A James Bond “twist” for a Monday

After the Weekend Report, which was pretty heavy on Technical Analysis, we thought today was a perfect opportunity to add some balance to how MM currently views stocks by putting on a different pair of glasses.

Since MM started back in late 2013 the ASX200 has managed to advance just under 20% before dividends, while also correcting over 20% in 2015/6. As most of you know we had a great time during the correction moving to around ~50% cash close to the ~6000 top and not aggressively jumping back into stocks until well under the 5000 level BUT as we regularly say to ourselves “you’re only as good as your last trade!”.

However there has also been another major investment theme over the last few years by way of sector rotation:

- Buy resources / growth and selling banks / financials has proved hugely successful since 2016.

Following on from this we generally start looking at the market commencing with the below 3 steps:

- Are we bullish / bearish the overall market for the next ~10%?

- Which sectors / markets do we believe will outperform by the next ~10% - markets can be “played” via ETF’s.

- Which stocks within our preferred sectors do we prefer?

Today we will outline our opinion on these 3 points for points 2018 /9 using more of an macro-economic and fundamental approach as opposed to Technical Analysis – this actually covers a number of questions we received this week plus the remainder we will address next week where appropriate.

ASX200 Chart

In hindsight we have been discussing the next decent correction too often for too long, it’s probably felt like a broken record to some! While we do believe a correction is looming we have remained well invested in stocks because in simple terms, although its threatened otherwise, the markets have not told us to do aggressively negative. Equities have literally had the kitchen sink thrown at them without falling e.g. North Korea, China-US trade war fears and now Turkey.

- When a market holds / rallies on bad news it’s a bullish market.

We have been in cautious sell mode for months now without pressing the aggressive “runaway” button because the market simply remains firm making fresh 10-year highs. We have taken some negative exposures through ETFs however this has simply tempered our bullish positioning, rather than negated it.

· We remain neutral the ASX200 while the index holds above 6250 but we remain in “sell mode” albeit in a patient manner.

Fortunes are lost by investors / traders trying to pick exact tops / bottoms, of course MM has an opinion and we have kept our subscribers informed of that opinion on a regular basis, however we will simply follow the $$ trail and attempt to hold on for the ride.

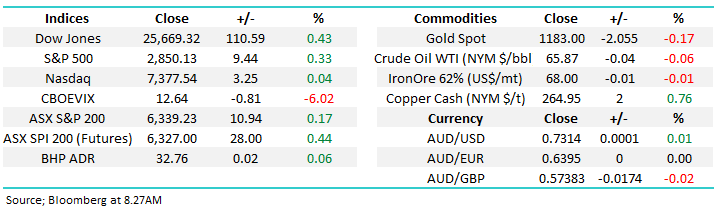

Some interesting statistics have emerged from the latest Bank of America Fund Managers Survey:

1. Fund Managers now have their largest weighting to stocks since January 2015, just before we corrected 20%.

2. Fund Managers are also betting against bonds i.e. US interest rates will continue to rise.

We pointed out a few times earlier in the year, primarily during the January / February panic, that fund managers were underweight stocks and hence it would be hard for them to fall too far, which proved accurate, this dynamic has now been removed.

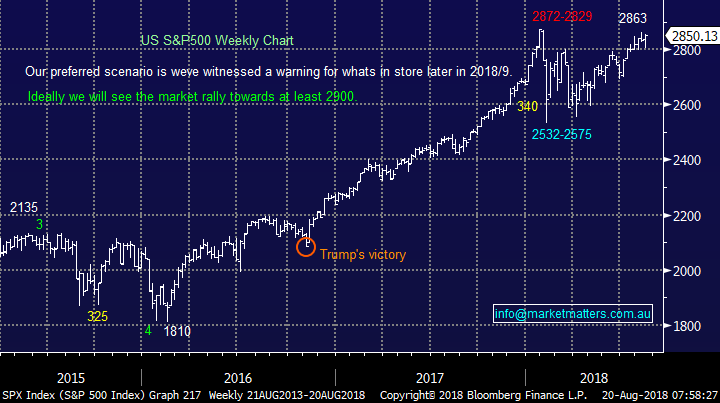

For the last 6-moths we’ve anticipated that the US S&P500 would make fresh all-time highs towards 2900 and then fail.

US S&P500 Chart

Are we bullish stocks for the next ~10%.

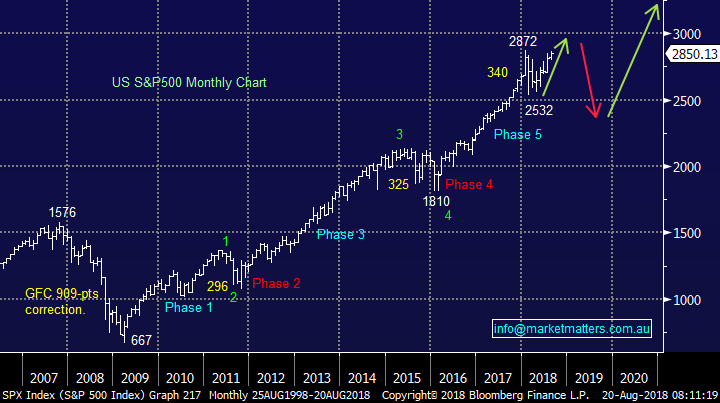

We’ve obviously covered this topic very often this month so I’ll keep it brief! Below we have used the American market because we feel its clearest at present, our current opinion based on a combination of market valuation, fund managers exposure, “Gut Feel” and some Technical Analysis NB this Elliot Wave interpretation was done some ~6 months ago.

- US stocks will make fresh all-time highs in the next 1-2 weeks.

- US stocks will then fail and correct but probably only 10%.

- US stocks will the rally again to fresh all-time highs before we are likely to become extremely bearish.

Given this view, we are likely to use ETF’s to play this initial move as opposed to huge stock movements.

I would caution those that may have gotten a touch frustrated hearing us say “beware stocks are close to a correction” while any real sort of correction has yet to materialise. This briefly for a moment around Sydney property, a market that was ‘the place to be’ however over the last 12-months many Sydney suburbs have seen housing prices fall ~15%, or more – something that was clearly not the consensus opinion.

US S&P500 Chart

Which sectors / markets do MM prefer at this stage of the cycle?

We have a few strong opinions here over both the short and medium terms:

- Banks will outperform resources over the next 6-months i.e. the jaws” will close on the below relative strength chart.

- The high valuation / growth stocks will probably rally a bit further but a ~10% correction is very close at hand.

- Medium – longer term resources should recover well in-line with our view on inflation hence we will look to buy aggressive corrections within the sector.

ASX200 Banks v Resources Chart

On an index level we believe the local ASX200 will finally outperform the US, probably influenced strongly by our banks which are such an influential sector on the index.

· Hence if / when we take an aggressive short position in an ETF it will probably be in the US facing BBUS.

ASX200 v US S&P500 Chart

Which stocks within our preferred sectors do we like?

The next sector we have our eyes on is the resources ideally into further weakness. This is not a contradiction to our banks v resources view, it’s more of a timing issue plus we have significant exposure already to the former.

· Due to our macro opinion on inflation we like the base metals as a sector moving forward ideally ~5-6% lower.

A number of the stocks within the sector have been hammered recently, for example over the last month – Iluka (ILU) -17%, BlueScope Steel (BSL) -10.5%, RIO Tinto (RIO) -8.7% and Fortescue (FMG) -5.8%.

FMG reports this morning and BHP reports later in the week - we remain keen to accumulate the “big Australian” below $30 hence we are likely to be observers until we get that opportunity.

Bloomberg Base Metals Index Chart

Conclusion

A different take on the Monday report this morning, however it has covered the basis for a number of subscriber queries / questions received over the last week.

The key message we continue to push is, remain open-minded and flexible and the market will look after us / you.

Overnight Market Matters Wrap

· The broader US majors have rallied 6 of the 7 weeks thus far as US trade tensions with China eased, but Trump threatened to impose further sanctions on Turkey unless a US pastor was released.

· The US and China officials hope to end the trade war before their respective leaders meet in November. Consequently, the $US fell from a year high against a basket of currencies.

· On the commodities front, oil and iron ore rose while base metals were mixed on the LME.

· On the domestic front, corporate earnings expected to report today are Woolworths (WOW), Ansell (ANN), Beach Energy (BPT), Primary Health (PRY) and Fortescue Metals (FMG).

· The September SPI Futures is indicating the ASX 200 to open 28 points higher, testing the 6370 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here