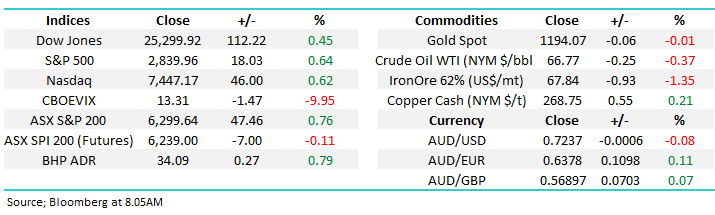

The washing machine continues to tumble! (COH, DMP, CGF)

Firstly, a big day on the reporting front with a number of reports out already.

CSL; A beat in terms of FY18 numbers and a beat in terms of FY19 revenue guidance but a miss on expected profit for FY19. They guided to $1,88-1,95B for the year and the market is currently at $1,97B , implying +10% profit growth for the year – but it’s a clear miss on guidance.

CPU; A miss on FY18 and a miss on guidance. Slightly better on dividend

IAG; More or less inline however underlying metrics suggest that SUN is doing a better job + the IAG share price has run hard into the numbers.

WES; Inline on earnings, no guidance provided which is the norm, and a slight miss on the final dividend $1.20 v $1.23 expected (however options market was implying $1.29)

On Monday the ASX200 was threatening to breakdown from its weekly “rising wedge” and then 24 hours later we traded within 9-points of a fresh decade high. Amazingly we are half way into August and while the local market has been inundated with potentially huge market concerning headlines, like Turkey, the index itself has remained resilient, trading in an extremely tight 82-point range.

- Over the last 10-years the local market on average has actually only declined -0.1% in August so it’s not historically a volatile time of year.

- Conversely September is usually more active with an average drop of almost -2%.

Perhaps we need a few more weeks patience before the constant stream of potentially bad macro-economic news finally has an impact on stocks.

Yesterday’s market strength was led by the banks whose news flow continues to be “not as bad as many feared” and remember we believe many fund managers / investors are now underweight this influential sector. Whilst the only areas of eye catching weakness were from companies who disappointed in reporting arena.

· We are neutral the ASX200 while the index holds above 6140 but we remain in “sell mode”.

Overnight stocks were firm in the US following on from the strong futures lead in our timeframe, the SPI futures are pointing to a small drop early in the day implying that traders don’t believe local stocks can meaningfully add to yesterday’s gains.

Today’s report is going to look at the MM Portfolio, 3 local stocks whose results we covered in yesterday afternoons report plus one overseas goliath that’s now looking interesting.

ASX200 Chart

1 The MM Portfolio

We’ve written about this a few times recently primarily I guess because a few stray brush strokes seem to be ruining a perfect Picasso!

Our core view remains that stocks are close to a minimum 10% correction with declines being led by the high valuation growth stocks while the banking sector outperforms. This still feels on the money but our Growth Portfolio has slipped marginally against the ASX200 on a relative basis because of a few “bad apples”, our goal is to add alpha, not lose it!

While I pondered our core views and portfolios last night a quote by the famed trader Jesse Livermore crossed my mind:

· “Experience has proved to me that real money made in speculating has been in commitments in a stock or commodity showing a profit right from the start.” – Jesse Livermore.

We have given a few stocks a little extra room because its reporting season and our cash / negative ETF positions are large, unfortunately this has clearly proven a costly mistake at this point in time as the likes of Orocobre (ORE) and Janus Henderson (JHG) have continued to slip lower.

Stocks failing should be no surprise considering we believe the 9 ½ year old bull market for assets, including equities, is maturing i.e. it’s what should happen, stocks slowly but surely “roll over”.

· MM expects to be far more active in cutting our losses earlier moving forward.

However we will not panic out of positions where we currently see long-term value e.g. Janus Henderson (JHG):

JHG – back in January when the stock was at $52 expectations for earnings per share (EPS) were at 72cps. Now, EPS is at 69cps yet the stock is $37 – this degree of massive PE re-rate which as we saw with PPT and PTM only lasts so long. At 9.3x it’s the cheapest asset manager globally that we can see.

Selling an asset manager on almost 9x when global peers are on 18x doesn’t make sense in our view, if anything we should be looking for areas to average this position.

ASX200 v Banking index Chart

2 Three local stocks catching our eye

Interestingly following on from our view that’s it’s time to generally avoid the high valuation / growth stocks, of the 3 stocks that noticeably fell yesterday after reporting 2 are high valuation stocks.

1 Cochlear (COH) $192.75

Yesterday hearing implant developer Cochlear delivered a reasonable result however guidance was well below analysts hopes for FY19 which sent the stock down 3%, not a bad result considering this much loved company was almost 5% lower at one stage.

· The shares trade on a high forward PE of ~37x which obviously requires a solid growth rate to justify. COH guided to net profit growth of 8-12%, or around $270m for FY19 which is 5% below consensus estimates of 284.5M, enough to worry the market.

What concerns us at MM is COH only sold ~30% more units in 2017 compared to 6-years ago but the share price has rallied by 400%, on the back of a significant PE re-rate as shown below. Over the last 5 years COH has traded between a PE of 22x and a PE of 41.5x, and is now at 39.5x.

Working in COH’s favour is commentary that may suggest the guidance may under-promise for the year ahead. The company indicates that guidance doesn’t include any currency tailwinds as it benefits from a falling Aussie dollar plus the board chose a more conservative estimate from emerging markets where they have seen a high level of growth in the second half of FY18. If these trends continue, the guidance should be under done.

· We believe COH is an excellent business but are only interested well under $180.

Cochlear (COH) Chart

2 Domino’s Pizza (DMP) $49

At MM we have been bearish DMP for a while not liking the picture both fundamentally and technically – the franchise model feels destined to struggle further at this stage while ‘the Don’ needs to start under promising and over delivering – the opposite is happening at the moment.

Yesterday DMP disappointed in its report on a couple of fronts:

- NPAT growth of 15% for FY18 was well below the company’s previous guidance “in the region of 20%,” and the subdued progress looks set to continue with the company also missing on expectations into FY19.

- Same store sales growth was below expectations in the two biggest markets – ANZ & Europe – both guided to 6-8% for FY18 but Domino’s only managed 4.5% & 5.7% respectively.

- Key to the commentary was FY19 EBIT guided to $227m – $247m, while consensus was looking for $251.7m next year = about a 6% miss to the middle of the range.

The stock is still trading on a Est. P/E for 2019 of 27x which considering the company’s current momentum feels a bit rich to us. However the shares only falling -6.5% on the news feels like a stock that’s relatively close to finding its “comfortable level” – over the last 2-years the same news would probably have led to double the decline.

Applying the same logic as we did above for COH, DMP has experienced a significant PE re-rate, down. Its traded between 21x and 55.8x over the past 5 years, and now traded on 26.6x.

Over 15% of DMP is short-sold implying that fresh marginal sellers need to be established investors who finally throw in the towel, hence the downside momentum is falling.

· MM is now neutral to negative DMP.

Domino’s Pizza (DMP) Chart

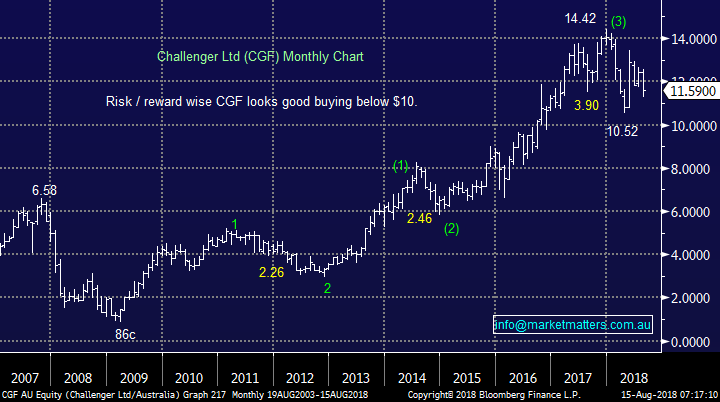

3 Challenger (CGF) $11.59

At MM we have avoided CFG since taking a nice profit back in late 2017, the risk / reward was no longer compelling plus it’s a stock that’s likely to be hit hard during a market correction.

Following its reporting miss yesterday CGF fell almost 7% but it is not yet at an interesting area for us.

· NPAT for FY18 came in at $406m versus the $423m expected by the market, which is a about a 4% miss on the profit line. The dividend was in line with expectations, however that’s of little comfort given the guidance was below expectations.

The real issue it seems for CGF is the inevitable move to lower risk assets underpinning their future liabilities (annuities). While a mix of lower risk assets reduces the overall risk in the business, it has a negative impact on margins and the companies ROE will come under continued pressure as a result.

CGF is now trading on an ok P/E Est. for 2019 of 17x while yielding 3% fully franked.

· MM is neutral / negative CGF with a drop below $10 feeling a strong possibility.

Challenger (CGF) Chart

3 Overseas stock

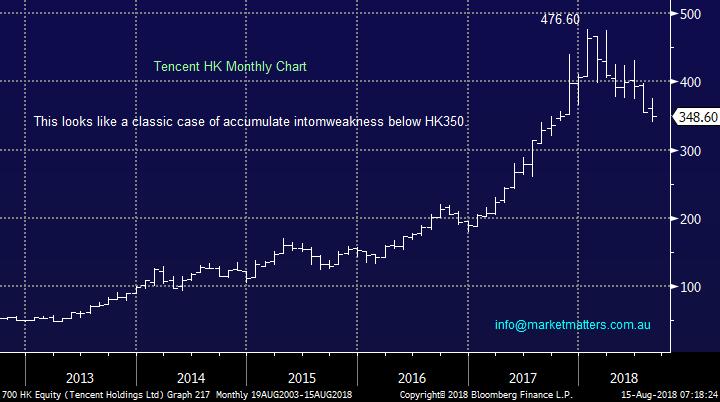

Tencent Holdings (HK) HKD348.60

Chinese games giant Tencent has now tumbled over 25% since its high at the start of the year wiping $150bn of shareholder value in the process, the largest global financial decline by any individual stock.

The recent weakness was caused by falling foul of the Chinese regulator with its “Monster Hunter : World” game, only a week after its launch, we feel this a hurdle as opposed to a roadblock for Tencent in the grand scheme of things.

· MM likes Tencent and would be accumulating between HK330 and 350.

Tencent Holdings (700HK) Chart

Conclusion

We will continue to avoid the high valuation / growth stocks at this stage of the economic and stock market cycles.

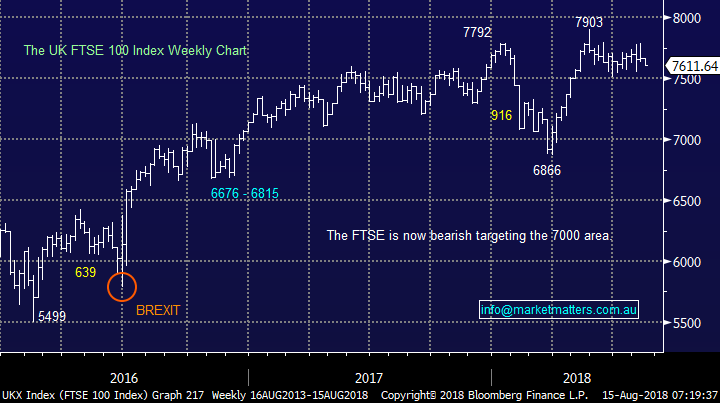

Overseas Indices

No change, the US S&P500 is following the path we outlined below 6-months ago, patience remains the key virtue at this stage.

European markets continue to track sideways like our own, the UK FTSE has hardly moved for over 3-months.

US S&P500 Chart

UK FTSE Chart

Overnight Market Matters Wrap

· Wall St rallied overnight as concerns around Turkey’s economic plight eased and the beaten up Turkish Lira rebounded following its recent significant selloff. The Dow rallied over 100 pts while the Nasdaq and the S&P 500 both firmed around 0.6% as investor sentiment improved on the back of the Lira rally.

· European equity markets however closed flat after an early rally, despite a strong second quarter German GDP number, as investor concerns remained around the potential for global trade wars.

· Commodities were also mixed with gold holding ground around the US$1200/oz level, oil slightly weaker and the copper price slumping over 1.5% to recent lows below US$2.70/lb on investor worries that global trade wars will impact growth. The US$ lost some of its recent gains, with the A$ rallying back above US73c.

· Despite the mixed commodity markets, BHP rallied 1.5% in US trading. The futures market is pointing to a small decline this morning on the ASX 200.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here