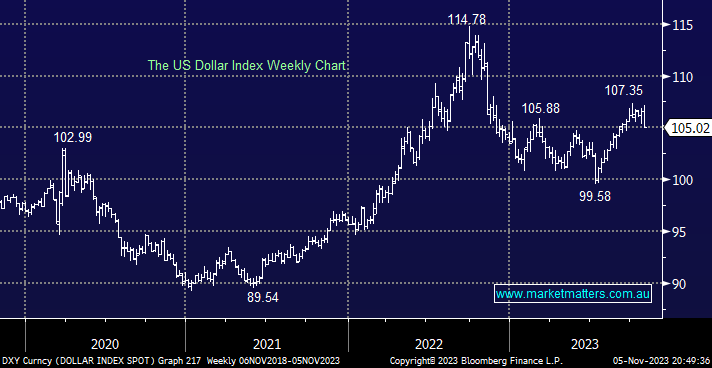

The $US fell sharply last week as the support from rising bond yields evaporated from Wednesday onward. The Greenback will likely receive plenty of support in the 105 area, but our preferred scenario, in line with a top for US bond yields, is that we will see a test and eventual break of the psychological 100 area.

- We remain net bearish towards the $US, and the Fed’s actions last week support this outlook.

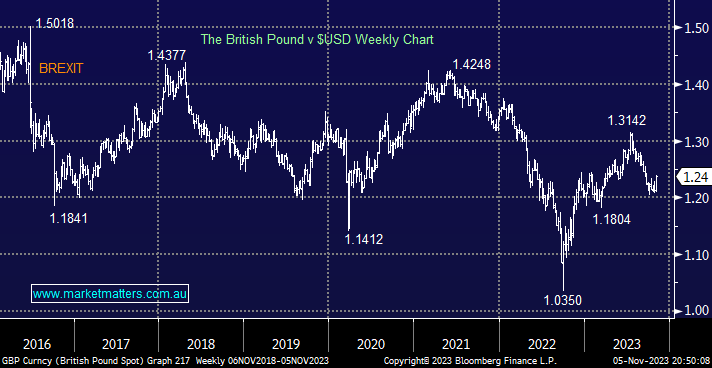

The Pound bounced last week after testing our targeted 1.20 support area. The move isn’t yet conclusive, but unless the Fed redons its ultra-hawkish hat, we believe it’s a buy into any dips.

- We remain bullish towards the Pound through 2024/5 with an eventual target back around 1.40.