Reviewing 5 of the ASX200’s most influential stocks. (CBA, BHP, CSL, WES, TLS)

The ASX200 experienced a horrible session yesterday as strong futures selling pushed the market lower into midday – classic offshore stuff. The market fell over 40-points intra-day with very few bright lights amongst the sea of red with the exception of more M&A activity leading to excellent gains by APA Group (APA) +21% and Gateway Lifestyle (GTY) +14.8%.

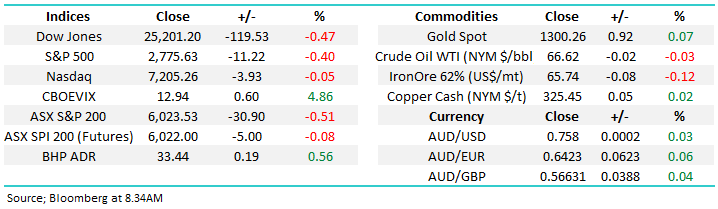

Overnight stocks were generally weaker as global markets digested the second hike in US interest rates by the Fed in 2018, with two more now expected in time for Christmas festivities. The Fed’s benchmark now sits at 2%, a full 0.5% above the RBA level. With the two more increases forecast this year and three in 2019 it’s likely this gap will widen considerably further, on obvious weight on the $A. The US economy is clearly strong while domestically the increasing speculation around a housing crisis is leading to heightened nervousness around Australia’s future, a sentiment the share market has unfortunately embraced.

- Medium-term MM is now neutral at best with a close back above 6050 required to rekindle any positive thoughts. – we remain in “sell mode”.

Today’s report is simply going to look at 5 very influential stocks on the ASX200 as we look for clues as to the future direction of our market i.e. have we topped out and are leading global indices lower – it wouldn’t be the first time!

ASX200 Chart

Yesterday we sold 2 holdings in the MM Growth Portfolio plus our stop was triggered in Fortescue Metals (FMG) increasing our cash position quickly up to a comfortable, but not aggressive 20%.

- We sold Webjet (WEB) for a nice 38% profit, slightly shy of our $13.50 target primarily because WEB can be a slightly illiquid stock hence its always best to sell into strength.

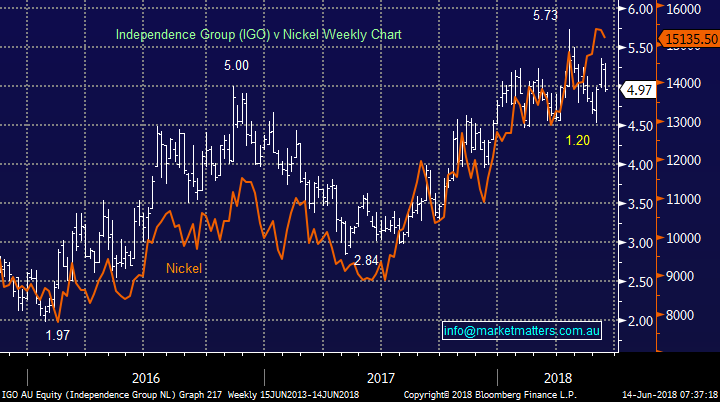

- We sold Independence group (IGO) because it failed to rally to its full potential with nickel over recent weeks plus the recent news from Vale that they are constructing a large Nickel mine in Canada should put a near term cap on Nickel prices, removing the positive tailwind for IGO – we took a small win here but importantly not the ~10% loss it would have been 2-weeks ago.

Lastly, we were stopped out of our “aggressive play” in Fortescue (FMG) as it closed below $4.60, (price of $4.55 costing us ~5% - potentially it will follow BHP and open a touch higher this morning. We will sell on open this morning.

Webjet (WEB) Chart

Independence Group (IGO) v nickel price Chart

Now we're going to look at 5 of the ASX200’s most influential stocks which make up almost 23% of the index but they arguably speak for significantly more if we say for example that the big the big 4 banks move as one, BHP leads the resources sector and / or Wesfarmers and Woolworths move together – then we could claim to be evaluating close to 50% of the market by looking at just 5 stocks – a bit of a scary thought)

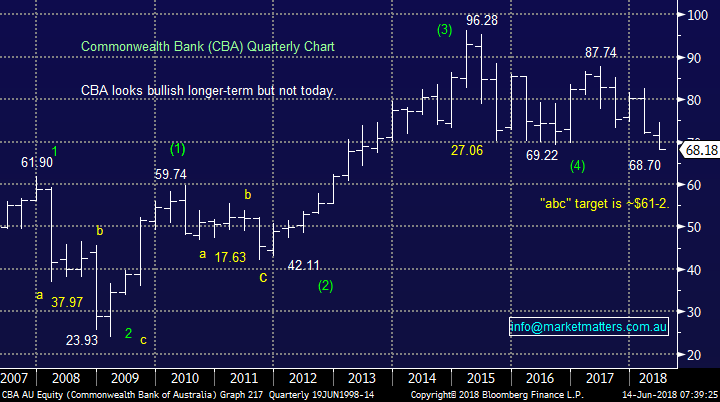

1 Commonwealth Bank (CBA) $68.18

Australia’s largest stock CBA currently represents 6.97% of the ASX200 plus of course we have ANZ 4.5%, NAB 4.17% and WBC 5.45% making up a huge 21.09% of the index – it’s hard for the market to go up without the banks.

A few weeks ago we highlighted the technical target area for CBA around $62, around 9% lower, this has been the major reason we shelved / backed off with our plans to average our banking exposure.

The current sentiment around our banks is clearly poor following the Hayne royal commission plus virtually all economists / analysts are forecasting a meaningful correction to Australia’s housing market, clear headwinds to our banking sector. However CBA is now yielding 6.31% fully franked while trading on an Est valuation of 12.68x earnings for 2018 as bad news becomes baked into the stock.

- At MM we are looking to average our CBA position but it’s unlikely we will press the “buy” button unless we see CBA well under $65, depending on timing of the dividend at the time.

Hence we anticipate CBA and the banking sector will continue to be a negative drag on the ASX200 in the short term.

Commonwealth Bank (CBA) Chart

2 BHP Billiton (BHP) $33.25

BHP represents 6.02% of the ASX200 and its 40% rally over the last year has certainly supported the ASX200. MM has enjoyed a nice part of this rally but recently exited the last of our position around $34 as we moved to a neutral stance.

While we are neutral BHP we feel another ~15% correction is not too far away, just like the 3 we’ve seen since the resources rally commenced back in 2016.

- We are neutral BHP at current levels but keen buyers back below $30.

On balance while we cannot be negative BHP with some excellent capital initiatives looming we do believe its optimistic to expect the stock / sector to continue to significantly support the ASX200 from here.

BHP BILLITON (BHP) Chart

3 CSL Ltd (CSL) $189.26

CSL represents 4.8% of the ASX200 and like BHP its strong year has clearly aided the sluggish overall market. CSL is now trading on a Est valuation of 38x 2018 earnings while yielding 1% unfranked, it’s certainly not cheap on old fashioned metrics but it continues to deliver on the corporate level.

Rising interest rates is usually a tough environment for healthcare / high valuation stocks but it feels like fund managers are struggling to find stocks that won’t become future landmines, hence the quality names keep getting pushed higher. Short-term we can see CSL dipping back under $180 or around a 5% pullback but the bull trend looks intact for now.

- MM likes CSL into weakness with ideal buy levels sub $190 and sub $170 if a major market correction unfolds.

Similar to BHP it feels a touch hopeful to expect the positive index influence from CSL to continue unabated.

CSL Ltd (CSL) Chart

4 Wesfarmers (WES) $46.66

WES represents 2.95% of the ASX200 and along with Woolworths (WOW) around 5%. WES made fresh al-time highs this week after 5-years of knocking on the $47 door. On balance we do not believe it’s going to be a break out that follows through but no technical sell signals will be generated until WES closes back below $45.

WES and especially WOW are examples of the elastic band effect with stocks as they were sold on concerns around the likes of ALDI causing margin contraction. Today over 2-years later we even have Amazon joining the competition but WOW has rallied almost 50% - it’s in stock markets DNA to be too optimistic / pessimistic on a regular basis.

- We are neutral WES at current levels.

We are slightly negative WES / WOW after the recent gains envisaging it being a big ask to push significantly higher in 2018/9.

Wesfarmers (WES) Chart

5 Telstra (TLS) $2.76

TLS represents 1.9% of the ASX200 and importantly a stock we own – our view is the elastic band effect is approaching for TLS as pessimism goes too far. D-Day comes on the 20th of this month with an investor day scheduled – perhaps we get more clarity around their strategy to skirt around the NBN moving straight to 5G technology.

TLS has clearly had an awful few years while the ASX200 advanced hence it’s not a great indicator for the overall market.

- MM is considering averaging our TLS position below $2.70, however we will wait till after their strategy day.

We believe TLS will be up over the next 12-months helping the ASX200.

Telstra (TLS) Chart

Conclusion

When we combine our thoughts on the 5 stocks / sectors above we are forced to come up with a net bearish outlook for the ASX200 over 2018/9.

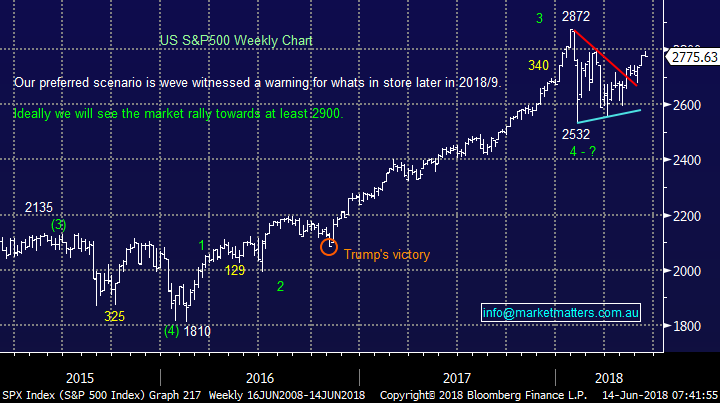

Overseas Indices

The tech-based NASDAQ again closed near its all-time highs but it did give back all of its early gains, the broader S&P500 sits 3.5% below its same milestone. We’ve now switched to a neutral stance on US stocks and will turn bearish if the NASDAQ starts to fail – remember mid-June is also usually a tough time for US stocks.

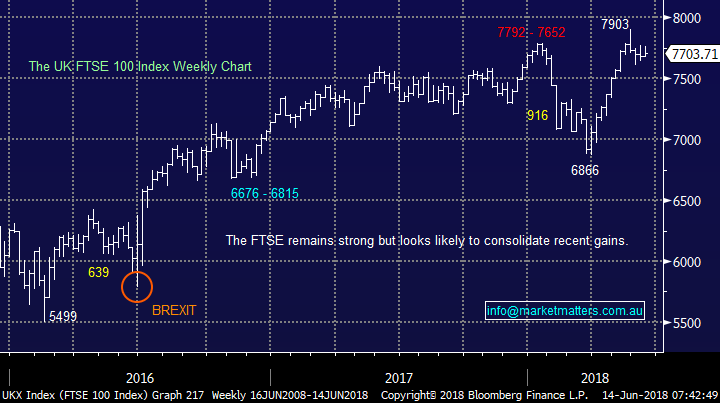

In Europe the UK FTSE like the NASDAQ recently made fresh all-time highs but its struggling to maintain these gains, our “gut feel” is a correction is looming.

Bigger picture no change, we are on alert for a decent market correction and are still looking to increase our cash position into strength.

US S&P500 Chart

UK FTSE Chart

Overnight Market Matters Wrap

· The US equity markets closed lower overnight, following the expected Fed rate hike of 0.25% to 1.70% with a further 2 rate hikes expected this year.

· Nickel rallied nearly 3% along with small gains in copper and zinc, while aluminium fell 1% on the LME. Iron ore was down a touch, while oil looks to creep towards US$67/bbl.

· BHP is expected to outperform the broader market after ending its US session up an equivalent of 0.56% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open marginally lower, around the 6020 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/06/2018.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here