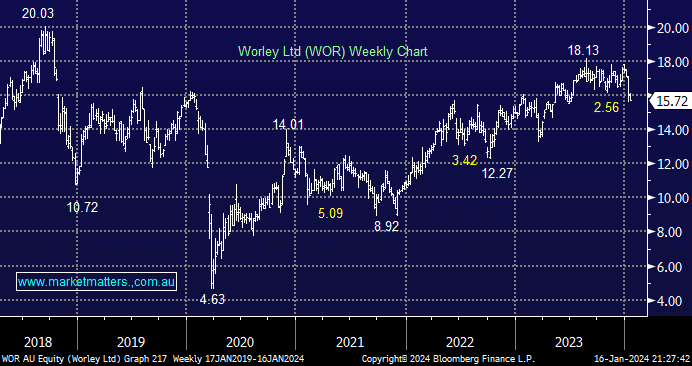

WOR has suffered an integrity challenge following corruption allegations out of South America which has seen the stock saw the fall 10% in 2024. At MM, we like WOR, believing it offers significant earnings leverage to the current cycle of global energy investment and decarbonisation projects; hence, the question we ask is how bad could things become in Ecuador and hence, should we be cutting, holding or adding to our position? The crux of the allegations is WOR engaged in bribery to secure contracts, whereas WOR claims they won the business based on credentials. Coincidentally, WOR brought arbitration against Ecuador in February 2019 when trying to collect some $58 million it claimed was owed from Petroecuador for services provided from 2011 to 2017 for energy projects, illustrating there were already tensions between these respective parties.

- While a negative, we don’t believe the Ecuadorian situation will have a meaningful impact on WOR in the medium term with the scale of global decarbonisation trumping a bribery issue.

WOR delivered a strong FY23 result back in August, reinforcing their growing push into sustainability-related work – it was a better way to play the ESG boom as opposed to lithium last year. Aggregated revenue was up 21%, well ahead of expectations, with sustainability-related work already 41% of aggregated revenue. They are well positioned as a first mover into decarbonization.

The $58mn is not irrelevant to $8.3bn WOR but this is primarily a confidence issue which is often best solved with time. After rallying strongly post-COVID, a deeper pullback wouldn’t surprise, but another 4-6% will start to present some compelling value. Interestingly Worley’s biggest shareholder has been creeping up the company’s shareholder register to secure a stake of more than 23.5%; they’ve already had a tilt at WOR back in 2017 at $11.80, it’s going to cost them more today, but it might be back under the microscope into further weakness.

- We continue to like WOR and will consider increasing our 4% position around the $15 level.