Over the last week, we’ve touched on a few strong stocks reversing after making fresh 2023 highs, e.g. REA Group (REA) and HUB24 (HUB). One underlying theme over the last 1-2 years has been the strong getting stronger and the weaker yet weaker, but by definition, all elastic bands will ultimately stretch too far; we question if the time is nigh for a few standout names of 2023.

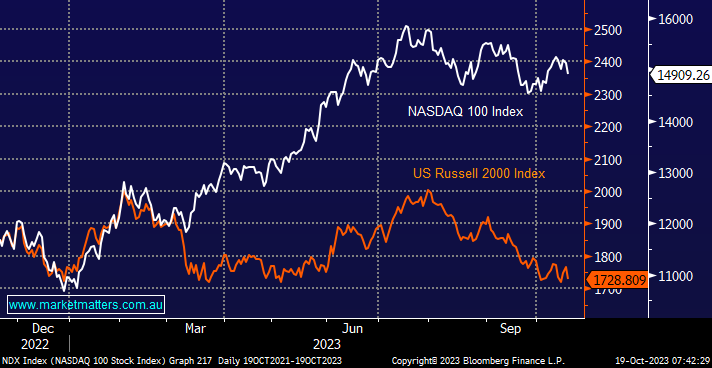

Over the last eighteen months, as interest rates soared higher, the small caps have stood patiently in the naughty corner as their cost of funding has gone from bad to worse, whereas US Big Tech has rallied, assisted by their large mountains of cash. If we are correct and bond yields are “looking for a top”, then stock/sector reversion is likely in many pockets of the market, today, we have looked at the outperformers with an eye on whether some look rich at current levels.

- The risk/reward towards small caps is improving by the week, but we can see more underperformance as bond yields forge higher.

This morning, we’ve updated our view on four lesser-discussed outperformers on the ASX over the last 10+ months, which has seen the local market edge up just +0.55%.