Will Netflix be the chink in the FANGS / NASDAQ armour?

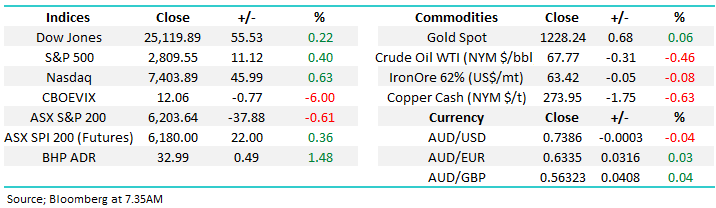

The ASX200 had a very weak session with a positive banking sector managing to stop things turning ugly. The -0.6% fall didn’t look too bad at a glance but in an almost stealth like manner the local market was close to making fresh monthly lows with energy -2% and heavyweight resources the main culprits e.g. BHP -1.7% and S32 -2.2%.

Yesterday the RBA agreed with our trumpeted concerns around the Australian economy, having read their statement a number of times the following 3 points caught my attention the most:

- They are very worried about household debt, hence there will be no interest rate hikes until inflation increases, 2019 now looks the earliest possibility.

- They are only mildly concerned around housing prices.

- They believe the next change is likely to be up but there is “no strong case” for a near term move.

The RBA like many market players are becoming increasingly nervous around a China–US trade war but the fact that further interest rate cuts is not totally discounted is remarkable considering where the US is in their hiking cycle.

- Short-term MM is neutral the ASX200 with a close below 6140 required to switch us to a more bearish stance, however we remain in “sell but patient mode”.

Overnight stocks were strong shaking off earlier concerns around China-US trade with Fed Chair Jerome Powell reiterating his upbeat assessment of the American economy – stocks rallied, the $US rallied while US bond yields ticked higher. Global stocks are certainly embracing good news with more enthusiasm than any potential negative flashes across our Blomberg terminals.

Today’s report is going to focus on the leading FANG / NASDAQ stocks following Netflix’s initial very negative reaction to its latest earnings numbers – a drop of almost 15% in the aftermarket followed by a recovery.

ASX200 Chart

Following on from recent reports there are 3 positions MM are likely to be considering today:

1. With gold falling over $US12/oz last night MM will be assessing Evolution Mining (EVN) into any relative weakness.

2. With both gold and copper down overnight MM will be assessing OZ Minerals (OZL) into any relative weakness.

3. With Europe regaining a “bid tone” MM will again be considering buying the BetaShares Wisdom Tree Europe ETF (HEUR).

*Watch for alerts

German DAX v BetaShares HEUR ETF Chart

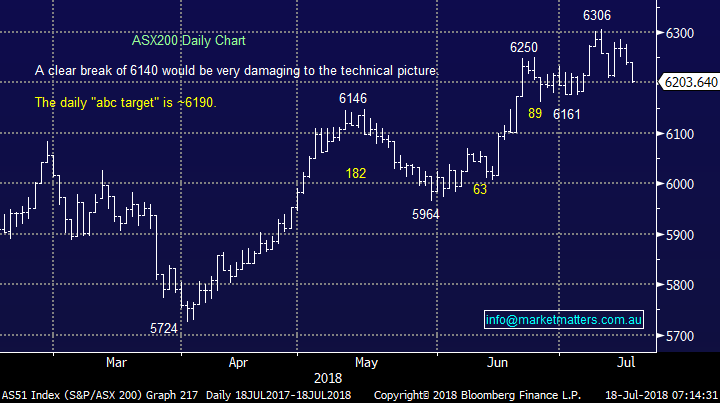

Moving onto the subject of today’s report - The FANG’s didn’t exist a few years ago but today we find ourselves regularly watching these high performers for signs that the 9-year bull market by US stocks maybe running out of steam.

Overnight the FANG Index rallied +0.8% after initially plunging well over 2% following weakness in both Netflix and Amazon.

- Technically we are short-term bullish the FANG Index targeting at least 3% further gains.

So with the overall index still bullish we will look specifically at the four FANG stocks plus highly correlated APPLE for any signs of what the next 12-months holds in store.

NYSE FANG Index Chart

1 Facebook (FB) $US209.99

Facebook made fresh all-time highs last night and for now the Mark Zuckerberg machine is ignoring Donald Trump and has put behind it any concerns around privacy – clearly impressive.

FB has rallied over 40% since the February “volatility triggered” aggressive correction by US stocks and its current P/E of 30.8x is not too demanding for a high growth tech company.

- MM is neutral FB at present anticipating a trading range between 150 and around 225 for the next 12-months.

NB There are clearly no sell signals at present.

Facebook (FB) Chart

2 Amazon.com (AMZN) $US1843.93

Amazon made fresh all-time highs last night helping push Jeff Bezos’s fortune well in excess of $150bn.

AMZN has rallied over 37% since the February aggressive correction by US stocks but its current est. valuation for 2018 of 148x is extremely lofty.

- MM is neutral AMZN at present.

NB There are clearly no sell signals at present, technically investors should be long, or square.

Amazon.com (AMZN) Chart

3 Netflix (NFLX) $US379.48

Netflix closed down over 5% last night but at one stage it was 14% in the red making the final outcome feel almost positive.

NFLX has enjoyed an amazing run since 2016 but we find its current estimated 2018 P/E of 139x to be very aggressive as investors try to understand the future value of this rapidly evolving business, particularly as competition heats up in the streaming space.

- MM is neutral NFLX at present anticipating a trading range between 350 and around 450 for the next 12-months i.e. sell fresh all-time highs for the aggressive players.

NB There are clearly no sell signals at present and last night we again witnessed the theme of recent years i.e. buy weakness.

Netflix (NFLX) Chart

4 Google Alphabet (GOOGL) $US1213.08

Google made fresh all-time highs last night but its upside momentum feels mature compared to the other 3 FANG stocks.

GOOGL has enjoyed a solid run since wobbles earlier in the year gaining over 20%, its current estimated 2018 P/E of 27.5 is not too demanding.

- MM is neutral GOOGL at present anticipating a trading range between 1000 and 1275 for the next 12-months i.e. again sell fresh all-time highs.

NB Again there are clearly no sell signals at present.

Google Alphabet (GOOGL) Chart

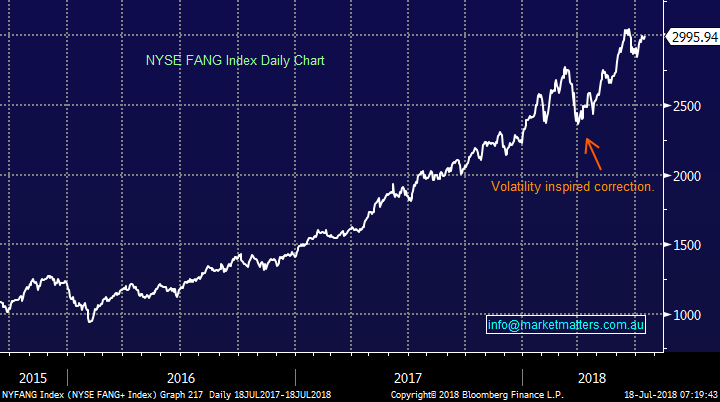

And just for good measure / sentiment let’s take a look at APPLE although officially it’s not an original FANG stock as such.

5 APPLE (AAPL) $US191.45

APPLE has ground out gains in 2018 compared to the soaring FANG’s and currently sits up only ~12% in 2018. APPLE’s current estimated 2018 P/E of 16.6x looks almost cheap.

- MM is neutral APPLE at present anticipating a trading range between 150 and 200 for the next 12-months.

NB There will be no technical sell signals until the stock breaks under $US180.

APPLE (AAPL) Chart

Conclusion

We are mildly bullish the FANG’s for the coming few weeks / months but we do expect a retest of 2018 lows over the coming 12-months + the risk v reward for buyers here does not stack up.

Overseas Indices

The tech-based NASDAQ continues to trade at all-time high while Europe has regained a distinct “bid-tone”.

The S&P500 is now only 2.2% below a fresh all-time high, our preferred scenario is an attempted rally to the 2900 area i.e. 3-4% higher.

US S&P500 Chart

European heavyweight the German DAX outperformed last night and now looks set to advance a further ~8% before MM will be looking for “sell triggers”.

German DAX Chart

Overnight Market Matters Wrap

· The US equity markets closed higher overnight, led by the tech. heavy Nasdaq 100, making fresh all-time highs despite Netflix selling off hard early in the session.

· Dr. Copper however continues to slide, down on its 7-month lows overnight – could this still to be an indicator that global growth is slowing down?

· BHP is expected to outperform the broader market today, after ending its US session up an equivalent of 1.48% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open 34 points higher, testing the 6240 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here