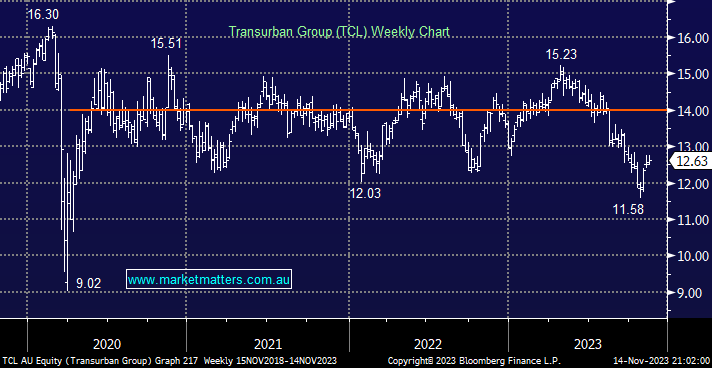

Toll road operator TCL has corrected -24% from its April high, it probably feels worse to many shareholders, but it’s only down -2.1% year-to-date, and it paid a 31.5c dividend in June. The company will deliver its next earnings report in mid-December, with a subsequent 31c dividend anticipated just after Christmas. They delivered a slightly disappointing FY23 result and outlook for FY24, contributing to the stock’s pullback over recent months. Revenue of $3,450m was up 25% on the previous corresponding period (pcp) but marginally below expectations; it never helps when a well-owned/liked stock delivers a “slight miss” to earnings &/or guidance – we’ve witnessed this plenty of times through 2023, especially on conservative guidance for FY24.

TCL’s latest result suggested Free Cash Flow (FCF) will grow ~6% in FY24 with support coming from continued traffic recovery on mature roads (e.g. post, COVID return to office, air travel). At this stage, we believe there is room for Transurban to beat recent guidance. This should help TCL shrug off the recent ACCC adverse ruling around Eastlink and soft traffic figures for Sydney; these should improve with the opening of the Rozelle Interchange, which will feed new traffic into WestConnex.

- We like TCL as a defensive play for a pullback by bond yields over the coming months.

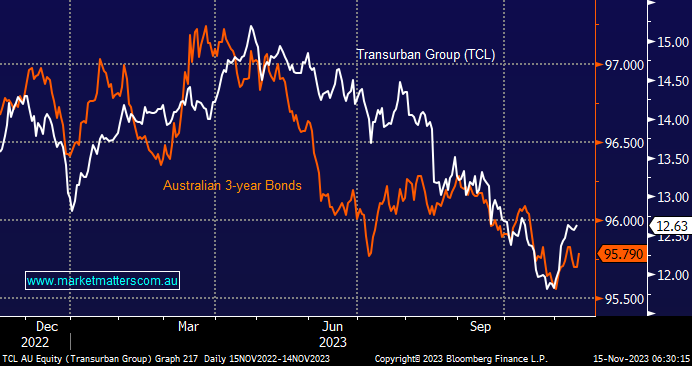

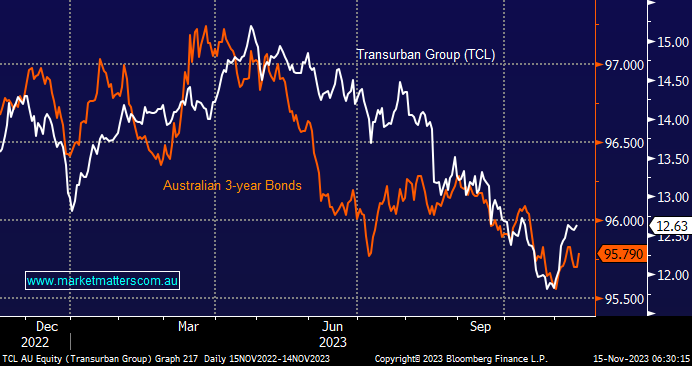

The chart below illustrates that Transurban (TCL) is an excellent proxy for lower bond yields as they’ve walked hand in hand through 2023. At this stage, we prefer real estate over TCL, but assuming we enjoy an ongoing Christmas Rally, TCL will come into its own if/when we want to migrate to a more defensive stance.

- We anticipate some performance reversion by TCL into 2024 but currently prefer the embattled Real Estate Sector for exposure to the rally by bonds.