Trump throws a grenade into markets! (CSL, OZL, CBA, TLS)

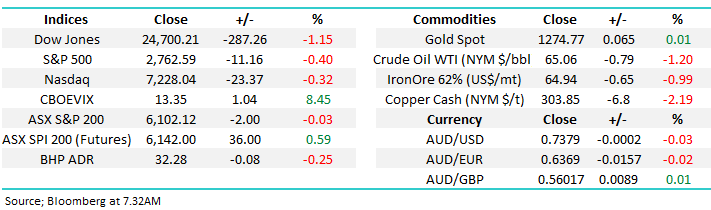

The ASX200 tried exceptionally hard to ignore Donald Trump’s fresh $200bn tariff attack on China, who not surprisingly immediately vowed to retaliate – this is most certainly a whole new level of brinkmanship when compared to the recent North Korea “distractions”. A trade war between China would be a game changer for global growth and markets both in Australia and internationally hence traders were voting with both feet on a very wet Sydney Tuesday afternoon:

- Stocks – Dow futures were down ~350-points, and Asian indices fell hard - China -3.8%, Japan -1.8% and Hong Kong -2.8%.

- Commodities – Copper was down -1.5%, iron ore -3.6%, crude oil -1.5% while gold was basically unchanged.

- Currencies – The $A was smacked 1% down to 73.5c, hurt by the RBA and tumbling commodities.

- Bonds – they rallied, sending yields lower as investors sought safety.

The ASX200 managing to close down only 2-points was an extraordinary effort under the circumstances, especially as the resources sector took another battering e.g. BHP -1.2%, RIO -2.2% and OZ Minerals -3.8%.

- The local market has been extremely resilient of late but for me the real test comes after the June futures expire today and then EOFY next Friday – it may become business as usual after these two potentially pivotal events.

Overnight stocks were weak as expected but the Dow rallied +130-points from its low to close down -287-points and the broader S&P500 erased 2/3 of its losses to only close down -0.4%. At this point in time markets appear to believe this is more Trump posturing early in negotiations, history would say that’s the case but when arguing with China the downside risks are meaningful. As Goldman’s CEO said overnight, he doesn’t think we’re on a suicide mission!

Today’s report is going to take a slightly different form and focus on a number of key markets, both locally and overseas, as we keep our finger well and truly on the pulse following Trumps provocative action.

1 The ASX200

The ASX200 rallied within 2-points of making a fresh decade high in early trade yesterday before failing, while no signals sell were generated locally we have to question how much “bad news” our market can continue to ignore before cracking.

- Bigger picture we must remember that MM are looking for a decent correction of the 9-year bull market in 2018 /9 hence it’s not a market to be caught frozen in the headlights.

This morning following a more stable US stock market than many feared the SPI futures are indicating the ASX200 will again test its decade high ~6150, overall local stocks are clearly in a very positive mindset short-term e.g. targeting a ~40-point bounce even with BHP indicating small losses on the open. This is a great example of investing around what you see, as opposed to feel – the knee jerk reaction yesterday could easily have been to sell but our market doesn’t want to fall so don’t fight it!

- Short-term MM remains mildly positive with a close below 6060 required to negate this view however we remain in “sell mode”.

Conclusion – stay with our plan to sell strength, ideally around 6250, unless the market tells us otherwise.

ASX200 Chart

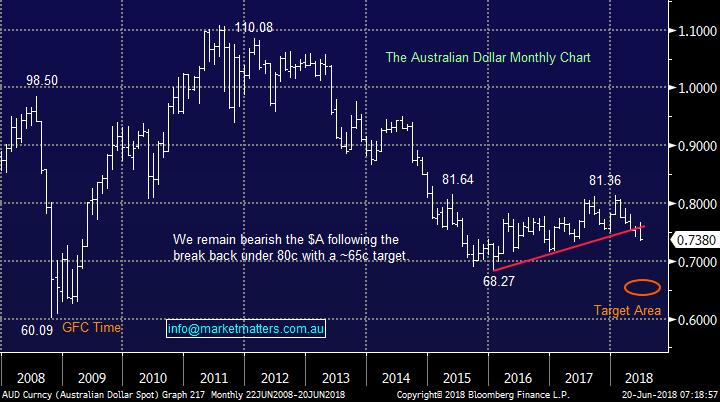

2 The Australian Dollar ($A)

One omission that we noticed yesterday which didn’t garner much publicity was the RBA implying they are becoming concerned with the health of our economy, in yesterday’s minutes they dropped the below statement, suggesting Australian rates have the potential to fall further – another nail in the $A coffin. Undoubtedly the weakening local housing market and its potential knock on effect is front and centre of the RBA’s mind.

Not surprisingly some of the stocks which performed stoically yesterday enjoy $US earnings – CSL Ltd, Cochlear, Nanoionics and Macquarie Bank.

Conclusion – we remain bearish the $A and firstly may consider adding to our Beta Shares long $US ETF position, secondly any buying in our market moving forward may be in stocks with strong $US earnings, even if the sector is hot e.g. CSL around $180.

Australian Dollar ($A) Chart

CSL Ltd (CSL) Chart

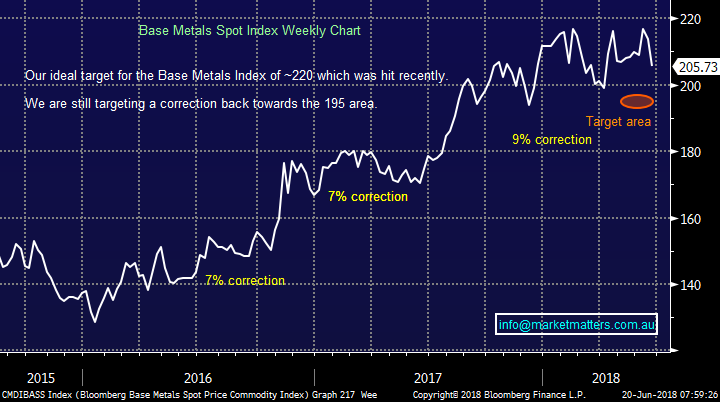

3 The Resources sector

The resources sector is correcting just as we anticipated with some big names well off their recent 2018 / 2-year highs e.g. OZ Minerals (OZL) -8.6%, BHP Billiton (BHP) -6.6% and Western Area (WSA) -13%.

Our view remains intact with the Bloomberg Base Metals Index now within ~5% of our target area. Investors should remember we are 2 ½ years into the resources bull market, many fund managers are still sitting on decent profits hence we are only buyers of weakness for the foreseeable future.

Conclusion – we are buyers of weakness in the sector but still at lower levels e.g. BHP below $30, OZ Minerals around $9, Western Areas (WSA) around $3 and Independence Group (IGO) around $4.20.

Bloomberg Base Metals Index Chart

Oz Minerals (OZL) Chart

4 The Banks

The banks have finally come back into favour, albeit from a very low base e.g. CBA is up +1.5% over the last 5-days but it’s still down -15% over the last year.

The banks are bouncing but it’s hard to see fund managers chase them hard until we get a little more insight into the softening housing market, policy makers wanted to slow house prices down now they’re worrying it may go too far !

- Our view is the housing market will give back some of its huge gains over the last 5-years but it will not collapse and the next move in Australian interest rates will in fact be up.

It will surprise many but it’s our view that the banks may continue the recent outperformance by the ASX200 when compared to its peers – Australian banks have been battered over recent times to a level where we believe downside risk is limited but the US banks for example have rallied strongly leaving more room for disappointment.

Conclusion – we are buyers of weakness as opposed to strength e.g. CBA below $65.

Commonwealth Bank (CBA) Chart

Australian v US banks Chart

5 Telstra (TLS)

This morning TLS have made a decent effort at sugar coats an earnings (EBITDA) miss of ~13% with infrastructure spin-offs and 8,000 job cuts – wow how will the service be now!

On a more serious note this may be the start of TLS being run like an efficient proper business as opposed to a government department but only time will tell. We’ll discuss TLS further in the Income Report today after the conference call.

Initial thoughts are that the market will look through the FY19 downgrade, even though it’s a big one and focus on the longer term strategic direction of TLS, which includes the infrastructure spin off and some extreme cost cutting, however that said the stock has rallied over 7% into today’s update.

Gut feel suggests TLS will be up today, however if we’re wrong, and it opens sharply lower, buying weakness based on the FY19 earnings miss makes sense. The ‘new vision’ for TLS may prompt slower, but bigger more influential money off the sidelines given the plans unveiled this morning improve the sustainability of future earnings.

Conclusion – we are buyers into weakness below $2.70 but not of strength.

Telstra (TLS) Chart

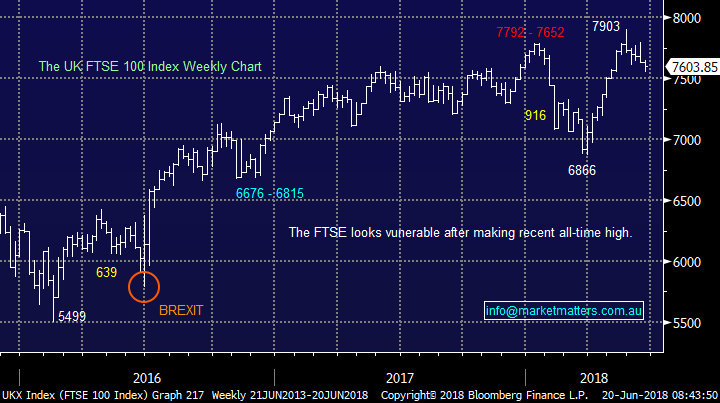

6 Overseas Indices

The tech-based NASDAQ continues to trade around its all-time high while the broad based S&P500 remains 3.8% below its same milestone – the chart below shows Trumps tariff bluster has hardly registered with the market.

US S&P500Chart

European indices are struggling after their recent strong rally with the FTSE now 3.8% below its all-time high formed in May and is very close to generating a technical sell signal.

UK FTSE Chart

Emerging markets which our resources are usually highly correlated to are making fresh lows since mid-August 2017 creating an interesting quandary:

- Emerging markets have now corrected over 15% into our initial support area but Australian resources have held up far better e.g. last August BHP was trading well under $30, or ~10% lower.

Conclusion – Global equity markets are on the whole proving extremely resilient in the face of potentially very bad new a bullish sign - we are sellers of strength but definitely not weakness at this point in time.

Emerging markets (EEM) Chart

Overnight Market Matters Wrap

· Risk was certainly off the table overnight in the US markets, as investors switch to ‘safe haven’ assets such as bonds and the like as the US-China trade war heightened during yesterday’s Asia-Pacific region.

· Oil also remains on investors’ agenda, with Crude Oil sliding 1.20% lower as investors and traders assess OPEC’s discussions on a compromise over increasing output ahead of a meeting in Vienna this week.

· On the European region, the Euro fell following a dovish tone from the European Central Bank, while the British Pound also sold off ahead of the Brexit vote next Wednesday.

· Locally, BHP is expected to underperform the broader market after ending its US session down and equivalent of 0.22% from Australia’s previous close. Telstra (TLS) will be closely watched today on strategy day.

· The June SPI Futures is indicating the ASX 200 to open 36 points higher, towards the 6145 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/06/2018.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here