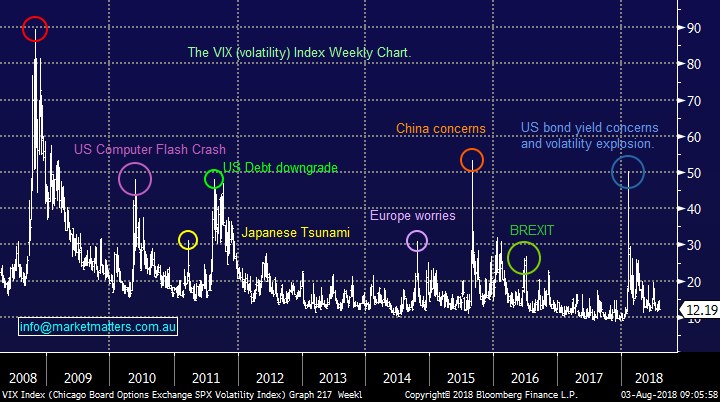

4 markets we are watching very closely

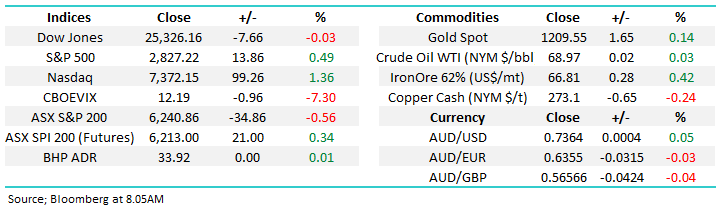

Yesterday the ASX200 had a bad day at the office falling 35-points but as we mentioned in the afternoon report it was a solid effort compared to most of Asia. The decline locally was focused in the resources sector with RIO -4.9%, BHP -3.3% and Western Areas -5.4% examples of the sustained selling pressure following RIO’s poor result and coppers sizeable decline.

The ASX200 has now traded sideways basically between 6200 and 6300 for a month as stock / sector rotation has remained the main game in town. Technically the ideal sell signal for MM would be a failed breakout over 6300 but we will let the market tell us what it wants to do, it’s easier that way!

- We are now neutral the ASX200 following the close below 6250 and will become bearish on a break of 6140.

US stocks were impressive overnight with APPLE’s rally to all-time highs shaking off early weakness created by Donald Trump’s chest beating on US-China trade. While American equities can rally on potentially bad news they remain strong.

· APPLE’s rally for a second day concurs with what we’ve witnessed locally after good / poor results the respective buying / selling follows through for a few days.

Today’s report was initially going to be Part 2 covering the Australian Agricultural sector but with so much activity unfolding in markets this week we’ve put that one on the back burner as we consider 4 important market situations evolving as I type.

ASX200 Chart

1 US-China Trade Fears reignited

The US has now said it’s considering increasing the proposed tariff on Chinese imports from 10% to a whopping 25% as it attempts to make China negotiate. However, China has “vowed to retaliate to defend the nations dignity and interests”. This feels like Trump may push the world to a very ugly economic conclusion.

Fund managers are clearly non-believers that a trade war will erupt, a very aggressive stance in our opinion considering that US stocks are around all-time highs after the second longest bull market in history as valuations are sit on the rich side of the fence – this concurs with our current message “sell strength but certainly not weakness at this stage”.

The resilience of equities to the current uncertainty is perfectly illustrated by the Chinese currency where we’ve seen the USDCNH soar almost double what it did in 2015 /16 when stocks tumbled over 15% i.e. the Chinese Yuan has been falling against the $US.

Chinese Yuan / RMB Chart

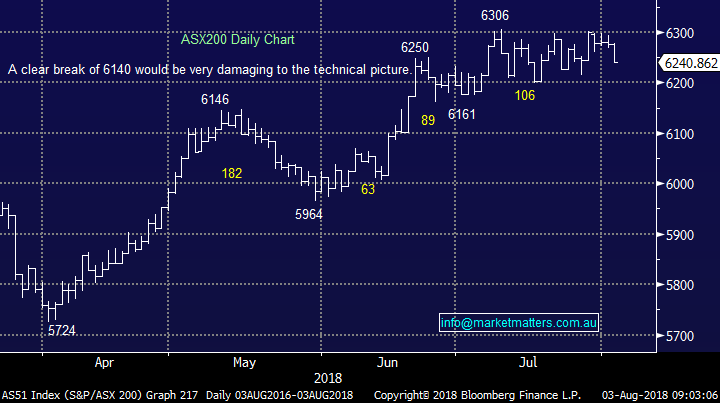

Furthermore, 3-years ago when the Chinese Yuan fell the Volatility Index (VIX) soared to over 50 compared to last nights close around 12 i.e. huge complacency.

· From a risk/reward perspective we believe ignoring this brinkmanship between Trump and China is a dangerous game.

While the outcome is far more likely that politicians will not let a full trade-war escalate we feel the market can fall 3 times further than it may rally if common sense prevails i.e. a good outcome is priced into the market.

US Volatility Index / Fear Index (VIX) Chart

2 Global stock indices feel complacent & vulnerable

We believe that the US S&P500 is still threatening a decline back below 2600, or over 10%, to test its lows of 2018. The question remains to us can it make fresh highs up towards 2900 first i.e. only another 2% higher.

· MM remains bearish US stocks for the next 10% move but remain only advocates of selling strength at this stage.

US S&P500 Chart

European stocks remain mixed with most indices remaining neutral / bullish but the FTSE is looking close to a 10% decline with a close below 7500 required to hit the technical sell button.

UK FTSE Chart

Lastly moving onto Asia which is bearing the brunt of the trade-war concerns, the Chinese market is now trading around its lowest level since mid-2016. Fortunately for us the ASX200 has not been correlated to our demographic cousins when it comes to performance.

China’s Shanghai Composite Chart

3 Resources could fall hard & fast

In our opinion investors are complacently long Australian resources and a wakeup call might just be being dialled with President Trumps finger on the button. If the crowd decides to exit a position the underlying stock / sector moves can be fast and dramatic.

At MM we remain keen buyers of a decent sell-off within the sector which coincides with our expectation that inflation pressures are building.

Yesterday’s $4 / 4.9% plunge by RIO Tinto (RIO) has rapidly brought our targeted buy area into play.

· MM remains bullish RIO around $74, now only ~ 5% below the last trade.

RIO Tinto (RIO) Chart

Other stocks within the sector we are looking to buy / accumulate:

1. BHP Billiton (BHP) below $30.

2. Independence Group (IGO) between $4 & $4.20, or Western Areas (WSA) below $3.

3. Alumina (AWC) now under $2.70 – potential for Income Portfolio.

4. Iluka (ILU) now around $10.80.

5. OZ Minerals (OZL) between $8 and $8.50.

6. Fortescue below $4.

These levels have obviously been tweaked over recent weeks as news flow unfolds. A couple are fairly close while other feel miles away but as we saw with RIO things can change quickly - the large miner is now well over 10% below its May 2018 high.

4 Global Interest rates

Overnight the Bank of England (BOE) raised interest rates to 0.75% with a surprise unanimous vote pushing rates to their highest level since 2009.

This decisiveness of this second rate increase in under a year tells the market that the BOE believes further rate increase are required to contain in inflation.

· MM will become very bearish the UK FTSE if it closes below 7500.

The US yield curve remains on most economist’s radar with gap now contracting to 0.3225%, investors should remember that inversion (2 -year rate above the 10’s) usually proceeds a recession.

US 2/10-year yields Chart

Conclusion (s)

Today’s 4 subjects highlight some of the risks MM sees for global equities moving forward but again we have no sell signals / triggers.

1. MM is currently comfortable selling strength in stocks / indices but not weakness.

2. MM likes a number of resources into weakness – a plan we’ve held for many weeks.

Overnight Market Matters Wrap

· Apple overnight won the race to become Wall Street’s first trillion dollar company in history as it continued its recent rally post this week’s quarterly earnings beat, rising another 2.9% to a touch over US$207/share.

· Trading on the broader market was however more subdued as a result of the continuing concerns of escalating US-China trade wars. The Dow closed a touch lower and the S&P 500 rose 0.5%.

· Apple’s rally helped boost the broader tech sector and consequently the tech heavy Nasdaq gained another 1.2% to take the index back above 7800. The so called FANG group of stocks, Facebook, Amazon, Netflix and Google (listed parent Alphabet) joined Apple in leading the charge higher.

· Commodities were mixed. Oil recovered some of the recent losses, with the Brent price rallying 1.4%, back above US$73.3/barrel and iron ore also firmed 0.5% to hover just below us$67/t. Gold and base metal prices remained weaker on the trade concerns. Both BHP and RIO sold off again in US trading, falling 2.5% and 3.5% respectively. Nevertheless the futures are pointing to a 0.3% recovery on the local market this morning while the A$ is a little weaker at us73.65c.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 03/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here