More extreme action “under the hood” (BKL, GXY, GEM, CTX, SDA, APT)

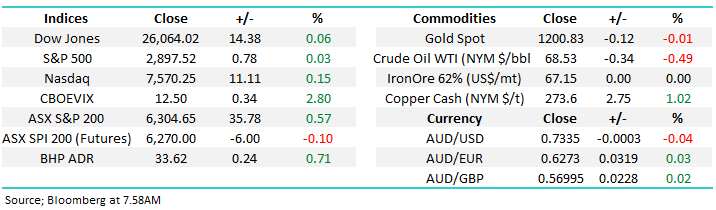

The ASX200 extended Mondays rally with Australian politics becoming a distant memory while US stocks surging to fresh all-time highs became front and centre. The strength was led by the banks and resources while the energy / telco sectors weighed on the index which impressively managed to close back above the psychological 6300 level. Our market has simply remained range bound between 6200 and 6350 for the last 2-months, no need to push views at this stage.

The volatility on the individual company level was again massive within the ASX200 as 7 stocks rallied by over 5% while 4 stocks feel by over the same benchmark i.e. over 5.5% of the ASX200 moved by over 5% on a day when the index itself rallied by less than +0.6% - that’s volatility.

· We are now neutral the ASX200 but remain in careful “sell mode”.

Overnight stocks were very quiet with the only activity actually catching our eye being an aggressive sell-off in gold ETF’s as the precious metal slipped back under $US1200/oz – we’ve touched on this below.

Today’s report is going to focus on 6 stocks which moved over 5% yesterday as “surprises” are springing out like the cherry blossom over recent weeks in Sydney!

ASX200 Chart

Gold ETF’s fell by almost 2% last night making fresh 2 ½ year lows. The picture is not particularly exciting for now but we would be very keen buyers of a break below 2016 lows.

We will be watching closely how the gold sector performs today with particular attention on Newcrest (NCM) which we own in the Growth Portfolio.

Gold ETF

Winners

We have signalled out 3 of the top 7 performers from yesterday although they do also encompass 2 other sector / sentiment related stocks.

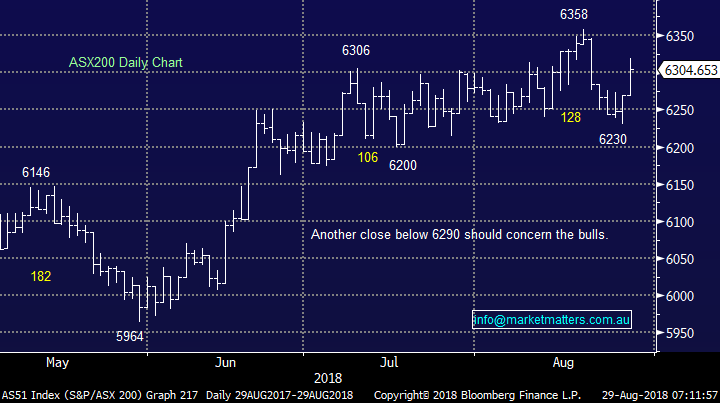

1 Blackmores (BKL) $162

BKL surged by +11.5% yesterday following its annual results which showed a 19% increase in net profit after tax (NPAT) to $70m while declaring a dividend of $1.55. Sales growth of 22% in China was the highlight of the numbers assisted by excellent performance on-line as hoped due to its affiliation with Alibaba.

The company gave no real guidance however the momentum in Q4 was strong while the newish CEO Richard Henfrey excited the market with an upbeat outlook – “The Board shares my confidence in our ability to continue to deliver sales and profit growth in the coming year.”

· MM has turned around on BKL and likes the stock targeting ~$200 while it can hold above $150 i.e. excellent 3:1 risk / reward.

Also, Bellamy’s (BAL) rallied almost 8% as it garnered confidence from BKL ahead of its numbers today, all things being equal we prefer Blackmores at time of writing.

Blackmores (BKL) Chart

2 Galaxy Resources (GXY) $2.93

GXY rallied +5.8% yesterday although the stock was up well over +10% earlier in the day. The lithium producer rallied following the announcement that South Korean conglomerate POSCO has purchased a package of tenements from GXY in Argentina for a cash consideration of US$280 million.

While the cash clearly helps GXY the potential for the two companies to work together is also a large positive influence on the stock. However even after yesterday’s rally the stock is trading 35% below the years high as concerns around the medium / long term health of the lithium price continue.

· MM is neutral both GXY, and the lithium sector, at this point in time.

Other major lithium player Orocobre (ORE) also rallied over 5% on the day following a strong result including a NPAT of $US25.7m. The stock remains one of the lowest cost producers enjoying a margin of 67%. Similar to GXY the future is all about the lithium price and the shorts are voting strongly that the price will fall hard as they fill 2 of the 4 most shorted stocks on our bourse – we are neutral for now.

The next catalyst for the sector may come from Mineral Resources (MIN) if they attract a strong price for a 49% stake in their Wodgina Lithium project.

Galaxy Resources (GXY) Chart

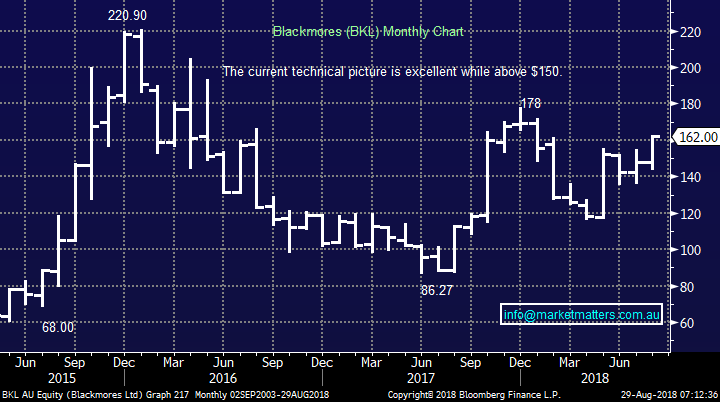

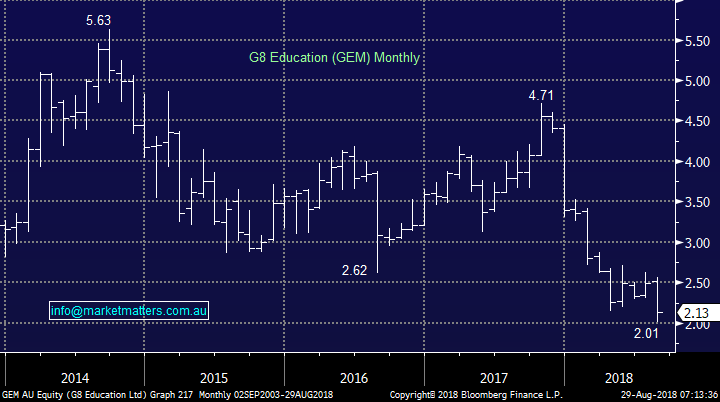

3 G8 education (GEM) $2.93

GEM rallied +5.5% yesterday but this was only a bounce following the previous days 16% fall on the back of a very poor result including a reduced dividend. GEM is a stock we’ve looked at numerous times for the MM Income Portfolio however weak occupancy trends and rising compliance costs have kept us rightly on the sidelines. With the stock on a PE of 10.8x for next year, it’s clearly cheap, however the stability of the 7%+ yield remains the concern.

Blended Forward P/E - GEM

· At this stage, MM is neutral GEM and sees no reason to catch this falling knife.

G8 education (GEM) Chart

Losers

1 Caltex (CTX) $30.68

CTX tumbled -7.9% yesterday following its first half numbers with the combination of a dividend cut and lack of clear near term growth weighing on the stock.

· MM remains bearish CTX with a target ~8-10% lower.

Caltex (CTX) Chart

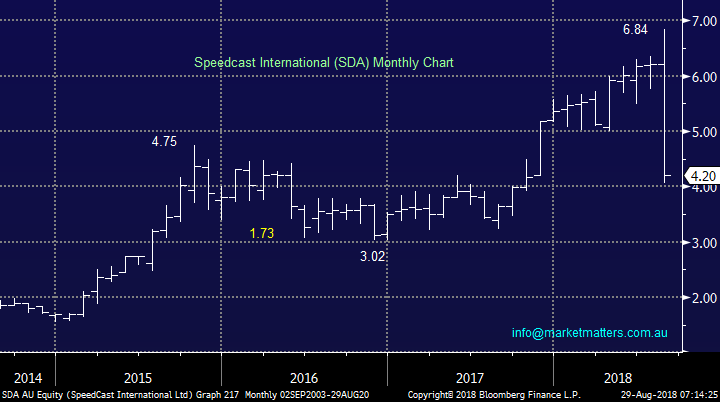

2 SpeedCast International (SDA) $4.20

SDA plummeted over - 37% yesterday illustrating the risks of the high growth / valuation stocks.

The result itself appeared ok with revenue up 24% and NPATA up close to 40% to US21.1m.

As is often the case it was not the numbers but the company’s outlook which caused the move, in this case down – it guided to EBITDA around 10% lower.

When growth stocks are priced “for perfection” the outcome can be devastating when the company just coughs!

· MM is neutral SDA but a bounce would not surprise.

SpeedCast International (SDA) Chart

3 Afterpay Touch Group (APT) $19.95

APT fell -5.6% yesterday as the volatile ride continues. The stock has been a phenomenal performer in 2018 but we feel investors now need to prepare for some major swings as we wait to see if the company can capture the anticipated US market share.

The stock corrected ~15% from its all-time high last week, for investors looking to buy APT we would currently be targeting the $18 area.

· MM is neutral APT and expects some choppy consolidation in the weeks ahead.

Afterpay Touch Group (APT) Chart

Conclusion

We have divided the 6 stocks we covered today into 3 obvious groups:

Bullish – Blackmores (BXL).

Neutral – Galaxy (GXY), G8 Education (GEM), SeedCast (SDA) and Afterpay (APT).

Bearish – Caltex (CTX).

Overseas Indices

The US S&P500 has hit our 2900 target but no sell signals have been generated, we believe that September / October may be extremely exciting times.

US S&P500 Chart

The recovery by the UK FTSE back above 7600 is slowly but surely switching us more neutral.

UK FTSE Chart

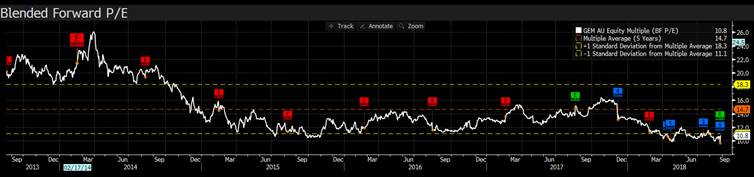

Overnight Market Matters Wrap

· The US major indices closed marginally higher overnight as investors weigh their positions following all majors at, or near its all-time highs.

· US economic data was also a positive, with its consumer confidence in August reporting its highest in 18 years… could this re rate investors’ thoughts of an interest rate rise at a faster pace?

· BHP is expected to outperform the domestic market today, after ending its US session up an equivalent of 0.71% from Australia’s previous close.

· Domestic earnings expected to report today are BAL, BGA, BLD, IGO, SRX & VAH. While MTS is due for their AGM.

· The September SPI Futures is indicating the ASX 200 to open marginally lower testing the 6300 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here