What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

Lithium has been dominating the news around the demise of the ESG Sector for months, but nickel has come to the fore of late as the collapse in the commodities price has led to the closure of mines operated by IGO and Twiggy Forrest’s Wyloo. Now heavyweight BHP Group (BHP) is feeling the pinch with estimates that its Nickel West business is losing $50m a month. The government has even been involved as it aims for a carbon-zero economy by 2030, a big ask if Australian businesses are losing millions in the pursuit of their optimistic goal.

- MM is still holding coal exposure, believing the journey to zero emissions will be a tougher and longer path than many idealists and optimists hope for.

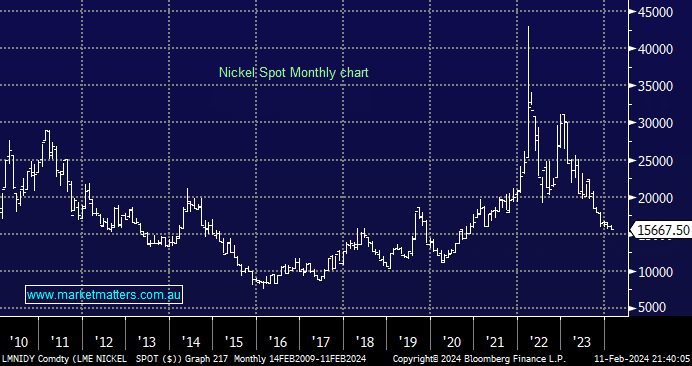

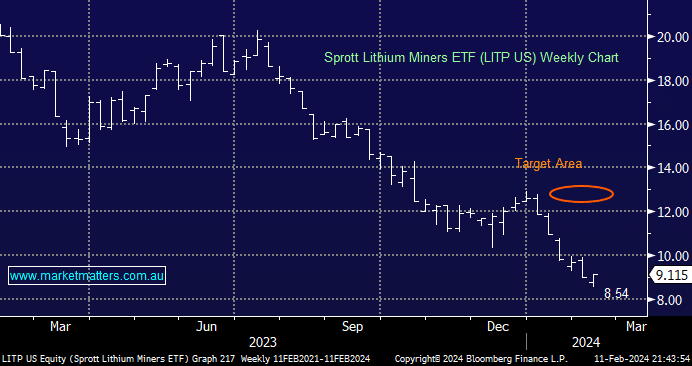

We’ve discussed the major issues faced by lithium producers a number of times in recent months as the price of the commodities tumbled by over 80% due to increased supply and lower demand by EVs than was forecast by most analysts. The nickel story is similar but not as dramatic, with the element halving in price over the last year, turning many mines into loss-making operations, although interestingly, the price is only back to the average of the last decade. Nickel is used in cathodes in of EV batteries to help increase a battery’s useful life and energy density – two big issues compared to combustion engines. Again, post-COVID, the ESG trade/sector got well ahead of reality, expecting strong prices for many years, but commodity prices have always been both cyclical and volatile.

- Local nickel producers are struggling because they’re trying to compete with “dirty” nickel out of Indonesia which is cheaper to produce and driving prices down.

Business is rarely fair, and although there is a market for our cleaner nickel, China consumes ~60% of global nickel, followed by another 25% going into the rest of Asia. Hence, price, unfortunately, may remain more important than how it is produced for the foreseeable future. However, producers who are making decent returns at current levels, the average of the last decade, look well positioned in the medium term as unprofitable mines start closing, i.e. the classic commodities cycle.

We touched on the lithium narrative earlier, and last week, the sector enjoyed an encouraging reversal higher; however, we only have interest in low cost and profitable producers with solid, balanced sheets, such as Pilbara Minerals (PLS).

- We believe the next 20-25% move by lithium stocks is up, but it’s clearly a contrarian and risky call.