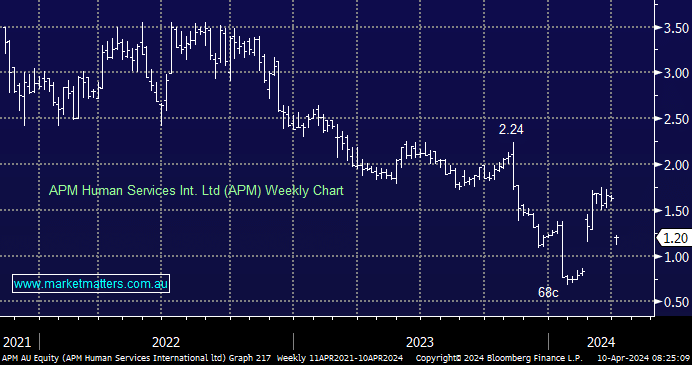

APM spent much of the last 2-weeks in a trading halt after the Private Equity business CVC walked away from their takeover offer of the global employment and health services company. CVC, initially offering $1.60/sh, walked away from the revised $2/sh bid after a period of due diligence. Before returning to the boards on Monday, APM’s largest shareholder, Madison Dearborn Partners, tendered a $1.40/sh deal for the remaining 71% of shares not held, though it looks a reluctant proposal given the non-exclusive and non-binding basis being put forward.

It’s been a rough ride for APM over the last 6-months. Downgrades followed comments made at the AGM in November, where the company said they were being impacted by low unemployment and that, despite revenue growth coming through, margins would be heavily impacted. APM disappointed the market again in January with a further trading update that quantified the extent of margin pressures. The initial CVC offer patched over the issues for a period there, but the return to trading this week came with the third round of downgrades with hopes of an earnings skew to the 2H dashed.

Given the resilient economic data that continues to come through, we see no sign of the headwinds easing for APM. A deal with Madison Dearborn seems like a get-out-of-jail card in front of the company, and we don’t expect a competing bid to come through, given the recent trend.

- Shares are currently trading at a ~15% discount to the $1.40 bid, though we would expect to see shares trade below $1 if the latest offer were to fall through.