Subscribers questions (CBA, GUD, IVC, ILU, CSL, MYR, CLF, VEA)

The ASX200 is set to open up 10-points if the futures are to be believed but it feels like a big ask with the Dow down almost 200-points and fears around Turkey leading to potential emerging markets contagion dominating the financial press. The Turkish President Recep Tayyip Erdogan is currently showing no sign of backing off from his game of Russian Roulette with president Trump, and the US.

$USD v Turkish Lira Chart

We are now 50-50 whether this is going to be the catalyst which propels equities down at least 10% but either way we remain confident that’s where they are heading – our preferred technical scenario remains US stocks make one final all-time high, an advance of just ~2%, before failing but the clock is certainly ticking in our opinion.

- We are neutral-negative the ASX200 while the index holds above 6140 but we remain in “sell mode” albeit still in a patient manner.

Thanks again for some great questions, especially with some suggestions around how we continue to grow our coverage.

ASX200 Chart

Question 1

“Hi Guys, if you believe a 10% correction is very close at hand why not move 100% to cash and go to the beach?” – Gary G.

Hi Gary, an extremely logical question and one I have heard on the phone a number of time over recent months.

The simple answer is we believe with the correct mix of stocks, cash & negative facing ETF’s we can add value / Alpha over a pure cash holding.

The ASX200 Accumulation Index reminds us regularly of the importance of dividends to investment returns, especially for the local market. For example this week CBA trades ex-dividend $2.30, a yield of 5.7% fully franked. CBA is 12% above its June low and our view is its now a buy into weakness with the Hayne Royal Commission slowly drawing to a close.

- We like the market position of short local stocks via the Bear ETF while being long Commonwealth Bank and its healthy yield.

ASX200 Accumulation Index Chart

Question 2

“Keen to stock up on IVC and ILU pre-reporting. Already stocked on QBE and TLS, also on Wednesday, put out some pre-reporting commentary always better than hindsight.” – Mark K.

Hi Mark, we have provided coverage / expectations of the stocks we hold across our portfolio’s pre-reporting in terms of market consensus. In terms of ILU, they report in 3 days with the market expecting revenue of $1.236B dropping down to EBITDA of $571.14m and a profit of $428.14m while IVC is expected to have revenue of $465.87m, EBITDA of $122.87m and a profit of $60.02m.

At MM we are comfortable making the “calls” hence our service is definitely equally suited to both pre & post company reports , especially when accompanied by a clear opinion on the respective stocks.

Fingers crossed your foray into both QBE and TLS pays off, as you know we are long both of these serial underperformers. A quick comment on the other 2 stocks:

- InvoCare (IVC) $14.37 – we have been bearish IVC since it rallied above $17 with a technical target around $10. No real change but from a risk / reward perspective around $14 with its report looming we would be neutral.

- Iluka (ILU) $11.37 – unfortunately similar to IVC, we are neutral ILU at current levels into this week’s report.

InvoCare (IVC) Chart

Iluka (ILU) Chart

Question 3

‘Hi Guys, as we are in the reporting season, could you include a daily/weekly coverage of major companies due to report, including consensus forecasts and your views? For example, what are you views on CSL?” – Cameron A.

Hi Cameron,

Following on from Question 2, we will look to include this in future.

Our view of CSL is not uncommon in today’s market, we like the business but we believe the stocks dangerous at current levels, especially considering its P/E of 38.9x Est 2018 earnings. CSL report their second half numbers on the 15th and for the full year the market sits at $7.731B in terms of revenue, EBITDA of $2.598B and a profit of $1.71B. Second half profit is expected to come in at $662.5m

- Our preferred entry levels into CSL remain around $192 and $180.

Remember, we’ve see some large corrections by high valuation stocks over recent weeks so being prepared is our mantra with CSL this week.

CSL Ltd (CSL) Chart

Question 4

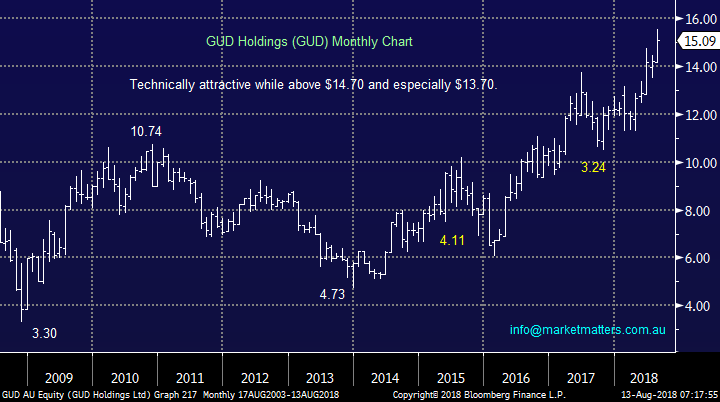

“Hi James, do you have any thought on GUD? They go ex div on 16th August and have had a very good run up from a low of $12.65 in May to today reaching $15.32. Do you see more upside or is now a good time to lock in some well-earned profits?” – Graeme D.

Hi Graeme,

GUD has undoubtedly enjoyed a great run over the last 5-years and the upside momentum remains intact.

- Technically we are bullish GUD while it holds above $14.70 and especially $13.70.

Also, we have noticed the Chairman has recently increased his holding by ~5% even though the stocks trading at highs, although he is not a major holding this action is certainly encouraging.

Lastly the 3.25% fully franked dividend is attractive considering the business is trading on a manageable P/E of 20.3x. In short, its fully priced however the momentum is strong for now.

GUD Holdings (GUD) Chart

Question 5

“Hi James, just a quick question for you about Myer. I have noticed that over the past few months the share price was around the .35cents mark. It has now jumped up to .505. I presume that this may be due to the higher turnover figures for the June quarter. Myer has also been closing some of their stores which to me means they are cleaning up their business. Can you give me your thoughts on Myer?” - Many thanks Greg

Hi Greg,

MYR unfortunately still feels like a broken business model whose shares are now in the basket of “penny dreadful punting shares”.

However, as you point out the stock has shrugged off bad news in May of yet further weak quarterly sales result and has rallied strongly, albeit it off a very low base.

We feel MYR is a trading stock that remains in the too hard basket for now.

Myer (MYR) Chart

Question 6

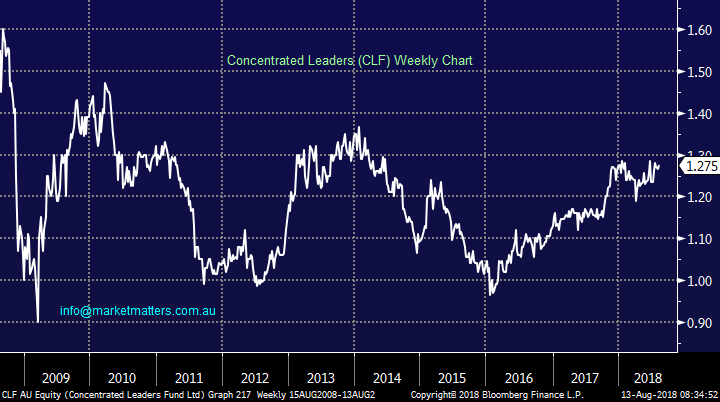

“James & Co - Amazing that you like ALR. They forayed into International Markets without a clue about Currency Hedging and copped it big-time. CDM was another that did the same but they've recovered a bit more respectably. I see that Geoff Wilson has been grabbing a few ALR but as things stand at the moment I think you'd have to consider them as Bear buy given their 'Performance Review and Dividend Policy' announced to the ASX on the 27/02/18.” - Michael B.

Hi Michael,

Not sure if we’re on the same page here, we don’t own / have not written about ALR int the past which changed name and ticker to CLF in April this year (it was the Aberdeen Leaders Limited and now is the Concentrated Leaders Fund). In terms of CLF, the logical reason why Geoff Wilson would buy into CLF is because its trading at an almost 9% discount to its NTA pre-tax while WAM is trading at more than a 10% premium. I’e he’s effectively using his cash which is being more highly valued by the market and buying into something that is being more conservatively valued – makes sense as ultimately he could simply keep buying until he buys it out.

- CLF currently yields 4.31% fully franked, with dividends paid quarterly.

Concentrated Leaders (CLF) Chart

Question 7

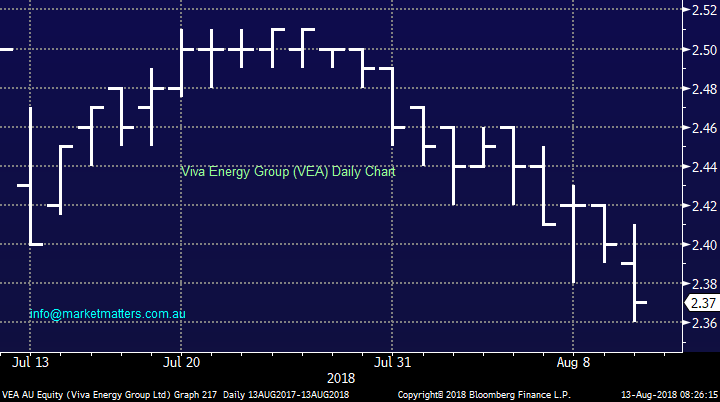

“Hi, was wondering what your thoughts are on Viva?” - Cheers Ross T.

Hi Ross,

To give some background, Viva currently owns 1165 petrol stations across Australia, including around 1000 under the Shell brand. Of these, 713 are operated as Coles Express while it also operates Liberty Oil petrol stations – with 50% equity in that business. They supply about a quarter of Australia’s total fuel consumption which is big – about 14 billion litres annually.

Freshly listed VEA has not travelled too well since listing however it’s only early days – we did write about it a few weeks ago in an income report which can be viewed here.

It’s on our radar, but more so an income play than in the Growth Portfolio

Viva Energy Group (VEA) Chart

Overnight Market Matters Wrap

· Geopolitics and increasing fears of trade wars caused a slump on global markets over the weekend, as President Trump raised the level of tariffs on steel and aluminium imports from Turkey, which caused a selloff in the Turkish lira - which slumped nearly 20% at one stage - on concerns it will lead to a full blown financial crisis in Turkey.

· European markets also sold off over 1%, with the German DAX hardest hit, dropping 2%. The Dow fell 200 points and the S&P 500 and Nasdaq had a similar selloff of about 0.7%. The commodity markets also suffered the fallout from fears of rising tariffs affecting global growth, with the copper and gold prices continuing to languish at recent lows, and iron ore dropping 1.5% to US$68.70/tonne. The oil price on the other hand firmed slightly, with Brent crude up 1% to just under US$73/bbl.

· Not surprisingly both BHP and RIO sold off in US trading, each down over 1.8%. Likewise the A$ was as under pressure again, dropping over 1% to a near 20 month low of below US73c. Surprisingly, the futures are currently pointing to small increase on the local market this morning of 11pts.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here