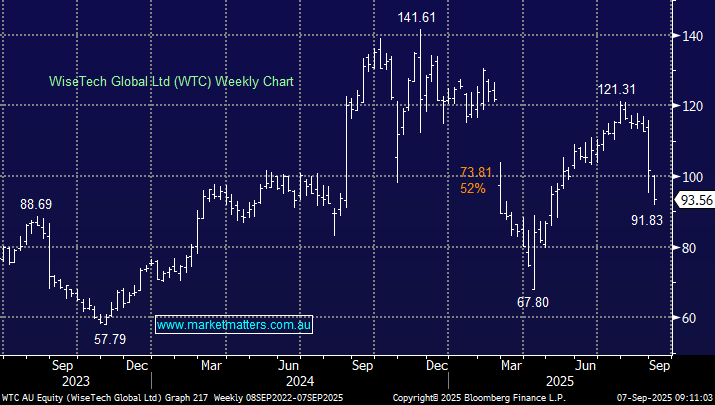

We bought ALB in the International Equities Portfolio 3 weeks ago at $US115.75, with the stock having a solid initial run, only to fall ~16% overnight to trade back below our entry-level. They announced a $2bn capital raise via preferred stock, which is clearly a surprise and highlights two issues for the Lithium company and the market more broadly. Cash flows are weak, and they need cash. This is understandable when we consider how the Lithium price has moved as outlined in this table, which looks at a summary of Lithium prices for the past year, along with the move between January and February of 2024.

In the statement, ALB said that the funds could be used in the construction and expansion of lithium operations in Australia and China, which is bearish news for the sector more broadly that has bounced in the last few weeks as multiple companies talked about reduction of supply, not expansion. The terms of the raise are different to what generally happens in Australia, being done through preferred stock, which pays a coupon (7-7.25%) and converts to equity in the future, with $2bn representing about 13% of the company’s current market capitalisation – so it’s a big raise.

We have always expected volatility in this space, and Albemarle has undoubtedly lived up to expectations in that regard. While we don’t think this changes the investment case into the sector or Albemarle specifically, it does highlight the importance of weightings to such a volatile area – MM has a 4% portfolio weighting.

- We retain the view that Lithium and associated stocks are looking for a low.