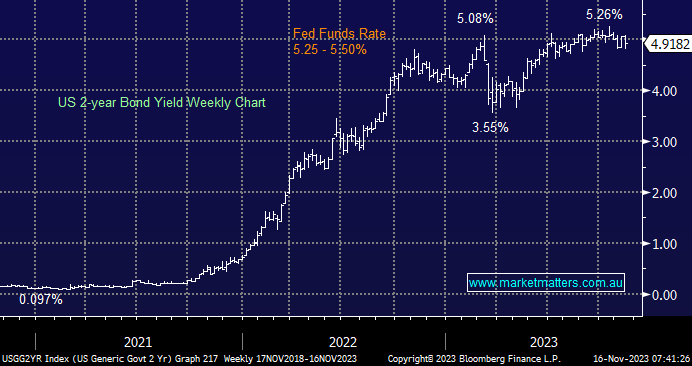

We have written almost at nausea around bond yields through 2023, but while a potential reversal lower is gaining some airtime, the US 2s are still trading ~5%, as they have since July. If we prove correct and yields eventually dip back to where they spent most of Q2, the sector reversion that began a fortnight ago will be in its infancy. The MM Active Growth Portfolio is positioned for lower bond yields; hence, it outperformed by ~0.6% yesterday after enduring a tough couple of weeks when long-dated bonds made fresh 2023 highs through October. It’s going to be a fascinating run into Christmas!

- We are targeting the 3.5% area for the US 2 years, where they spent much of early 2023.

This morning, we “Kept it Simple Stupid” (KISS) and highlighted three stocks we haven’t written about recently that we like into 2024, assuming bond yields do correct some of their substantial advances over the last 2-years.