Has the easy money been made in Lithium stocks? (ORE, KDR, PLS, MIN)

‘Minds are like parachutes, they only function when they are open’ Mark Dewar

Each morning when we fire up our Bloomberg terminal a new quote appears at the top of the screen, and this morning the above line seems very fitting for us at the moment. Markets are becoming extremely exciting and now more than ever we need to be keeping an open mind about our approach. We firmly believe that markets are in the mature stages of a bull market, the NASDAQ which has been the global leader in this rally is showing some signs of cracking and now Asian markets are coming under some sustained pressure following Donald Trump’s attack on global trade.

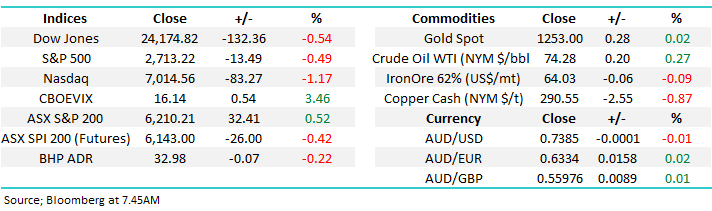

The ASX200 looks set to open down around ~20 points this morning following a shortened but overall weak night on Wall Street where the Dow fell -132 points courtesy of a late sell off, although the NASDAQ locked in a bigger decline down 1.17% to settle at 7014, below the 7040 technical handle we had previously flagged - Facebook and Twitter were down around ~2.5% a piece.

In our opinion US stocks feel like they are slowly changing their tune and investors need to change from a mindset of buying the dip, to selling strength. A move back over 2900 for the S&P 500 would see us increase cash levels.

S&P 500 Chart

Yesterday, the ASX200 managed to grind higher throughout the session despite weakness across Asia thanks largely to strong buying within the banking sector. It seems underweight fund managers are showing their hand and finally stepping up to plate, rotating some funds out of the consensus call of being long commodities, into the non-consensus call of long banks. Given the index composition of the ASX 200, support for our banks after a torrid period should see our market outperform on a relative sense into any further weakness.

ASX 200 Chart

Today will be an interesting session to see if we embrace the more negative markets we have woken up to this morning – stocks down in America but they were up in Europe, while commodities bar Gold and Oil where generally lower. BHP is set to open below $33.00.

This morning we are going to look once again at Lithium, where we expect some significant volatility over the coming years – a sector not for the faint hearted!

Has the easy money been made in Lithium stocks?

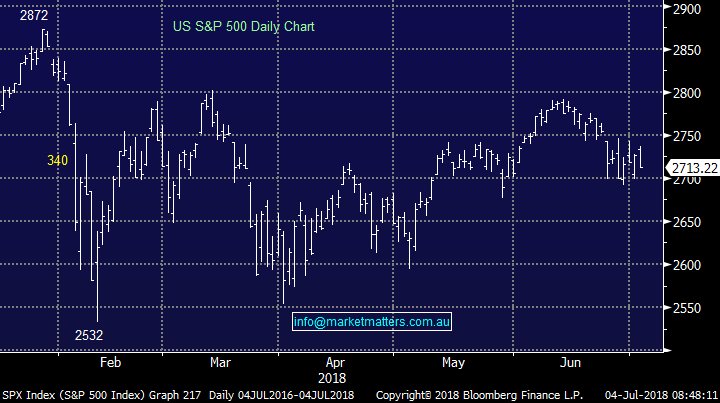

It’s very easy to get excited about Lithium and the huge uptick in demand as the world moves from internal combustion engines to electric vehicles. All the major car companies are following Tesla’s lead and investing billions to produce battery powered cars, while China has declared that more than 20% of all new vehicles they produce by 2025, will be electric.

China will produce nearly 30m vehicles in 2018

Like all commodities prices are dictated by supply and demand. A trigger for demand comes along, in this case the move towards electric vehicles and prices rally as a consequence. As prices move up new production is incentivised and capital gets deployed.

The period where the gap is largest between forecasted demand and current supply is where the easy money is made. We’re now past that point and are now entering a more mature phase for the Lithium sector. For example , the world’s largest producer of Lithium – the Chilean company SQM which accounts for around ~30% of global supply will likely double its current production over the next 2 years.

China is now a force in Lithium while Australia has some great Lithium opportunities, however the trend overall is for a large and sustained ramp up in production which could outpace the growth in demand in the nearer term – that would put pressure on prices.

The market is very split on what the Lithium sector will look like in the shorter term and that is likely to create more volatility. With so many moving parts to the debate looking at price action from a technical standpoint therefore makes sense for Lithium. While we’ve got an overall positive bias towards the sector given the clear tailwinds outlined above, being active in when we own, and don’t own Lithium stocks will remain the key.

During FY18 we were in and out of Kidman (KDR) for a ~21% profit and Orocobre (ORE) for the a ~14% profit while we currently hold ORE from higher levels.

I reiterate that this is a sector that MM likes however remember this is / will continue to be an extremely volatile area.

1 Lithium ETF $32.43

The Global X Lithium Battery Tech ETF is probably the most diversified way of playing the electric vehicle / lithium sector. It’s a $US913m fund which houses both producers of raw materials and EV manufacturers like Telsa. Over the past 12 months. LIT has declined ~20% since new Chilean production was announced. Please note, this is an ETF listed in the US.

Lithium ETF (LIT.US) Chart

2 Orocobre (ORE) $5.25

ORE peaked at a similar time to the majority of the sector and corrected ~36% to its April low. The stock is attempting to grind higher, and solid production numbers out earlier in the weak were a positive.

We are however sellers into the next period of strength, preferably above $6 taking a small loss on our positon

Orocobre (ORE) Chart

3 Kidman Resources (KDR) $1.82

KDR has now seen a decline of ~27% from the may high, however further downside into the ~$1.70 region feels a strong possibility.

Kidman Resources (KDR) Chart

4 Mineral Resources (MIN) $15.57

Similar to ORE, MIN peaked in December of 2017 above $22 and has corrected ~30% since then.

MIN looks interesting on a move below $15

Mineral Resources (MIN) Chart

4 Pilbara Minerals (PLS) 88.5c

A higher risk / higher reward company in the Lithium space with the stock having corrected ~30% from its December 2017 highs.

We remain 50/50 on PLS right here with a slight preference for another low below 80c

Pilbara Minerals (PLS) Chart

Conclusion (s)

While we like Lithium longer term, we think volatility will increase in the short term

We are sellers of any reasonable strength in Orocobre (ORE)

Mineral Resources (MIN) looks interesting below $15

Overnight Market Matters Wrap

· The US equity markets sold off ahead of Independence Day tonight, led by the tech. heavy Nasdaq index as uncertainty rises on the current trade war tension.

· ‘Safe haven’ assets such gold rallied 0.99% higher, while crude oil futures traded to its highest in 4 years (US$75.27/bbl.), before retreating towards the lower US$74 area.

· The September SPI Futures is indicating the ASX 200 to open 15 points lower towards the 6195 level with investors keeping an eye out on the Asian markets for any update on the current geopolitical issues.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 04/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here