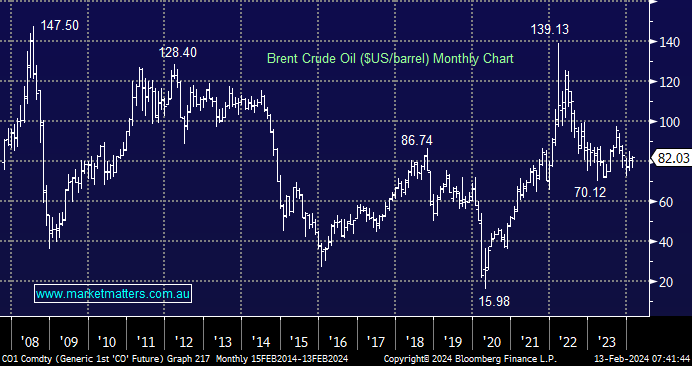

Crude oil has been supported by major geo-political events since COVID, but it’s not delivered an overly exciting performance from the ASX oil & gas names – uranium has been the big winner in the Energy Sector. The supply and demand fundamentals continue to concern some analysts as record U.S. production combined with a weak Chinese economy creates risks of oversupply, potentially offsetting tensions in the Middle East and the Russia/Ukraine war. Brent crude is trading around its average level of the last five years, albeit with some volatile spikes in both directions.

- We have been looking for Brent Crude to rotate between $US65 and $US85 through 2024; so far, so good, but it’s early days.

Growing confidence in the US economic recovery has driven massive deals in the energy sector over recent months, including Chevron’s $53 billion acquisition of Hess in October and a $59.5 billion deal two weeks earlier to buy Pioneer by Exxon Mobil, its biggest acquisition since buying Mobil two decades ago. Now we see Diamondback Energy will attempt to purchase rival Endeavor Energy Resources to create an energy giant worth more than $50 billion in the Southwestern United States. Unfortunately, it’s all quiet on the local front, with recent early discussions between Santos (STO) and Woodside (WDS) ending before they hardly got going.

This morning, we looked at various oil plays to see if any appeared interesting to MM, as unfortunately, tensions in the Middle East remain a concern, and a potential catalyst for higher oil prices.