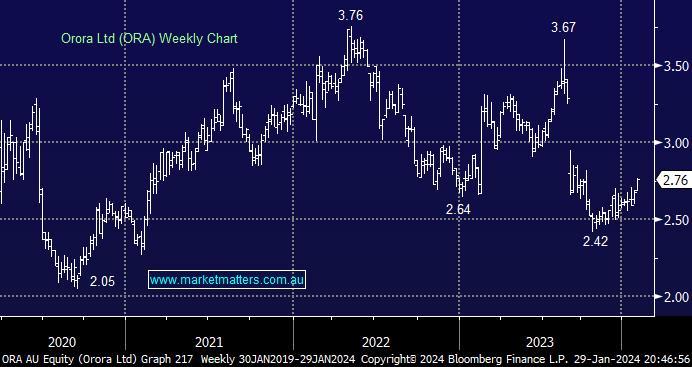

Packaging business ORA saw its stock fall dramatically after raising money last August to expand its business into Europe with the new shares offered at $2.70, close to yesterday’s close, i.e. the panic washout looks to be well and truly over. ORA should be well-positioned for investors like MM looking for some defensive exposure into 2024 aided by a yield of ~6% (unfranked) and defensive earnings that can grow at low double digits in the coming years. The company reports its interim results for FY24 on the 19th of February, but we doubt there will be many surprises following the company’s recent large foray into France.

- We like ORA, believing it has been oversold following its $1.2bn capital raise in 2023 to buy bottle maker Saverglass.

- ORA currently resides in the Active Income Portfolio, while it is a candidate for our Growth Portfolio when we take a more defensive stance