Trump fires another bazooka at global markets! (ORG, OZL, AGL)

Minutes after the US share market closed the night before last, President Trump said he would push ahead with tariffs on an additional $200bn of Chinese goods - a very real US-China trade war is looming. We strongly believe that if this continues to escalate equities / risk assets have much further to fall.

Normally I start pondering the next morning’s report after the kids have gone to bed, usually a perfect time to reflect when the phones are not ringing and markets are quiet ahead of the US trading session starting. This week I’m in and out of the office given school holidays, however thinking about today’s report last night I thought would have been fairly futile following President Trump’s latest posturing and the market’s reaction to it – i.e. big moves from stocks, to oil and copper had started to play out - I would have thought this morning we would have woken to something more aggressive on the downside from markets generally.

However, not a great deal of change except England lost in the football world cup – some pommy mates will be very downbeat this morning!! while the Dow has fallen over 200-points we saw most of that fall through the futures market yesterday, oil fell almost 5% and copper -3.5%. With BHP closing down over 50c in the US the SPI futures calling the ASX200 to open down less than 10-points feels a touch optimistic.

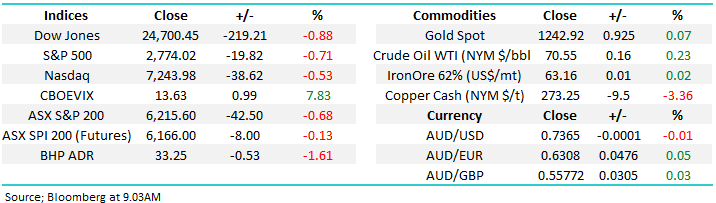

- MM is now neutral the ASX200 with a close below 6140 required to seriously concern us, however we remain in “sell mode”.

Today’s report is going to look at 3 market moves that caught our eye amongst the pickup in volatility over the last 24-hours.

ASX200 Chart

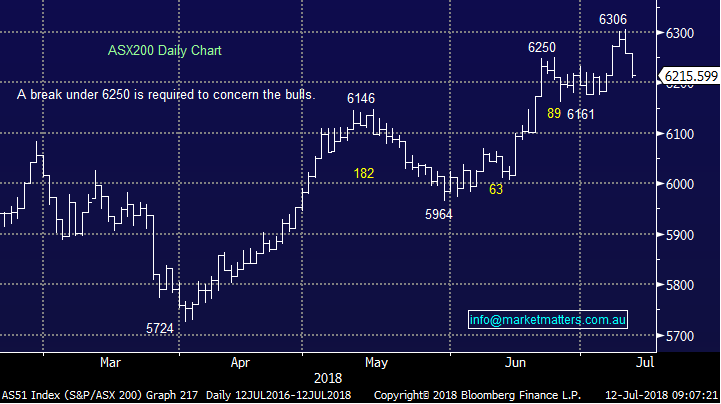

One thing we find pretty remarkable is the VIX remains very complacent as it trades well below its average of both the last 1 / 10-years.

Equities are assuming the trade war will not be the undoing of global economic growth yet other common global economic indicators like copper, the $A and crude oil are clearly far more worried – a fascinating market is unfolding.

Volatility / Fear Index (VIX) Chart

1 Copper

Overnight copper fell to its lowest level in a year and from a technical perspective continued weakness to the order of 5-10% is now our preferred scenario but we must acknowledge this market can turn on a “Trump “tweet” at any time.

Over the last few weeks we’ve been eyeing OZ Minerals (OZL) into weakness as its followed the copper price lower however now copper has broken down technically we are either going to pass on the purchase altogether, or lower our entry to sub $8.80.

- MM is still considering purchasing OZL but we would be looking for an entry below $8.80, around 3% lower.

Copper Chart

OZ Minerals (OZL) Chart

2 Origin (ORG) and AGL Energy (AGL) get whacked

Yesterday both AGL and ORG were sold off aggressively, even considering it was a poor day for stocks, with ORG closing down -3.6% and AGL -7%. Basically, the Australian competition and consumer commission (watchdog) are looking at a tough package to pull in power prices which potentially will cap growth and expose the 2 majors to greater competition.

At MM we’ve been cautious these 2 stocks for a while and actually put out sell notices on ORG in a few recent Weekend Reports – the time for the declines feel like they have arrived:

- Origin Energy (ORG) $9.73 – we are bearish initially targeting sub $9, or ~8% lower.

- AGL Energy (AGL) $21.17 – we are bearish targeting around $19, or ~9% lower.

Origin Energy (ORG) Chart

AGL Energy (AGL) Chart

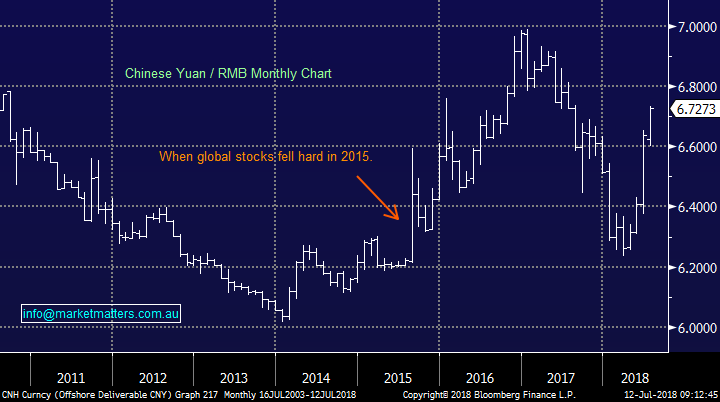

3 The Chinese Yuan is a worry

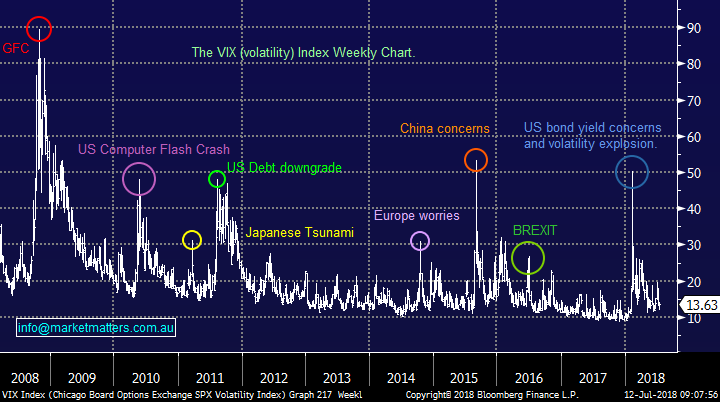

Donald Trump’s trade war onslaught has sent the Chinese Yuan to its lowest level since August 2015 but last time it was down here global share markets were about 30% lower!

Stocks were hammered and the VIX soared on China concerns back in 2015 but today equities seem very relaxed which we find disconcerting – at MM we remain comfortable with our view that stocks will be noticeably lower in 6-months’ time, what will break the bull market is always hard to call but perhaps it will be Trump after all.

MSCI World Index Chart

Chinese Yuan (CNH) Chart

Conclusion (s)

We are nervous around stocks which would not surprise many subscribers considering Donald Trump is currently playing their tune:

- Copper has broken down technically targeting a likely further 5-10% decline, hence we are pulling our potential purchase of OZL below $8.80.

- We are bearish AGL and ORG targeting 8-10% downside.

- The Chinese Yuan we believe should be a worry for equities but complacency is ruling at present.

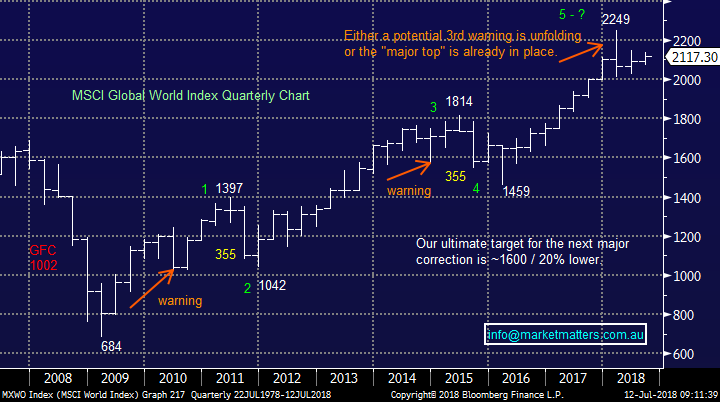

Global markets

The US S&P500 feels like it’s had a rollercoaster ride of late but it remains firmly in the middle of its 2018 trading range and hence neutral.

US S&P500 Chart

European stocks traded poorly overnight following the US lower, bullish technical signals remain in place but market sentiment / risks plus our medium-term view is a clear concern.

UK FTSE Chart

Overnight Market Matters Wrap

· U.S. equity markets plumbed along with crude oil, while the US dollar spiked amid renewed trade and geopolitical tensions. The S&P 500 lost the most in two weeks and Treasuries edged higher, with 10-year yields falling to 2.84%.

· It appeared U.S.-China high-level trade talks have ground to a halt as the Trump administration ramps up rhetoric on the trade tariffs, and China threatens retaliatory measures.

· Commodities were under pressure, with oil in particular at one stage sinking more than 6%. The fear that increasing protectionism will hurt global raw-material demand and sent copper plunging 3.2% to the lowest in a year.

· The September SPI Futures is indicating the ASX 200 to open marginally higher, towards the 6220 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. MarketMatters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Marketmatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here