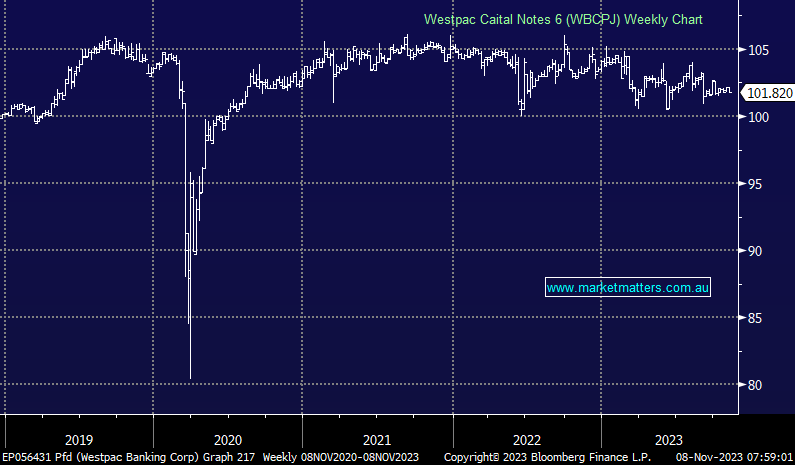

Media reports are suggesting a new hybrid security from Westpac will be launched next week to raise $1.5bn in tier 1 capital, around 18 months since they tapped the hybrid market under the Capital Notes 9 offer (WBCPL), which was issued at a margin of 3.40%. The deal will be used to replace an existing hybrid on issue, the Westpac Capital Notes 6 (WBCPJ) which is due to be called in July of 2024. That security has an issue size of $1.4bn so with a likely reinvestment offer + new money via syndicate brokers, it will be tight. While the FY23 result from Westpac was a mixed bag this week, the clear takeaway was around their strong capital position, which has underpinned a $1.5bn on market share buyback.

That in itself prompts the question of why Westpac would announce a buyback, and then tap the market for hybrid capital. Banks like diversification in funding from depositors, wholesale bond markets and Hybrid investors, and rolling an existing security into a new one does make sense, however, there has been a conscious decision made at Westpac to pay around ~7.5% for hybrid capital, in essence, used to buy back stock. The too-simplistic conclusion we can make is WBC ultimately believes its equity will be a better investment than its hybrids.

- We will assess the Westpac Hybrid Security when it is released next week.