We believe the ASX200 can outperform over the next 12-months (CSL, COH, CWN)

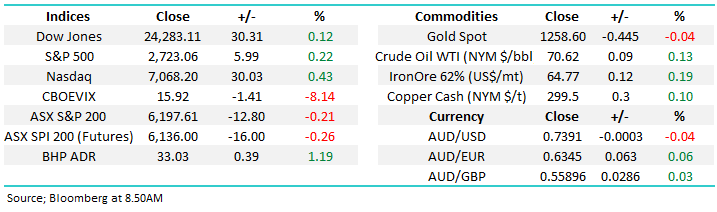

The ASX200 put on a very impressive performance yesterday only falling -0.2% largely ignoring the absolute pummelling global markets received on Tuesday night – as we often say our market doesn’t go down without the banks. The banking index led the recovery closing up +0.4% with market heavyweight CBA certainly helping sentiment closing up +0.9%, over a dollar above its early morning lows. However, with no sectors falling by more than -1% it was an overall excellent effort by the Australian market – remember with EOFY looming on Friday anything can happen over the next 3 days.

Overnight stocks were mixed with Europe closing generally flat and the US managing a small bounce courtesy of the energy sector, following crude oils 3.8% bounce, but a 30-point bounce by the Dow is hardly inspiring stuff following the 328-point whack it received the night before. Although BHP is set to open up over 1.5% courtesy of oil the SPI futures are pointing to an ~15-point drop early on for the ASX200.

- Short-term MM is neutral the ASX200 with a close below 6140 to switch us bearish, however we remain in “sell mode”.

Today’s report is going to focus on 3 stocks we will be monitoring into any decent weakness over coming weeks / months – remember we now have more flexibility as the MM Growth Portfolio has bought 2 bearish ETF’s.

NB Our current plan is to add to the BEAR position if the ASX200 trades up towards 6300.

ASX200 Chart

Yesterday MM purchased 2 negative facing ETF’s, one to the ASX200 (BEAR) and one to the US S&P500 (BBUS). Our Growth Portfolio may look a touch confusing to the uniformed eye hence a quick explanation of how we’re currently viewing things.

We believe stocks are very close to an inflection point with at least a 10% correction in the offing hence we are investing defensively at this moment in time – don’t think it cannot happen to us, the Chinese Shanghai Composite Index has already fallen over 20% from its February high.

1 - We are now holding 12% of our portfolio in $A cash and 3% in a $US ETF which means we have 3% in USD – we consider this a 15% cash position, spread between two currencies.

2 - We are now holding 8% of the portfolio in negative facing index ETF’s with the 5% exposure in Australian unleveraged while the 3% exposure in the US has leverage of 2 – 2.75x – this means we have a short exposure of around ~11%

3 - We are holding 27% in “big 4” banks plus 15% in related Suncorp (SUN) and Clydesdale Bank (CYB).

4 - We hold 35% of our portfolio in 7 other stocks.

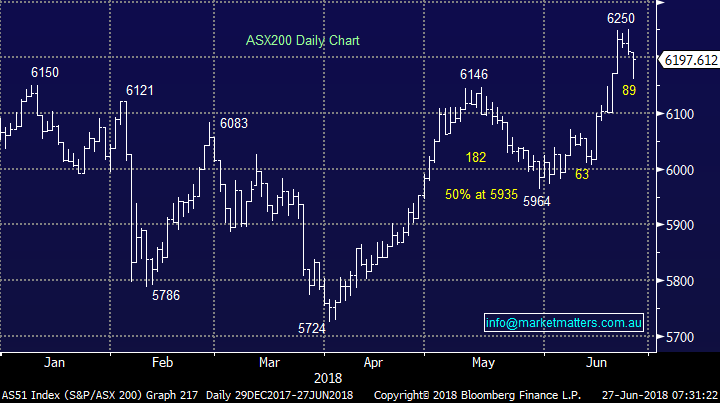

Overall, we feel comfortable with the spread of holdings / exposure primarily because we believe that Australian banks will outperform over the coming months / quarters, especially if markets do experience a meaningful correction given we think they have a significant amount of bad news baked into their prices – over the last 5 trading days CBA for example as almost outperformed the ASX200 by a factor of 3x, a week’s trading is far from a trend but it does feel like the beginning of a more significant performance reversion.

While the local banks outperform we are well positioned, and as they are a big part of our index perhaps we will finally outperform global markets – so far in 2018 the ASX200 is up +2.2% while the Dow is down -1.8%.

ASX200 Banking Index v US Banks Chart

3 stocks we are considering into weakness.

A couple of the below stocks we covered in Weekend Report but it’s important to keep our eye on the ball when the market volatility is clearly picking up.

It’s essential we don’t find ourselves wearing blinkers moving forward but focusing on the macro themes we like over the coming years is a solid starting point:

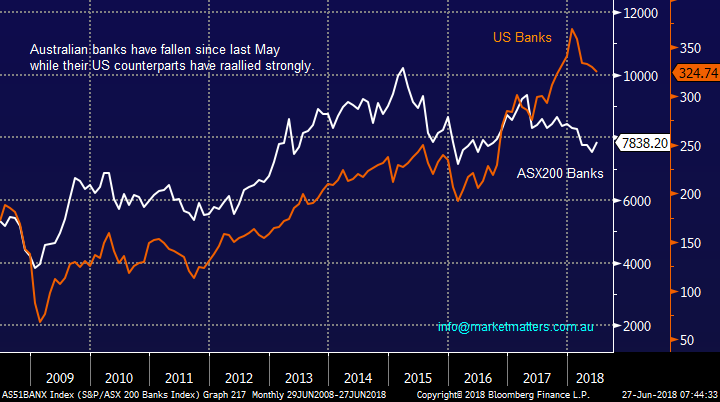

- We like $US earners as our technical & fundamental opinion is the $A is headed down towards the 65c level against the greenback.

- The growing Chinese consumer is a group we believe cannot be underestimated over the coming years

- Disruption stocks are tougher to identify and less plentiful in Australia than the US but can produce excellent opportunities, plus attractively with very low correlation to the overall market.

- Healthcare may have enjoyed a great few years but China is rapidly improving its general health offerings while many developed countries like our own are experiencing ageing populations.

Hence any high quality stocks that correct into attractive areas while fitting into the above 4 macro themes will be catching our attention at MM.

Australian Dollar ($A) Chart

1 CSL Ltd (CSL) $196.49

CSL has been an exceptional performer over recent years and appears to be well positioned moving forward, especially if the $A falls. The stock’s expensive trading on a forward P/E of 38.4x but considering the growth expected, it not overly demanding, especially into a pullback.

Over the last 2-years even while the stock has soared it’s experienced 3 pullbacks between 7.7% and 24.4% i.e. opportunities often present themselves to the patient.

- MM is considering buying CSL around $185 and $175 if corrections unfold.

CSL Ltd (CSL) Chart

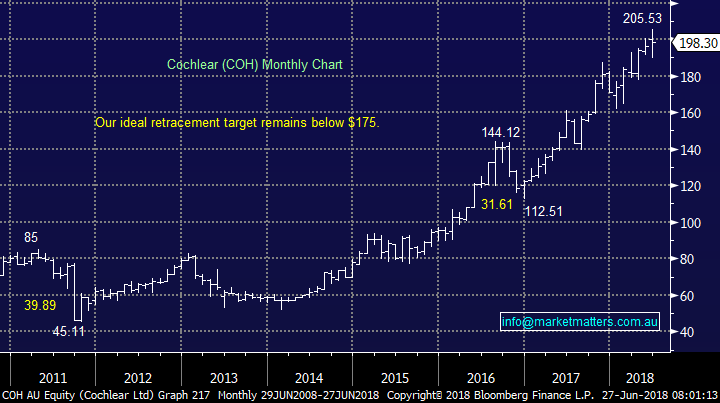

2 Cochlear (COH) $198.30

Cochlear has also been a great performer over recent years and appears to be well positioned moving forward, especially if the $A falls. The stock is again not cheap trading on a P/E of 45.8x forward earnings while yielding 1.4% fully franked.

- MM is considering COH if it has a hefty correction back towards $175.

Cochlear (COH) Chart

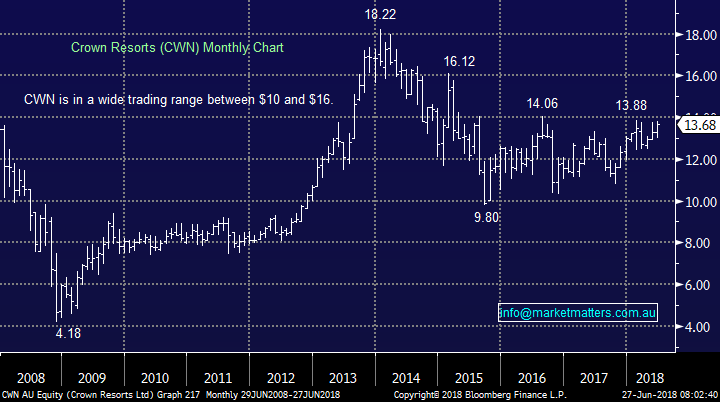

3 Crown Resorts (CWN) $13.68

CWN has been knocking on the door of $14 resistance for ~2-years and as Barangaroo slowly approaches completion in Sydney, we believe it’s a matter of time before it gets rerated to the upside – the opening date for the upmarket 6-star, pokies free casino is on track for 2021 . CWN is currently trading on 25.6x while yielding a solid 4.4% fully franked – the next dividend is due in September.

With James Packer taking a back seat the business now feels on a solid footing to move ahead and benefit from the growing Chinese tourism numbers – the upmarket Barangaroo casino looks set to attract a large number of visitors wanting to see the best Sydney has to offer. The increase in earnings when the new casino opens its doors is very likely to make todays price seem cheap, to us it’s a matter of where we buy CWN.

- We like CWN below $13 but will be tempted to buy at higher prices if the stock generates technical buy signals.

Crown Resort (CWN) Chart

Conclusion

We are comfortable with our net “relative” bullish view on our banking sector from current levels over the next 6-12 months.

We like CSL, COH and CWN into weakness and may consider paying up for CWN.

Overseas Indices

The tech-based NASDAQ is looking eerily like its set up in 2015-16 just before it dropped 19%, we are bearish targeting a significant pullback over the coming months.

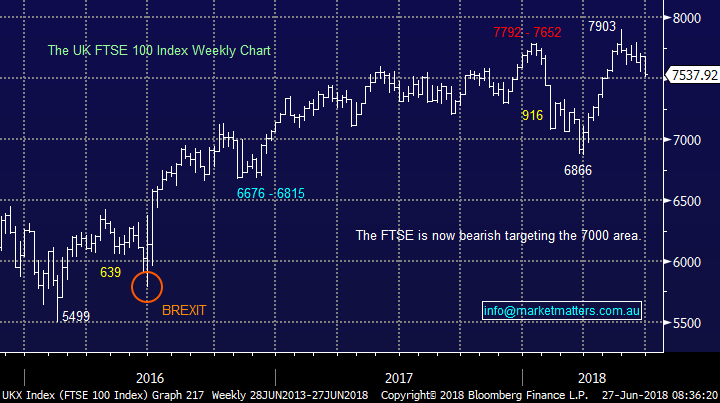

Similarly the FTSE has generated a technical sell signal targeting below the psychological 7000 area. Part of the reason of our “sell mode” at MM.

US NASDAQ Chart

UK FTSE Chart

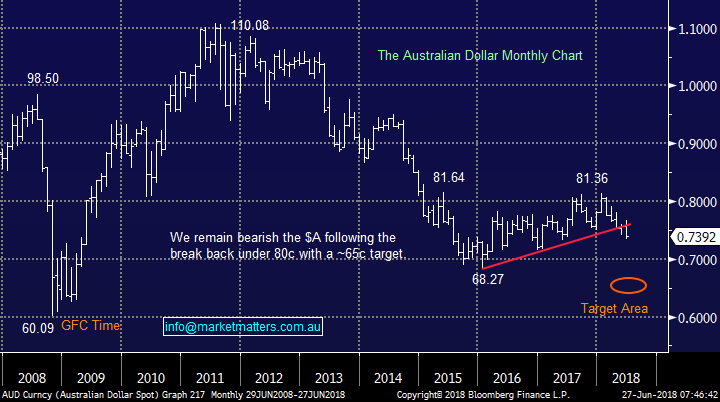

Overnight Market Matters Wrap

· The US had a breather from its recent selloff overnight, ending the session with little change across the major indices.

· Crude oil however jumped above US$70/bbl. helping the assisting the energy sector to outperform the broader market, up 1.4%. This will likely assist BHP to claw back most of its losses overnight, as the US session ended up an equivalent of 1.2% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open with little change from the previous close, testing the 6200 resistance level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/06/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here