Subscriber’s Questions (TPM, TLS, WTC, MIN, IPH)

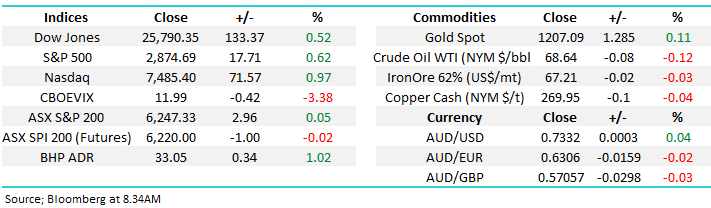

It’s amazing how the share market can choose to either embrace or ignore news with no clear rhyme or reason. Labor have been clear favourites to win the next election for a long time, but a week of self-destruction by the Liberal’s and the ASX200 adjusted as if the Labor Party had moved from being underdogs to outright favourites. In our opinion, the market had run up into a position where it was simply vulnerable to bad news i.e. last week the ASX200 fell -1.45% while the US S&P500 rose +0.8%.

This is one of the reasons that we strongly believe that technical analysis has its place in a sound investment approach with the sell signal we received last Tuesday, from the SPI futures, working perfectly. Just like with Turkey, we expect the market to forget last week’s debacle down in Canberra and soon resume trading as usual.

· We are neutral the ASX200 while the index holds above 6140 but we remain in “sell mode” albeit still in a patient manner.

Thanks again for some great thought provoking questions, it’s a great way to get the thought processes woken up on a Monday morning, please keep the coming.

ASX200 Chart

Question 1

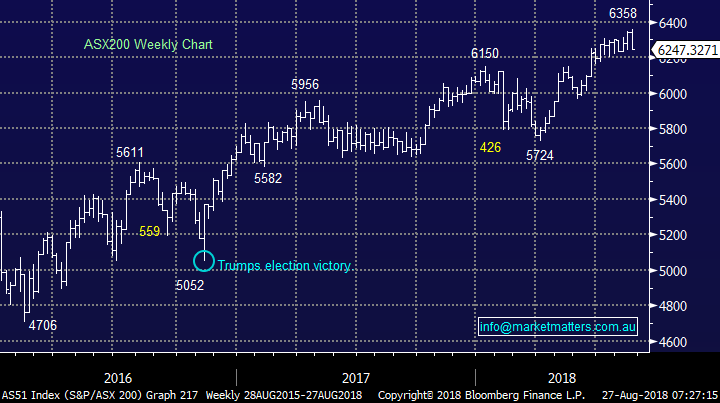

“Hi Guys. I bought into TPG at $6, it went down to $5 so I emailed you guys and you convinced me to dig in. I also took up TLS at $2.70. Thank you very much!” – Bruno F.

Hi Bruno,

We appreciate the thanks, the rally took a while to arrive and then when it did the magnitude / speed of the advance left many gasping for air. That’s what happens when investors become too bearish on a stock / sector.

· MM continues to believe the telco sector will outperform in 2018/9 but we may take some $$ of the table if / when TLS rallies back towards $3.50.

TPG Telecom (TPM) Chart

Telstra (TLS) Chart

Question 2

“Hi. There is more than one way to handle Money management within a portfolio but how does MM decide to set, reduce, or increase the weightings in platinum and Income portfolios and to what percentages?” - Regards Bryan.

Hi Bryan,

An excellent but obviously very encompassing question, I have tried to answer in a manner that most subscribers can relate to:

1. We use a classic “Top-down approach” to investing i.e. we establish our macro-economic view which then leads to sector analysis and finally company analysis. This is then dovetailed with our technical opinion on markets / stocks.

2. Hence if we believe the markets next 10% is likely to be down, as opposed to up, we may hold defensive cash levels / negative facing ETF’s like today. In 2015 we actually moved to over 50% in cash as we believed a major pullback was due.

3. Sector weightings are relatively straightforward once we have a clear macro opinion i.e. today we believe the old fashioned blue chips will outperform the high valuation / growth stocks hence A2 Milk (A2M) is our only standout growth holding.

4. We currently have minor exposure to resources which feels correct as they are both in the red at present but we are close to re-entering the sector following its fairly aggressive correction.

5. We do like selling and buying stocks / sectors when market sentiment becomes too optimistic / pessimistic, we often use the elastic band analogy – this alone may lead to a few % tweak on our holdings.

6. Technical analysis and a company’s individual performance is often our catalyst to make adjustments to our respective portfolios.

7. Lastly we do like to be receiving a decent yield from at least parts of our portfolios, as below illustrates the ASX200 Accumulation Index (including dividends) is at its all-time high while the ASX200 index is ~10% below its respective milestone.

ASX200 Accumulation Index Chart

Question 3

“Wow WTC up 20%, market not disappointed at all with the result.” - Sean C.

Hi Sean,

It certainly was but come Friday its closed -19.8% below its weekly high, the volatility is almost out of control for the cloud-based logistics company trading on a huge Est P/E for 2019 of 92.8x.

The -15.5% pullback on Friday alone confirms to us the ever increasing risks in this part of the local market which has exploded during the year.

· MM will continue to avoid these high growth / valuation stocks at this stage of the economic / market cycle.

Wisetech (WTC) Chart

Question 4

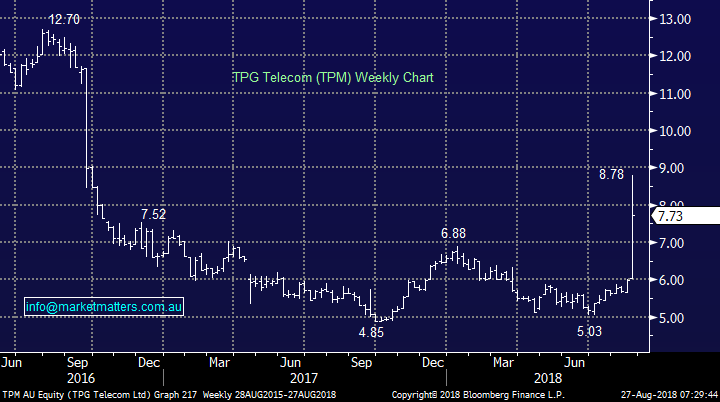

“You may wish to rethink the Retail sector if Labor win the next election with plenty of low income earners likely to get substantial handouts” – Shayne G.

Hi Shayne,

It feels like the markets been listening to you with the retail sector enjoying a solid recovery this month. The market had become too negative around the sector with Amazon scarring many but we are not convinced the recovery is sustainable.

Unfortunately I find it extremely hard to get past the large debt levels being carried by the average Australian, coupled with falling housing prices people are feeling relatively poor which is not conducive to sustained strong spending.

· We are likely to avoid the retail sector in general until we see debt levels turn or housing prices improve.

For MM to buy retail stocks we will want to see stand out situations like Nick Scali (NCK) in our Income Portfolio.

Australian Retail Index Chart

Question 5

“Hmmmm...... I do not want to read about politics on this "forum". I would be pleased if you stuck to the shares etc. and leave the other rubbish to the news. Same with Trump really..... he may not be your choice but the Market has sure gained since he got in. I don't like him either but credit where it is due.” – Waz.

Hi Waz,

I appreciate your thoughts but we must consider / discuss political influences on stocks.

Last week our banking sector fell almost 5% because of the shenanigans in Canberra it would unprofessional for us not to discuss such a huge market influence.

Likewise with President Trump we have remained almost fully invested in stocks until recently because of the huge positive economic influences of his tax cuts and deregulation of many sectors, he has undoubtedly been a bullish influence on equities since his election victory.

Like yourself I would be happier if they just bunkered down and ran the country but that’s not always the case.

ASX200 Banking Index Chart

Question 6

“I am just wondering how I can see what stocks MM currently have purchased?” – Jordan B.

Hi Jordan,

You can find it on our website under “Market Matters Portfolios”, this should also be combined with looking at “Recent Activity” to get a complete picture of the investment activity over time -you can also see including past alerts.

Question 7

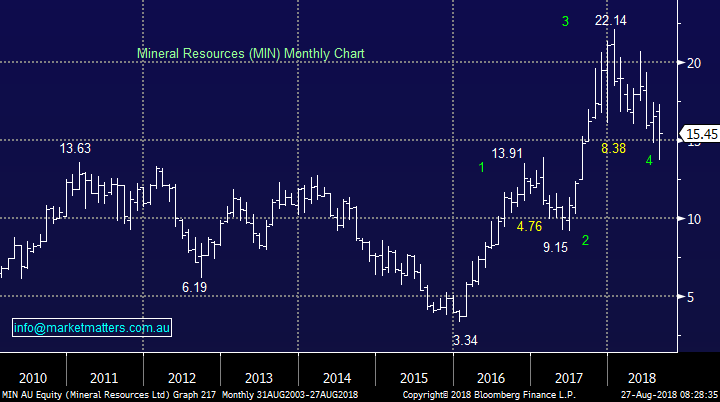

“Hi MM Team, is Mineral Resources (MIN) still on your radar? Could I get both a fundamental and technical opinion, thanks. Looks to be on wave 4-monthly chart to me, keep up the good work” – Thanks Tim.

Hi Tim,

We covered MIN in the Weekend Report under “Trading Opportunities on our radar”.

Mineral Resources (MIN) is a stock we own in the Growth Portfolio. We’re down on the position however a few interesting aspects now playing out. MIN is in the final stages of a process to sell up to 49% of the Wodgina lithium project in the Pilbara. There is speculation in the news that a Chinese Lithium player is keen to pay a strong price while last week the MD and MINs No 1 shareholder Chris Ellison bought another 38k shares at an average price of $15.02, spending about $570k. Interesting timing given the outcome of the sale process is imminent.

· MM are bullish MIN targeting a move towards $20

Mineral Resources (MIN) Chart

Question 8

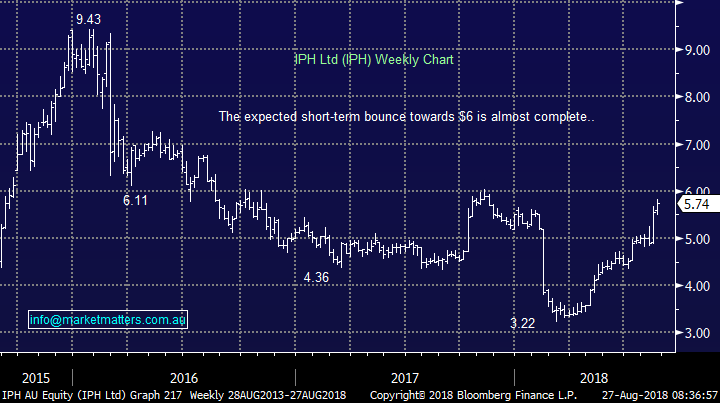

“Hi Guys, love your work, look forward to my daily very easy to read communication from your team. My portfolio includes a number of companies accumulated prior to receiving the MM report. Most of them you have reported on at various times except one that MM have never covered even though other brokers have. I’m interested on your thoughts on IPH. I’ve been on this roller coaster for a number of years and doing pretty well based taking the opportunity to average out.” – Sharon & Danny W.

Hi Guys,

Technically we have been looking for IPH, an intellectual properties firm, to recover towards the $6 area for a while which is now close to fruition.

This month they reported solidly showing an increase of revenue by over 20% to $226m and the business is well positioned moving forward being close to Asia.

· MM is now neutral IPH close to the $6 area.

IPH Ltd (IPH) Chart

Question 9

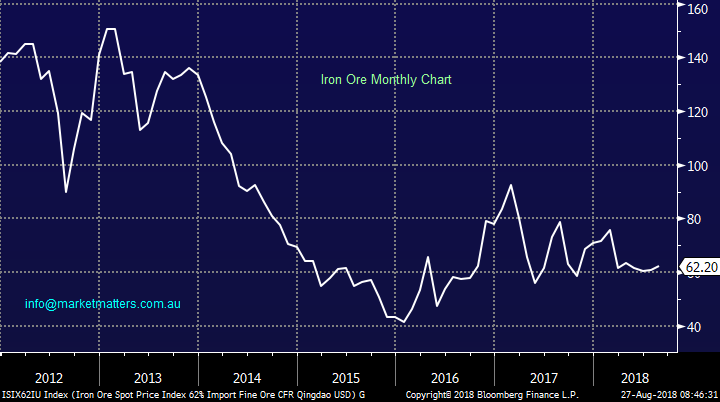

“Hi Team, keepthe reports coming. They make for interesting reading. One thing I have noticed is that lithium and cobalt are having a hard time of it at present. The argument seems to be about supply and demand. Earlier on in the piece the research showed that the was an undersupply and hence the stocks like KDR and GXY and others such as AUZ and LPD all had the rise in their share price. Another was ARL that went to $2.20 and now trades at around the .80cent mark. This downturn as I understand it is that there is now an oversupply of these minerals. Can you let me know if there is anyone out there doing the research about the supply side of things? As I hold ARL I am particularly keen to get your thoughts on this one.” - Many thanks. Greg.

Hi Greg,

It’s been a classic resources story………lithium suddenly becomes in demand creating shortage and higher prices……..miners strive to get production on-line and we eventually get oversupply (potentially)…..remember the iron ore crash of recent years.

We had a great run with Orocobre (ORE) and Kidman Resources (KDR) before buying the latest correction in ORE too early and subsequently realising a painful loss.

· We are considering KDR as an aggressive / trading buy around the $1 mark but the falling knife still feels too scary at present.

There have been a number of research notes written on lithium with arguably one of the most influential put out by Morgan Stanley in February calling prices to fall by 45% by 2021 due to excessive supply from Chile – you can read on-line.

Car makers like Toyota with ORE have panicked into locking in supply moving forward and at present they look to have created a top in the market which may last for years. However even if Morgan Stanley are correct a more than 50% correction in KDR feels excessive.

Lastly it still concerns us that the professional traders are happily sitting short the sector with Galaxy (GXY) and Orocobre (ORE) the 3rd and 4th most shorted stocks in our market – a turn lower in these positions would be interesting – www.shortman.com.au.

Iron Ore Chart

Kidman Resources (KDR) Chart

Overnight Market Matters Wrap

· The US major indices ended its Friday session in positive territory, led by the tech. heavy, Nasdaq 100 (+0.97%) following the US Fed Reserve Governor’s speech at Jackson Hole being interpreted that its key interest rates would not rise as much as anticipated.

· Short term however, the current consensus of a rate rise in September is 92.3%.

· Corporate earnings expected today are AYS, CNU, GEM, JHC, MVF & SKI.

· BHP is expected to outperform the broader market today, after ending its US session up an equivalent of 1.02% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open 5 points higher, still testing the 6250 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here