elastic band continue to stretch on both the stock and sector level.

This morning, we’ve briefly considered four stocks from this high-flying group.