Overnight, the world’s largest manager of alternative assets, such as private equity and real estate missed earnings estimates as high-interest rates weighed on asset values prompting lower than expected earnings. While higher rates were an issue, the environment for deal making is ‘slow’ to say the least which has prompted them to hold assets for longer than they usually would. Distributable earnings fell from $US1.4bn to $US1.2bn year on year, and profits from asset sales -36% to $US259.4mn.

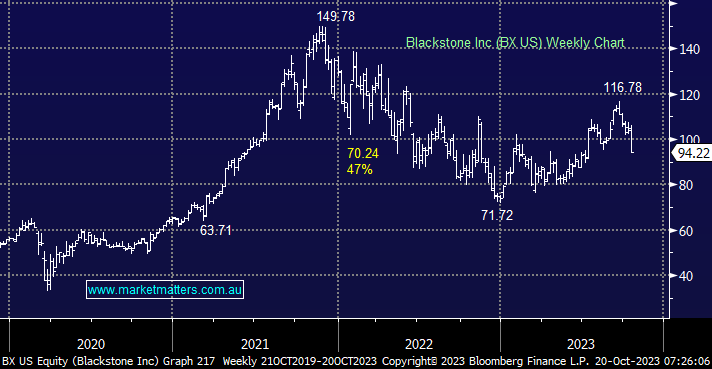

While the stock fell 7.9% on the session, not great when we are holders, the results show the flexibility that Blackstone has around when to buy and sell assets.

- We believe that BX should fare better through 2024/5, assuming our view on bonds proves on point – we are long BX in our International Equities Portfolio.